US CRUDE OIL

WTI oil started week in negative mode after Friday’s report showed increase of numbers of US oil rigs which adds to existing concerns over global growth slowdown and oversupply.

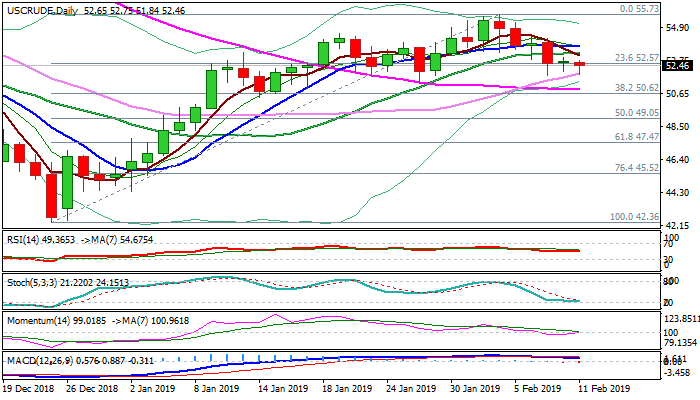

However, the downside attempts were so far limited by rising 30SMA (currently at $51.94), with downside rejections seen last Thu/Fri and today’s bounce from 30SMA) generating initial signal that bears might be running out of steam.

Rising daily momentum supports scenario and may keep the downside protected for some time, but more work at the upside is needed to neutralize existing downside risk.

Break above 20/10 SMA’s ($53.30 and $53.69 respectively) is needed to activate reversal scenario and shift near-term focus higher.

On the other side, last week’s close in red and formation of weekly bearish engulfing weighs, however, fresh bears need clear break below 200WMA ($52.33) to generate stronger bearish signal and expose supports at $50.90 (55SMA) and $50.62 (Fibo 38.2% of $42.36/$55.73 ascend), loss of which would spark stronger weakness.

Res: 52.98; 53.30; 53.69; 54.28

Sup: 51.94; 51.32; 50.90; 50.62

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.