US CRUDE OIL

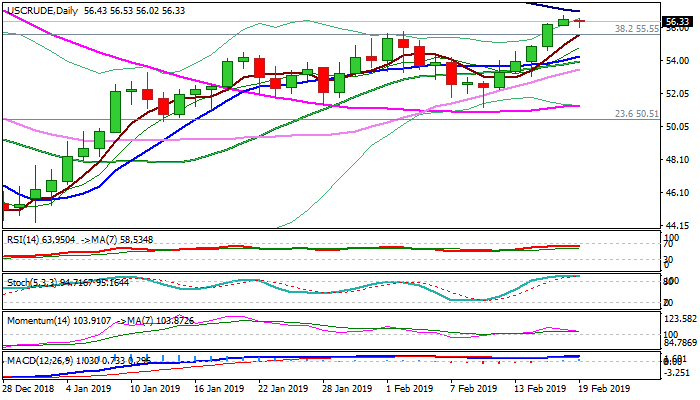

WTI oil price holds within tight range under new 2019 high posted after strong 5-day advance, showing hesitation on approach to strong barrier at $56.92 (falling 100SMA).

Bulls are running out of steam as daily slow stochastic is turning south in deep overbought territory and momentum moved lower and is creating bear-cross.

Strong rally from $51.23 trough is likely taking a breather and would be positioning for fresh advance through 100SMA pivot.

The sentiment remains positive on OPEC production cut and sanctions on Iran and Venezuela, but traders look for more news on US/China trade talks, as fresh optimism on comments about possible deal, boosted oil price but needs more evidence.

Focus turns towards US crude inventories reports, API report on Wednesday and EIA report due on Thursday ( delayed one day due to US holiday) for fresh signals.

Former high at $55.73 (4 Feb) and broken Fibo barrier at $55.55, reinforced by rising 5SMA, mark solid support zone which should ideally contain dips, however, deeper pullback towards pivots at $54.25/$53.95 (converged rising 10&20SMA’s) cannot be ruled out before fresh attempts higher.

Only close below these supports would sideline bulls for stronger correction.

Res: 56.71; 56.92; 57.43; 58.14

Sup: 56.02; 55.55; 54.48; 54.25

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.