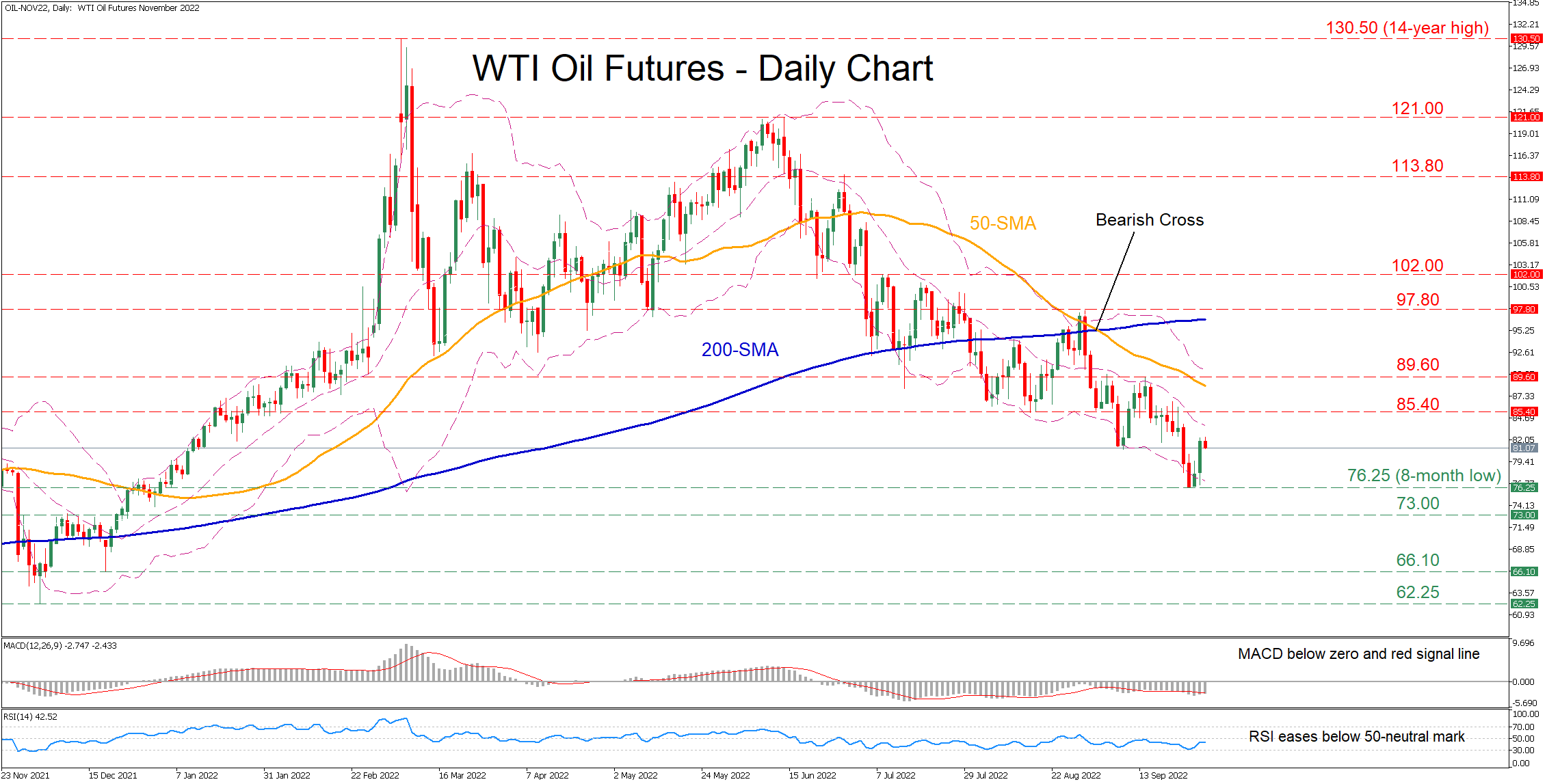

WTI oil futures bounce off 8-month low, downtrend intact

WTI oil futures (November delivery) have been experiencing a prolonged decline since mid-June when the price failed to surpass the 121.00 mark. Although the commodity has been recording consecutive fresh lows in the last few daily sessions, it managed to recoup some losses after hitting an 8-month low.

The short-term oscillators are depicting that bearish forces remain in control despite the recent upside bounce. Specifically, the MACD remains below both zero and its red signal line, the RSI is flatlining beneath the 50-neutral threshold.

Should the negative momentum intensify further, price declines could cease at the eight-month low of 76.25. Dipping beneath that region, the bears could target the December 2021 resistance zone of 73.00 before the December low of 66.10 comes under examination. Even lower, the November bottom of 62.25 may provide downside protection.

On the flipside, bullish actions might propel the price towards the recent support zone of 85.40, which could now act as resistance. Conquering this barricade, the price may ascend towards 89.60 or higher to challenge the August peak of 97.80. A break above the latter could open the door for the 102.00 region.

Overall, despite the minor upside correction, WTI oil futures are likely to lose more ground as the commodity appears to be facing persistent downside pressure. For that bearish tone to reverse, the price needs to jump above the 97.80 ceiling.

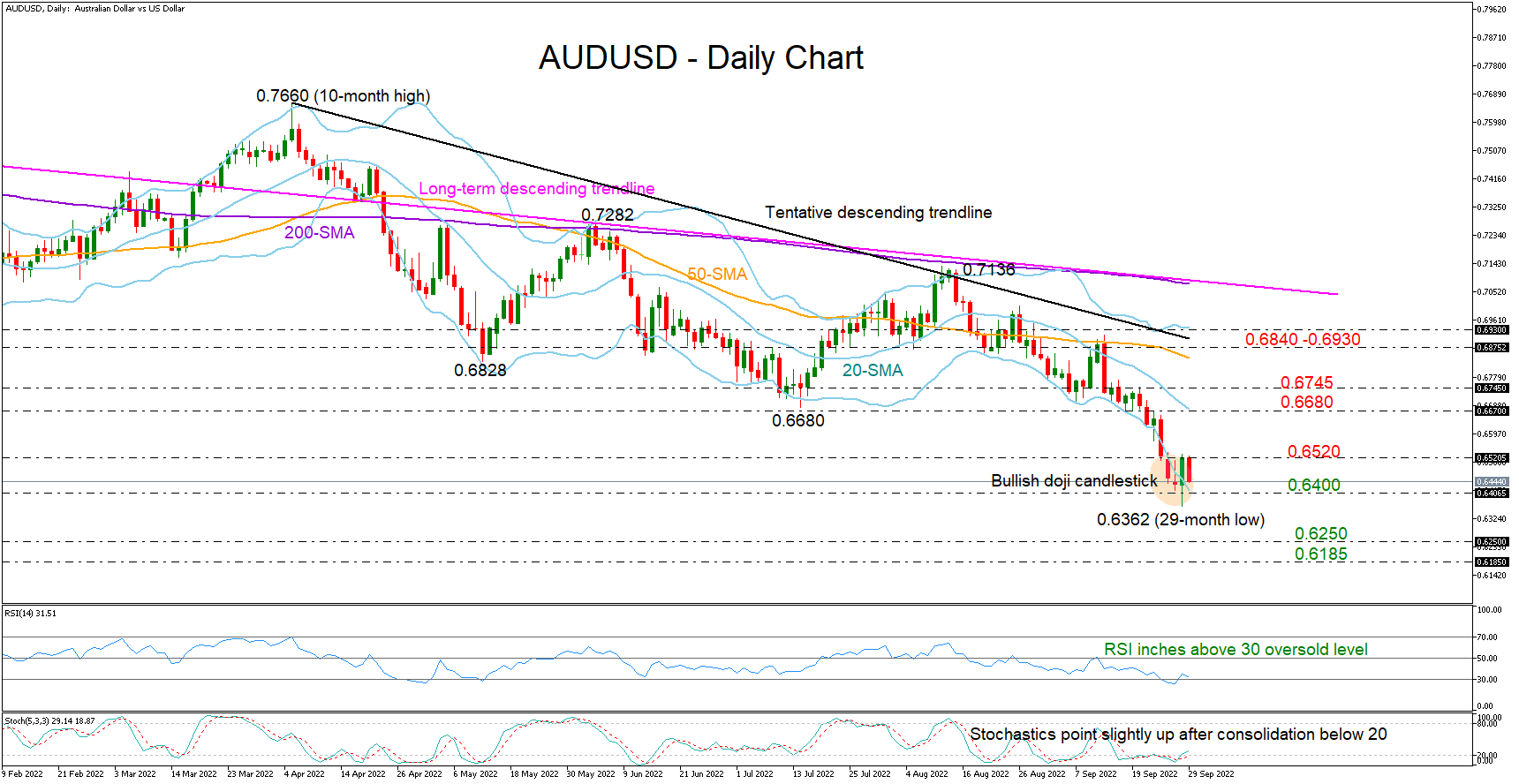

AUD/USD detects oversold conditions near fresh lows

AUDUSD was trimming Wednesday’s quick bounce from the 29-month low of 0.6362 during Thursday’s early European trading hours, but the completed doji candlestick pattern continued to feed hopes for an upside reversal.

Given the price’s continuous contact with the lower Bollinger band over the past month, the odds are favoring the bulls. The RSI and the stochastics are adding to this optimism as the indicators are trying to exit the oversold territory.

Nevertheless, buyers could hold up until the price successfully claims the nearby resistance of 0.6520. If that proves to be the case, the pair might fly directly towards July’s trough of 0.6680, where the 20-day simple moving average (SMA) happens to be. Slightly higher, the 0.6745 region had been frequently tested during 2019 and could be the key for an advance towards the 0.6840-0.6900 zone. Note that the 50-day SMA, as well as the tentative descending trendline from 0.7660, are positioned within this region.

If the bearish scenario plays out, with the price closing below 0.6400, the next pivot point could develop around 0.6250, taken from April 21 2020. Should sellers persist, the downtrend could stretch towards the 0.6185 barrier.

In short, despite the clear downtrend in AUDUSD, the technical picture is increasing the stakes for some stabilization in the market. Perhaps a decisive close above 0.6520 could help the pair to gain some extra ground.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.