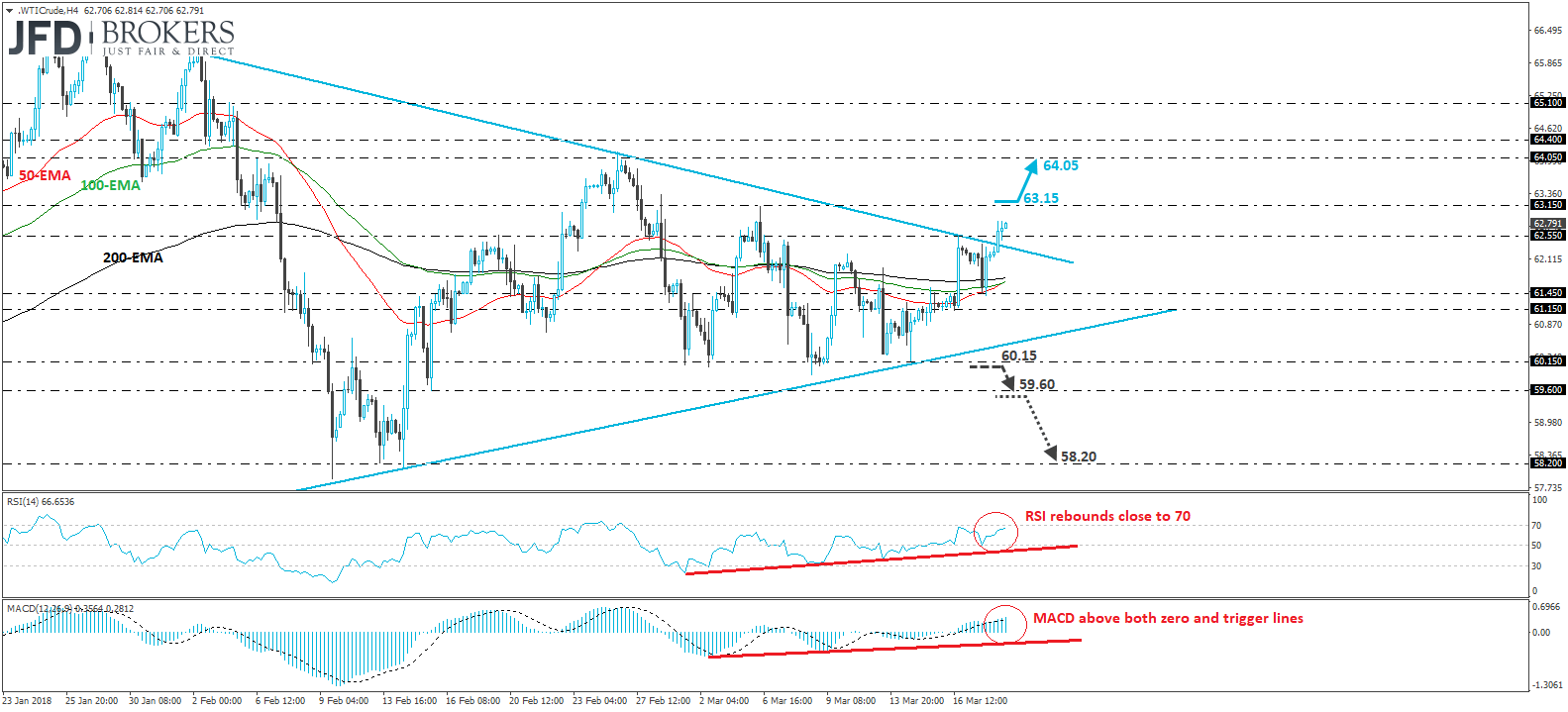

WTI edged north during the European morning Tuesday, breaking above the upper bound of a symmetrical triangle formation that has been containing the price action since late January. With that in mind, and also taking into account that the price continues to trade above the longer-term uptrend line drawn from the low of the 21st of June, we believe that the outlook has turned back to positive.

Currently, WTI looks to be heading towards the 63.15 resistance obstacle, defined by the peak of the 6th of March. A decisive break above that level may set the stage for more upside extensions, perhaps towards our next resistance hurdle of 64.05, marked by the peak of the 26th of February.

Turning our attention to the short-term oscillators, we see that the RSI rebounded from near 50 and now appears ready to challenge its 70 line, while the MACD stands above both its zero and trigger lines. Both these indicators reveal positive momentum and support the case for the liquid to continue trading north for a while more.

On the downside, a move back within the triangle will push us to the sidelines. We would like to see a dip below the lower end of the formation and the 60.15 support before we start assuming that the short-term outlook has turned negative. Such a break could initially aim for the 59.60 support, marked by the low of the 15th of February. Another dip below 59.60 could carry more bearish implications and could pave the way towards the 58.20 territory.

Having said all these, even in the case of the aforementioned declines, the price would still be trading above the longer-term uptrend line drawn from the low of the 21st of June. As such, although we would turn negative for the short run, we would maintain the view that the broader picture remains cautiously positive.

Are you interested in institutional-grade research? Sign up for our Weekly Strategic Report HERE – it’s free!

Article written by Charalambos Pissouros, Senior Market Analyst at JFD Brokers

You want more? Visit our Research Website HERE, or subscribe to our JFD YouTube Channel HERE. To contact Charalambos send an email to [email protected]

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'