Oil prices have generally tracked risk appetite so far this week, dropping sharply on Monday before recovering over the last three days. Today’s rally has been supercharged by escalating geopolitical tensions in the Middle East; when asked whether the US would go to war with Iran, the President stated “I hope not.” The latest comments come on the heels of last week’s news that the White House was positioning aircraft carriers in the region and has drawn up plans to deploy more than 100k US troops to the Middle East if necessary.

From a fundamental perspective, oil prices are delicately balanced between competing forces: geopolitical risks in Iran and Venezuela are boosting prices on concerns of a supply shock, while the ongoing US-China trade tensions and potential for OPEC to increase production are keeping bulls on their toes.

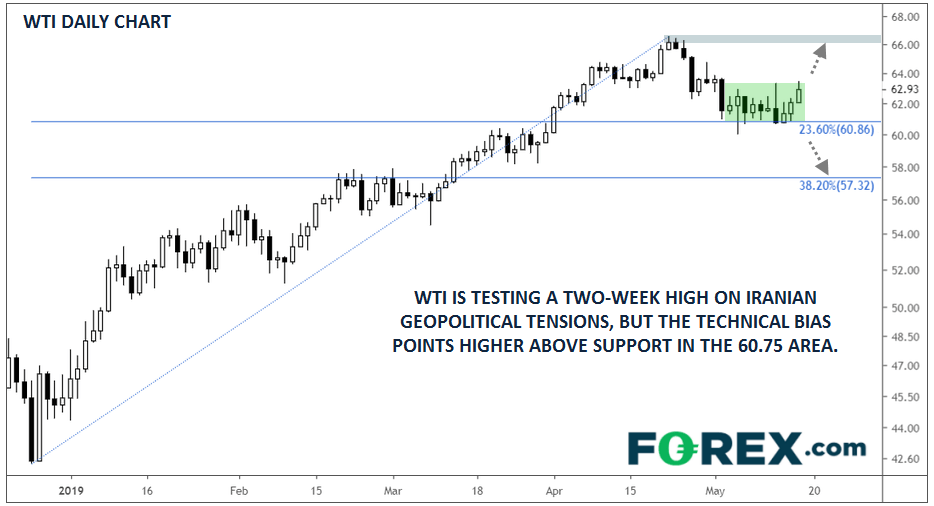

Technically speaking, US oil prices peeked out to a two-week high above 63.00 this morning before pulling back as of writing. So far, WTI has only seen a shallow 23.6% Fibonacci retracement of its 2019 rally, suggesting that the medium-term momentum remains with the bulls for now:

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.