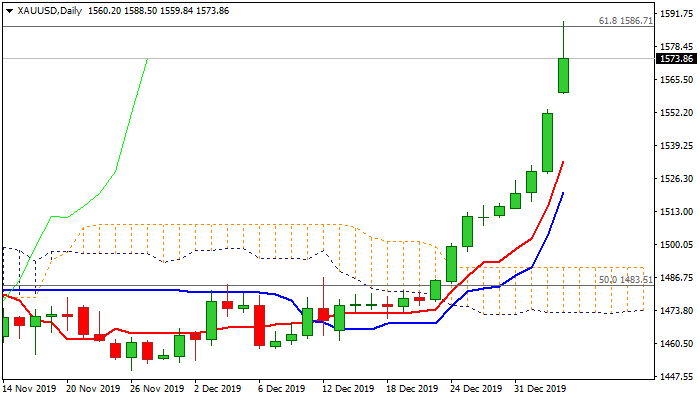

GOLD

Spot gold opened with gap-higher and spiked to new nearly seven-year high at $1588 in early Asian trading on Monday. Rising tensions in the Middle East after the United States killed top Iranian general, further boosted demand for safe-haven yellow metal, which advanced 3.5% in past four weeks and was up 1.8% in early Monday's trading. Risk of further escalation, as both sides threaten of new actions, Iran to retaliate and the US of direct attack, keep traders at high alert and further rise of gold price can be anticipated in such conditions. The gold price is currently riding on the fifth wave of five-wave cycle from $1160 (Aug 2018 low), which could, according to wave principles, extend to $1630 zone (also near Fibo 161.8% extension of bull-leg from $1445). Fresh advance today cracked important Fibo barrier at $1586 (61.8% of $1920/$1046, 2011/2015 descend) but faces headwinds here and may hold in extended consolidation before resuming higher. Strongly overbought daily studies support scenario, with dip-buying remaining favored scenario. Former high at $1557 (4 Sep) marks initial support and so far holding, with extended dips to find ground at $1535 zone (24 Sep lower high / Fibo 38.2% of $1445/$1588 upleg / rising daily Tenkan-sen) and keep bulls intact. Close above cracked Fibo barrier $1586 would generate fresh bullish signal for attack at psychological $1600 barrier (also Fibo 138.2% projection of the upleg from $1445) which guards $1630 target zone).

Res: 1588; 1600; 1616; 1630

Sup: 1559; 1557; 1553; 1535

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.