Earlier this week, Oil prices rose as U.S. crude stockpiles showed a drawdown largerthan- expected late last week. In addition, Britain's largest pipeline from its oil and gas fields in the North Sea had an unexpected shutdown for several weeks due to cracks appearing. This pipeline carries about 450,000 barrels per day (bpd) of Forties crude, and causing supply constraints as the pipeline is the largest out of the five crude oil streams that underpin the Brent benchmark.

However, Oil prices fell again overnight most likely due to technical resistance at USD58.60 bbl. Even despite the massive Crude Oil Inventories drawdown last week, production from Crude Oil in the United States has steadily grown from 8.946 million bpd per week starting January this year and reaching an average of 9.707 million bpd for the week ending December1.

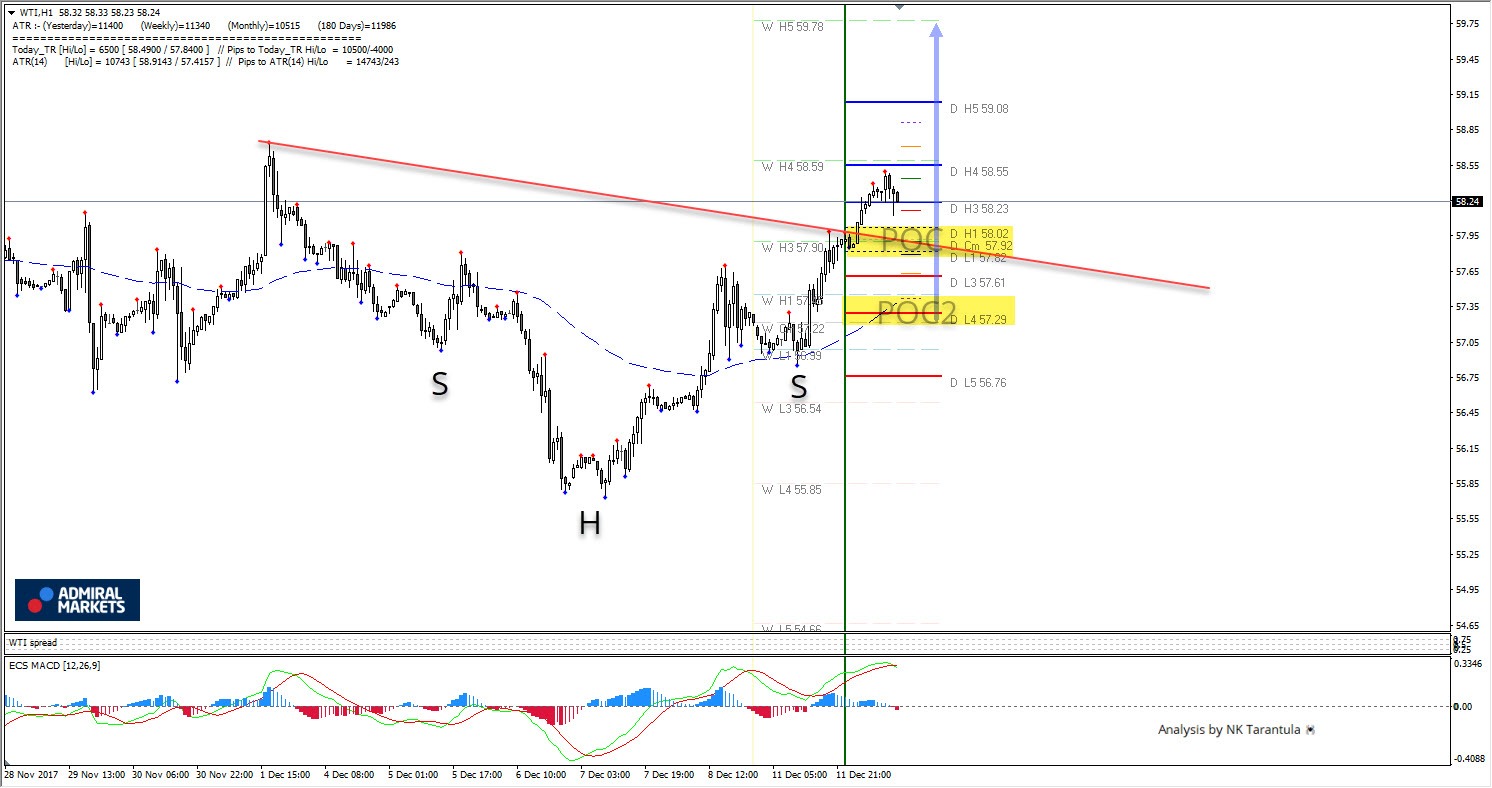

All eyes will be on Crude Oil Inventories data from USA later today. Technically the WTI is bullish and we see 2 POC zones where it could bounce. 57.80-58.00 is the first POC zone while 57.30-40 is the POC2. Additionally we see an inverted SHS pattern that is bullish. However if the results come worse than expected, the WTI might drop below 56.65 aiming for 55.85.

H3 - Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 - Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 - Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC - Point Of Confluence (The zone where we expect price to react aka entry zone)

Oil Current Trading Positions

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.