GOLD

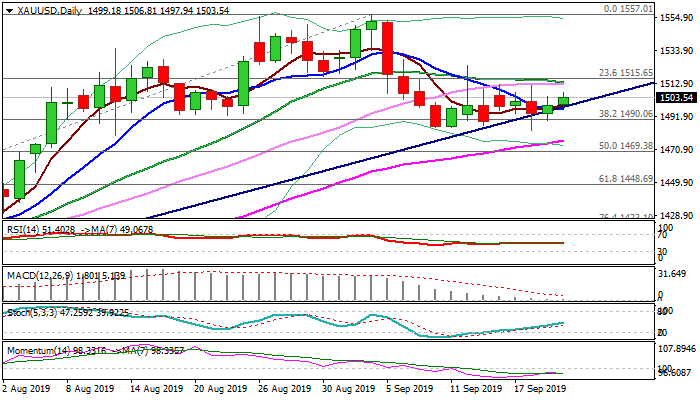

Spot gold price rose above $1500 handle on Friday, recovering from $1507/ $1483 dip after Fed rate cut. Widely expected action of the US central bank resulted in rather mild action of the dollar that kept the yellow metal, which usually moves in opposite direction, largely unchanged. Gold price holds in two-week consolidation range after pullback from $1557 (new six-year high) found footstep at $1484 zone (reinforced by the top of rising daily cloud), but recovery attempts were limited and capped by converged 20/30DMA's at $1515 zone. Near-term action lacks firmer direction signals as daily techs remain in mixed setup, suggesting that current congestion may extend. The yellow metal will look for a catalyst to spark fresh action and signal direction, with Brexit story and forecasts on Fed's next steps, to be also in focus of traders. Higher base and daily cloud top ($1484) mark pivotal support, followed by rising 55DMA ($1476), with firm break lower expected to generate stronger bearish signal for extension of pullback from $12557 peak. Conversely, lift and close above $1515 resistance zone would signal completion of higher base and shift near-term focus higher.

Res: 1512; 1515; 1520; 1524

Sup: 1498; 1490; 1484; 1476

Interested in Gold technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

GBP/USD drifts lower for the third straight day on Tuesday and drops to its lowest level since November 17 during the Asian session. Spot prices trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

EUR/USD falls toward 1.0600 on higher expectations of the Fed prolonging higher rates

EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.