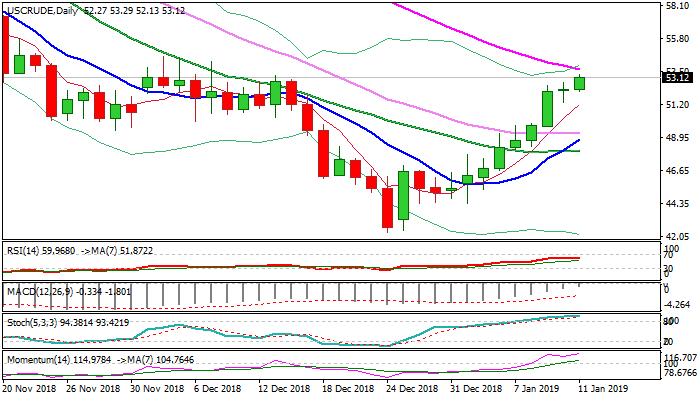

US CRUDE OIL

WTI oil extends advance on Friday after the action on Thursday ended in Doji, signaling a pause in recent strong rally.

Fresh upside pressures falling 55SMA ($53.68) and could extend towards key barriers at $54.54/$55.08 (4 Dec high / base of falling thick daily cloud), after break above psychological $50 barrier and extension above 200WMA ($52.24) generated strong bullish signals.

The oil is on track for the second straight bullish weekly close (the biggest one-week gains since late June 2018).

Bullish studies add to growing positive sentiment on hopes of US/China deal and output reduction from main oil exporters that would stabilize global oil markets.

Fresh draws in US crude stocks last week added to bullish outlook, with weekly close above 200WMA needed to confirm.

Dip-buying above $50 remains favored near-term scenario.

Res: 53.68; 54.54; 55.08; 55.55

Sup: 52.24; 51.30; 50.50; 50.00

Interested in WTI oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.