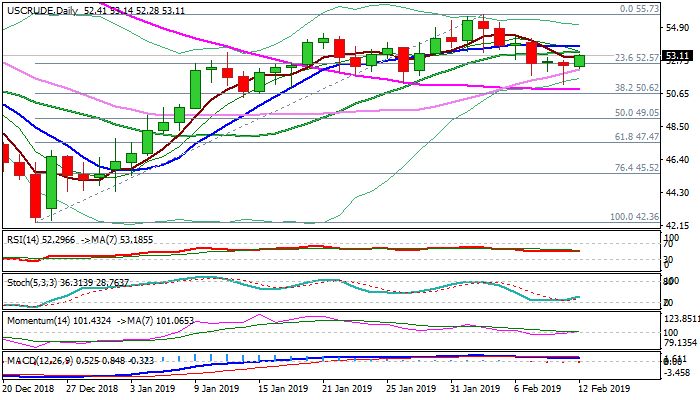

US CRUDE OIL

WTI oil edges higher on Tuesday as traders booked some profit's after week-long pullback from $55.73 high started showing initial signs of stall. Monday's hammer candle suggests that $55.73/$51.23 corrective dip might be over after bears repeatedly failed to clearly break below 200WMA ($52.33). Daily momentum emerged into positive territory and stochastic turned north from sideways mode (just above oversold border line) adding to positive signals. Today's bullish close may generate initial bullish signal, but extension and close above converged 20/10SMA's ($53.34/66 respectively) is needed t generate reversal signal. Fundamentals remain mixed as OPEC-lead production cut and US sanctions on Iran and Venezuela underpin but fears of global economic growth slowdown, partially offset positive impact. Traders would look for fresh signals from US API crude stocks report, due today, and Wednesday's EIA US crude inventories report.

Res: 53.34 53.66; 54.28; 55.15

Sup: 52.33; 51.23; 50.94; 50.62

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.