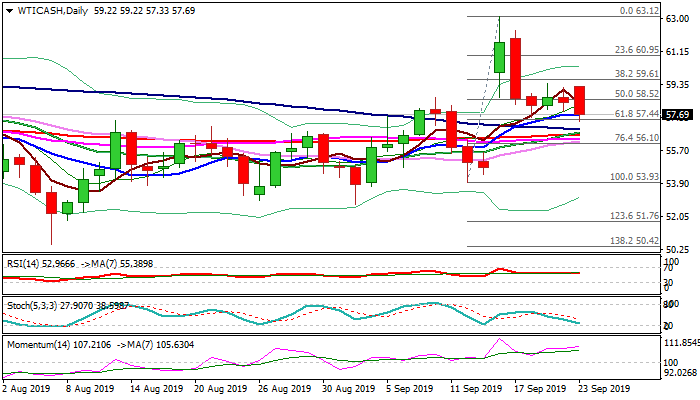

US CRUDE OIL

WTI oil price changed direction and fell below important supports at $57.66/44 (10DMA/Fibo 61.8% of $53.93/$63.12) on Monday, following the latest news that Saudi Arabia is restore production from oil facilities damaged in attack last week, as soon as next week. The WTI oil opened with gap higher on Monday and hit session high at $59.22, on concerns that recovery of oil facilities would take months, but the latest optimistic comments changed sentiment. Fresh weakness attempts to break out of three-day congestion that would signal a continuation of pullback from new four-month high at $63.12 (16 Sep peak). Close below $57.44 pivot is needed to confirm negative signal, but fresh bears would face strong headwinds from a cluster of daily MA's at $56.89/21zone (converging 100/20/200/55/30 DMA's). Only firm break here would confirm bearish stance and open way for further weakness. Daily momentum continues to rise and together with MA's still in bullish setup, marks strong obstacle for bears. Failure to close below $57.44 Fibo support would risk extended directionless mode.

Res: 58.52; 59.22; 59.43; 59.61

Sup: 57.44; 56.89; 56.58; 56.32

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.