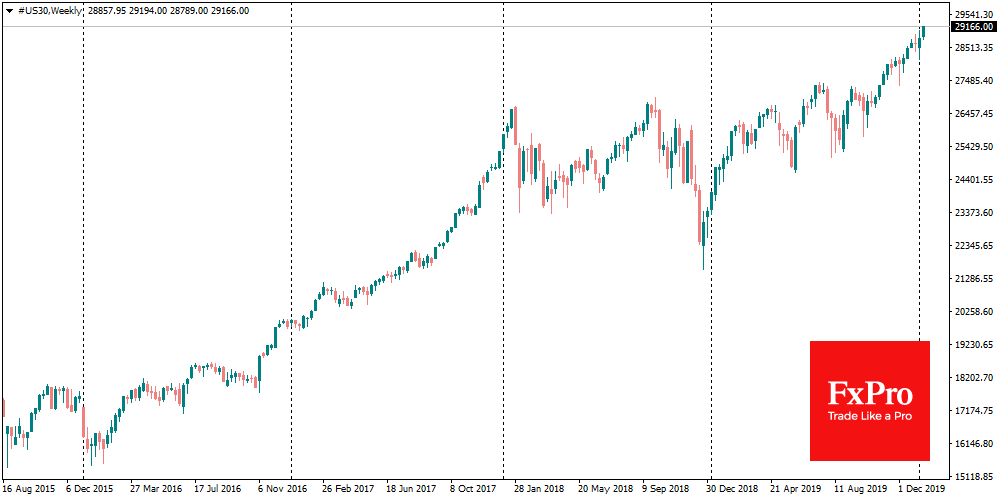

The global market continues to grow, showing new historical highs for the major American indices, as well as the ones of Australia and India. The American Dow Jones closed above 29,000 for the first time, and the SP 500 hit 3300. After signing the trade agreement, Trump gave a new impetus to the markets in the form of a new tax reform package. The US Treasury Secretary said yesterday that further measures might be announced by the middle of the year, which promises to be serious support for Trump in the presidential race.

Previous tax reform was in the end of 2017, but while there was a debate in Congress and the Senate, markets grew steadily throughout the year, adding more than 25% on SP500 and 35% on Dow Jones. It may well turn out this time that the tax cuts will help markets to grow from the moment they are announced until the approval. And under these conditions, the achievement of Dow Jones 30,000 (+ 3% to current levels) may be seen as a very close and real target for market players, which will attract additional interest in the media, creating a favourable noise.

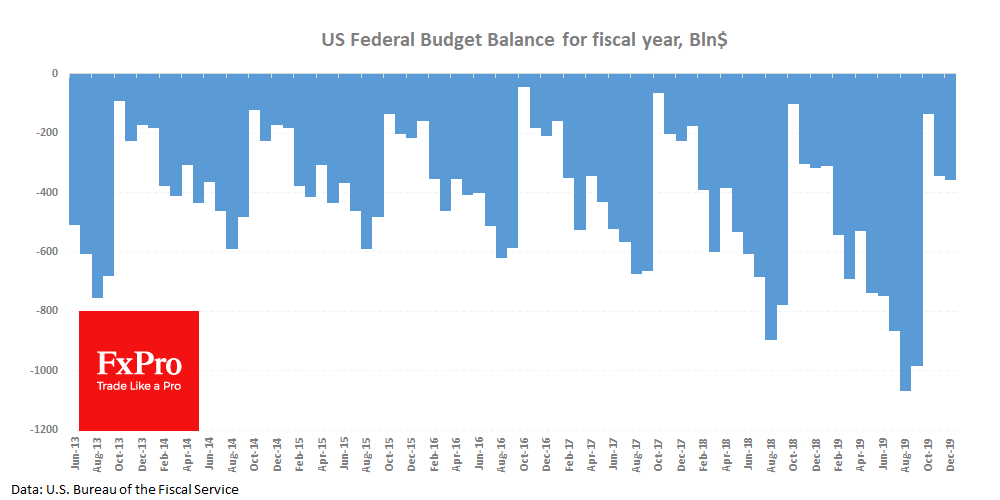

Of course, as always in such cases, there are no free lunches. The US economy has been creating jobs for the 12th consecutive year, companies and market analysts are looking to the future with confidence but still have an impressive budget deficit of about $1 trillion for the fiscal year ending in October 2018.

However, as long as the growing budget deficit does not lead to a loss of interest in American debt securities, markets may ignore this fact. However, the problem of a high debt burden will be challenging to solve instantly.

In this case, the most obvious solution may be to weaken the US dollar, which will spur inflation and eat up the real value of national debt. However, it is not so easy to do. The Fed can weaken the dollar only through monetary easing - a technique that is quickly copied by other central banks, as we saw in 2019. As a result, the dollar index showed the minimum volatility in recent years and even slightly increased.

There is much more room for manoeuvre for the US. Treasury, which may order the Fed to weaken the dollar, as well as agree with the authorities of other countries not to prevent this weakening. But this conflicts the idea of free markets, which the US itself so fiercely advocates. Moreover, a systematic weakening of the dollar risks undermining the demand for US debt securities, which would eventually result in higher government debt service costs.

The US chose to kick the can down the road, meantime continue to accumulate problems and even increasing efforts in this direction. In the short term, it does not harm the dollar, but it puts a time bomb under it, risking to repeat the scenario if not Greece of the 2010s, then Japan of the 1990s.

FxPro UK Limited is authorised and regulated by the Financial Services Authority, registration number 509956. CFDs are leveraged products that incur a high level of risk and it is possible to lose all your capital invested. Please ensure that you understand the risks involved and seek independent advice if necessary.

Disclaimer: This material is considered a marketing communication and does not contain, and should not be construed as containing, investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. FxPro does not take into account your personal investment objectives or financial situation. FxPro makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or other information supplied by any employee of FxPro, a third party or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without the prior permission of FxPro. Risk Warning: CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all your invested capital. Therefore, CFDs may not be suitable for all investors. You should not risk more than you are prepared to lose. Before deciding to trade, please ensure you understand the risks involved and take into account your level of experience. Seek independent advice if necessary. FxPro Financial Services Ltd is authorised and regulated by the CySEC (licence no. 078/07) and FxPro UK Limited is authorised and regulated by the Financial Services Authority, Number 509956.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.