Outlook:

The r ise in US yields on the inflation r epor t and Yellen's comments was a welcome relief from asset prices responding willy-nilly to careless tweets from a jackass. We must admit the market chose to hear only the parts of Yellen's remarks that reinforced what traders were already feeling—inflation is coming faster than we thought and we need to start pricing in more rates hikes or at least earlier ones.

What Yellen actually said was more sedate. Yellen said she expected rate hikes to continue "a few times a year" until it the neutral rate is reached, probably around end-2019. Nobody noticed that "end-2019" thing or the remark that monetary policy takes a long time to get a grip. They did hear that waiting too long "could risk a nasty surprise down the road -- either too much inflation, financial instability, or both. In that scenario, we could be forced to raise interest rates rapidly, which in turn could push the economy into a new recession."

The "nasty surprise" phrase is what got the attention, although even then, the yield rise was outsized compared to the Fed funds futures response. As noted above, Yellen's rising confidence in the US economy is reflected in the chances of a rise in March—the CME gives it the same 20% but Bloomberg's version is up to 34% from under 30% the day before. The next Fed meeting is Jan 31-Feb 1... and then March. From now on, we will probably be focusing increasingly on the odds of a March move.

Oddly—very oddly—El-Erian told Bloomberg he found Yellen's comments to be more dovish than he expected. "She recognizes structural headwinds to this economy, but then didn't imply what that means for the ineffectiveness of excessive reliance on monetary policy." While the stage may have been set for a more hawkish signal, "She didn't go there." Evidently, the Fed funds market is more in tune with El- Erian. The probability of a March hike is still very low.

To add to our doubts, Bloomberg also reports that bond bear Lacey Hunt, a name from the past, sees the current inflation-driven bond move as a puff of smoke. "It's just more of the same." Hunt uses the velocity of money, which the uneducated reporter calls an "out of fashion metric," to divine that "the rout since the election of Donald Trump is just a bump in the road for an extended rally." And he's right about velocity, although using a single factor to forecast a gigantic market is a bit iffy, especially now that money is so ill-defined. But it's certainly true that M2 velocity "has fallen to a record-low of 1.44, meaning every dollar spent circulates only 1.44 times in the economy, down from over 2 times at the peak in 1997. To Hunt and other adherents, that shows even after years of unprecedented money printing by the Federal Reserve, inflation will remain subdued and elusive, largely because the private sector has chosen to hoard, and not spend, the money in the years after the financial crisis."

This is a point we have made ourselves many times over the past few years. The biggest problem in the Fisher equation (money supply times velocity equals GDP times inflation) is that it's a tautology. It's true because it's (demonstrably) true. Any big change in one side of the equation must be mirrored on the other side, whether it's outright "causative" or not. If money supply remains the same and velocity is falling, the other side of the equation should display a drop, too, either in GDP or in inflation.

This is one reason it's so interesting the Fed is starting to consider raising money supply by dumping holdings. The FT reports "A series of Fed speakers have sent up trial balloons in recent days talking of the possibility of reducing the size of the central bank's $4.5tn balance sheet. Patrick Harker, Philadelphia Fed chief, suggested the topic would become central once short-term interest rates hit 1 per cent — something the Fed is on course to achieve this year if its current forecasts are borne out. Lael Brainard, a normally ultra-dovish member of the board of governors, suggested on Tuesday that a big fiscal stimulus by the Donald Trump administration could bring forward the day when the Fed starts trimming its balance sheet."

This will have more power than comments from anyone. It's not yet a "theme" but may easily become one. In other words, we are about to get a battle between data and sentiment, or facts vs. "authority."

We liked that Yellen's authority got a move that offset Trump's reckless "too-strong dollar" comment earlier. But authority doesn't always arises from authenticity, even if it should. It was nice when an authentic authority in economics—Yellen—seemed to get more weight than a fake authority—Trump. Alas, this is probably a rare thing. We can't count on genuine experts to offset stupid comments by Trump. That didn't work during the campaign and is unlikely to work now, unless the cohort of professional traders in fixed income and FX can separate themselves from the herd. Even then, it might be dangerous. Going with the crowd is usually the profitable course of action, even if the crowd is stampeding the wrong way.

To be fair, sometimes the professionals ignore Trump tweets. The NYT has a list of 10 lies Trump has told, now politely re-named "fake news." Foremost is birtherism and Muslims celebrating 9/11 on New Jersey rooftops, but Trump also said the underemployment rate is 20% or more. Market players knew the actual data and declined to respond.

We already have rules to define what is true and what is false, but now we need to create a new rule that tells us how to differentiate between a lie that will have a market effect and a lie that won't. The too-strong dollar comment may have gotten an outsized reaction because the market was already entertaining the idea and also because it's as rare as hen's teeth for a president to mention the level of the dollar in any manner, let alone critically. Even Fed chiefs and Treasury Secretaries are very, very careful when speaking of the dollar, which they hardly ever do. Trump's reckless disregard for this hardwon convention is shocking in its down right.

The biggest problem going forward is that the masses don't read hard news from conventional news sources like the major financial newswires and newspapers. The professionals do, or are supposed to. But as we know from hard experience, truth is often a friendly-fire victim.

It could be worse—it could be actual propaganda. Luckily for lovers of true news, Trump lacks discipline. If he had discipline, he would hire thousands of fake news uploaders to social media, like China does. Quartz points out an academic study in the American Political Science Review outlining how China "fabricates social media posts for strategic distraction" .

And yet, even deep-pocket Big Bank professionals have to hold their nose and heed tweets. Barry Eichengreen, a certified dollar expert even if he is an academic (U Cal Berkeley), gave an interview to Reuters in which he says if we want to know how and when the trade war with China is beginning, we have to heed the tweets. About the too-strong dollar comment, Eichengreen notes that Trump wants a strong dollar, given his stated policy preferences, but fails to see he is creating a strong dollar with his policy preferences. "Trump wants a mix of loose fiscal and tight monetary policies, which will push up the dollar, and then he is frustrated by the strength of the dollar. He wants tariffs on imports, which push up the dollar, but then he is frustrated by the currency's strength. A paradox, no?"

As for the trade war with China, it will probably start with naming China a currency manipulator and then imposing tariffs, which a president has the ability to do. "Watch Twitter. China is exercising admirable restraint, but at some point its pride will be offended and it will be provoked. And I interpret treasury selling by China as an attempt to moderate the depreciation of the yuan, not as a political statement."

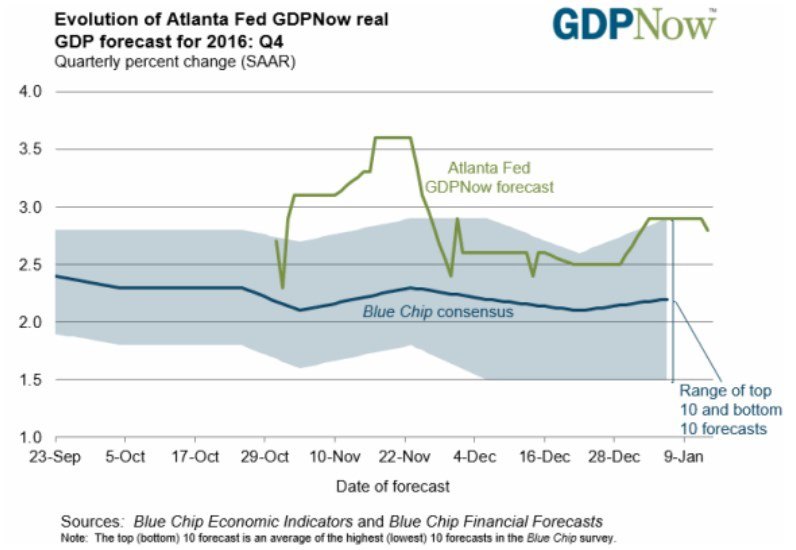

In addition to the other stuff on the calendar today, including the EIA oil inventory report, we get the latest Atlanta Fed GDPNow forecast for Q4. It was 2.8% back on Jan 13, down from 2.9% the time before, the drop attributed to personal consumption expenditures and retail sales. See the chart. Anyone else see a downturn forming? A lousy number could bash the newly revitalized robust economy story.

Turning to the eurozone, everyone and his brother expected the ECB outcome—rates and QE kept the same. Nobody expected anything new but we still await the Draghi press conference. Draghi is ex-pected to push back against the faction (read: Germany) that sees inflation getting too high and wants tapering. Well, they never liked QE in the first place and would use any rationale to get rid of it, and toot sweet. The FT argues, convincingly, that Draghi will push back, naming wide differences in the inflation rates of members.

"The governing council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases." While the bank's economists show inflation weak, the committee cut the monthly purchase goal from €80 to €60 billion ast the last meeting. If the ECB wants to maintain credibility, it really should explain why that was enough and it's not tapering. "The bank's task in hitting its inflation target may become more com-plicated because of divergent price pressures within the region. At 1.1 per cent, inflation for the euro-zone as a whole remains well below the ECB's target of just under 2 per cent. But in Germany the rate stands at 1.7 per cent, compared with 0.5 per cent in Italy. The ECB's mandate allows inflation in the region's strongest economies to exceed the bank's target. But while price pressures in weaker member states remain subdued the bank looks set to come under pressure to raise rates from German lawmak-ers, who say low returns are penalising the country's savers."

At a guess, Draghi is not giving anything away to the BBK or anyone else. This implies the divergent monetary policy thesis can resume. For a while.

Bottom line, we have swirling feelings about rates and yields, but also mixed feelings about the trade and currency war to come. The top two "ideas" of the Trump campaign are building the wall and giving China a comeuppance. We are likely to get both—next week. Will anyone be looking at reducing the Fed balance sheet or the velocity of M2 once Trump attacks China?

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 114.7 | SHORT USD | WEAK | 01/05/17 | 115.93 | 1.06% |

| GBP/USD | 1.2328 | SHORT GBP | WEAK | 12/16/16 | 1.2444 | 0.93% |

| EUR/USD | 1.0656 | LONG EURO | WEAK | 01/10/17 | 1.0587 | 0.65% |

| EUR/JPY | 122.23 | LONG EURO | STRONG | 11/03/16 | 114.30 | 6.94% |

| EUR/GBP | 0.8644 | LONG EURO | WEAK | 01/09/17 | 0.8649 | -0.06% |

| USD/CHF | 1.0062 | SHORT USD | WEAK | 01/05/17 | 1.0113 | 0.50% |

| USD/CAD | 1.3289 | SHORT CAD | WEAK | 01/05/17 | 1.3253 | -0.27% |

| NZD/USD | 0.7175 | SHORT NZD | WEAK | 12/19/16 | 0.6963 | -3.04% |

| AUD/USD | 0.7554 | LONG AUD | STRONG | 01/05/17 | 0.7343 | 2.87% |

| AUD/JPY | 86.64 | LONG AUD | WEAK | 10/06/16 | 78.48 | 10.40% |

| USD/MXN | 22.0128 | LONG USD | STRONG | 10/31/16 | 18.9054 | 16.44% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.