US CRUDE OIL

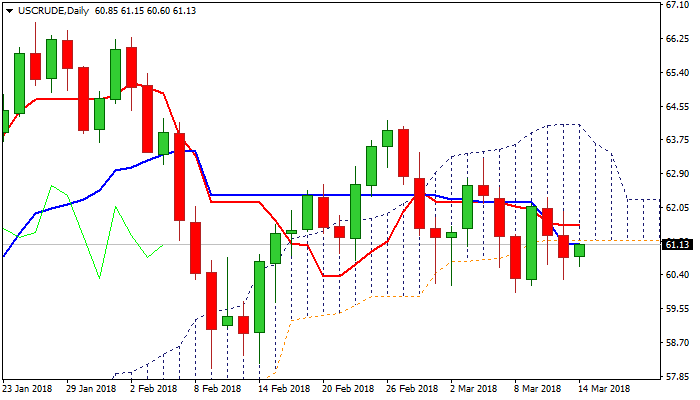

WTI oil trades higher on Wednesday and regains $61 handle, but recovery attempts so far hold below the base of thick daily cloud which marks solid resistance at $61.23.

Oil price bounced from new low at $60.26, posted after strong two-day fall on Mon/Tue, on mild support from API crude stocks report which showed oil inventories rose less than expected last week (1.15 million barrels vs 1.5 million barrels f/c).

However, near-term outlook remains negative as rising US oil production continues to weigh and offset efforts from OPEC-led production cut program to stabilize oil market.

Also, bearish daily techs add to existing pressure, seeing bears intact for fresh downside while daily cloud caps recovery attempts.

Tuesday’s strong downside rejection suggests oil price may hold in extended consolidation before renewed attack at cracked psychological $60 support and rising 100SMA ($59.85).

EIA crude stocks report is due later today and focused for fresh signal. Forecast shows build of crude inventories by 2 million barrels vs previous week’s build of 2.4 million barrels. Unless strong surprise at the downside (weaker than expected build in stockpiles or possible draw) data are expected to keep oil prices pressured.

Alternative scenario requires return and close in daily cloud to ease existing bearish pressure and signal stronger recovery of $62.31/$60.26 bear-leg.

Res: 61.23; 61.53; 61.87; 62.31

Sup: 60.60; 60.13; 59.94; 59.85

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.