Some market participants worry that the passing of Hong Kong Human Rights and Democracy Act can reverse the gain in stock market. Both the US Senate and House of Representative overwhelmingly voted 417 to 1 in favor of passing the bill. It is now waiting for President Donald Trump to sign. According to Bloomberg, Trump is expected to sign the legislation rather than veto it. This bill will sanction China's officials who are deemed to harm human rights and freedom in Hong Kong. It will also require US to assess annually whether Hong Kong is sufficiently autonomous to warrant favorable trading status.

Separately, the House also passed another bill called the Protect Hong Kong Act. This bill will ban the export of weapons such as tear gas and rubber bullets to Hong Kong. These measures are mostly symbolic but may alter Washington's relationship with China. Even before this bill, China has accused the U.S as meddling with China's internal affair. Joshua Wong, the poster child of the protest movement, was spotted meeting one of the US consulate employees in Hong Kong. What started initially as a peaceful protest against extradition bill has morphed into violent acts and vandalism.

With the U.S and China currently still negotiating a "Phase 1" Deal, this bill led some market participants to believe that a deal will never happen. They argue that the U.S has insulted China's national honor and thus there won't be any comprehensive trade deal. Consequently, the global economy will suffer greatly as the relationship between two biggest economies in the world worsen. Indeed, there are currently obstacles to reach the agreement as China wants the US to roll back some of the existing tariffs. Trump recently was visibly frustrated and he publicly warned that he can raise the tariffs higher if there is no agreement.

For their part, China has responded to the passing of the bill with strong condemnation and opposition. The following is part of the official response by the Chinese government:

"On November 19th, the US Senate passed the "Hong Kong Bill of Rights on Human Rights and Democracy." The bill disregards the facts, confuses right and wrong, violates the axioms, plays with double standards, openly intervenes in Hong Kong affairs, interferes in China's internal affairs, and seriously violates the basic norms of international law and international relations. The Chinese side strongly condemns and resolutely opposes this."

Despite the complexity of the situation, we don't think the passing of the bill will derail the gain in stock market. Based on our technical analysis, pullback in major stock markets exhibit corrective characteristics. Thus, we still conclude the bullish bias remains intact for now. Dips should continue to provide opportunity to buy in the sequence in 3, 7, 11 swing. Below we will take a look at a couple of charts to determine the structure of the latest decline.

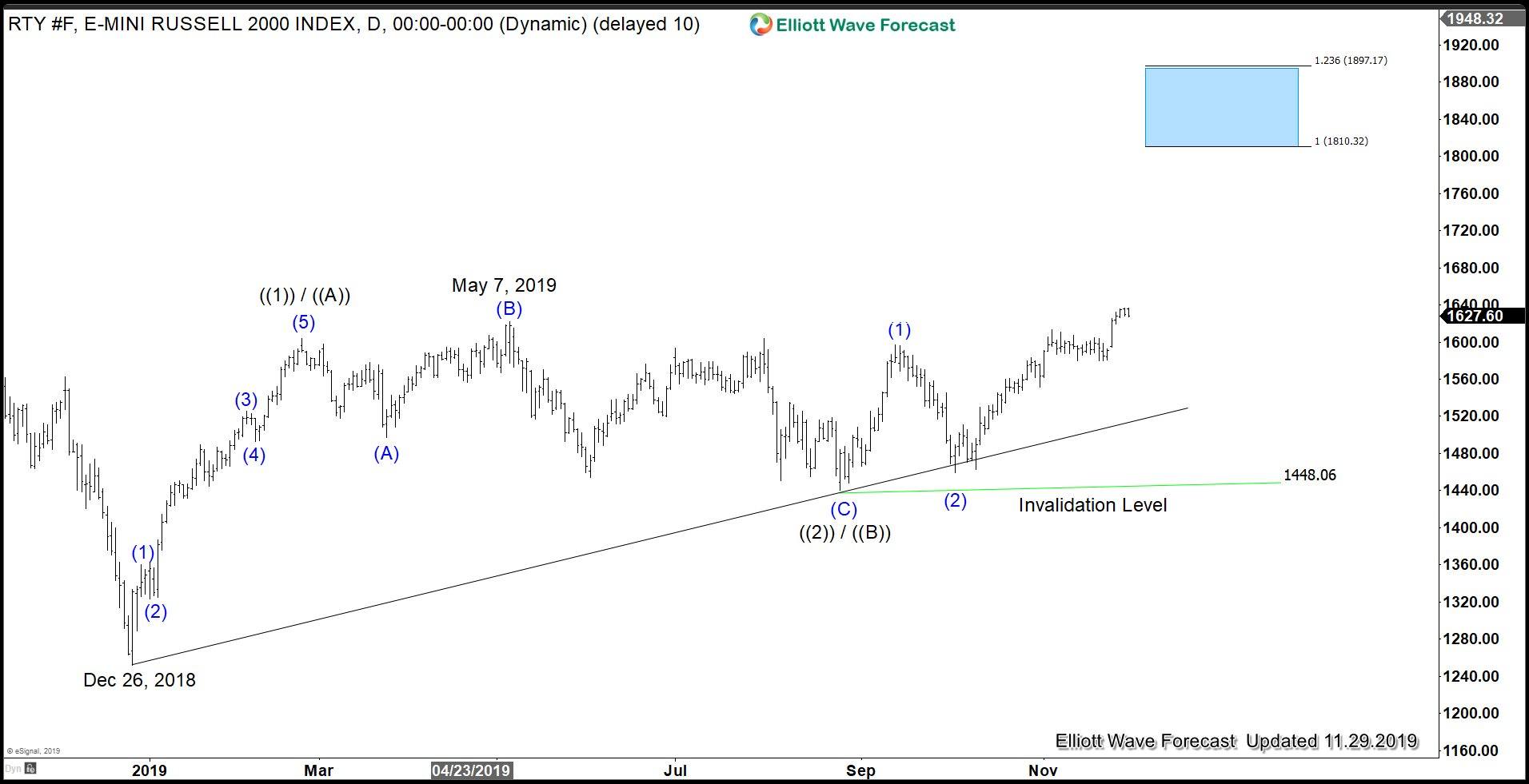

Russell 1 Hour Elliott Wave chart

We can see from above chart that the decline in Russell from wave 3 high still shows a clear overlapping corrective characteristic. We believe the Indices remain firmly bullish. Pullback should find buyers in the sequence of 3, 7, 11 swing.

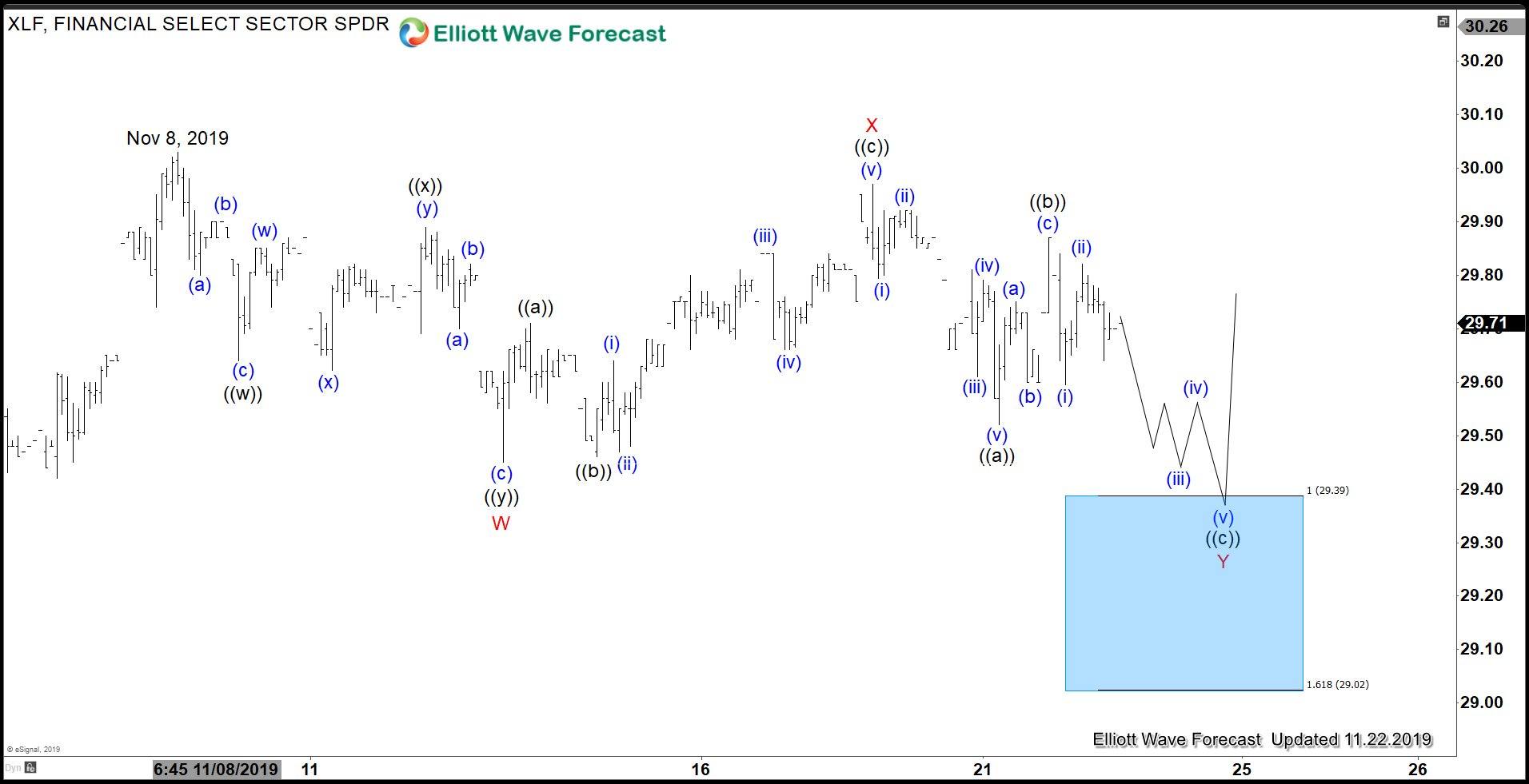

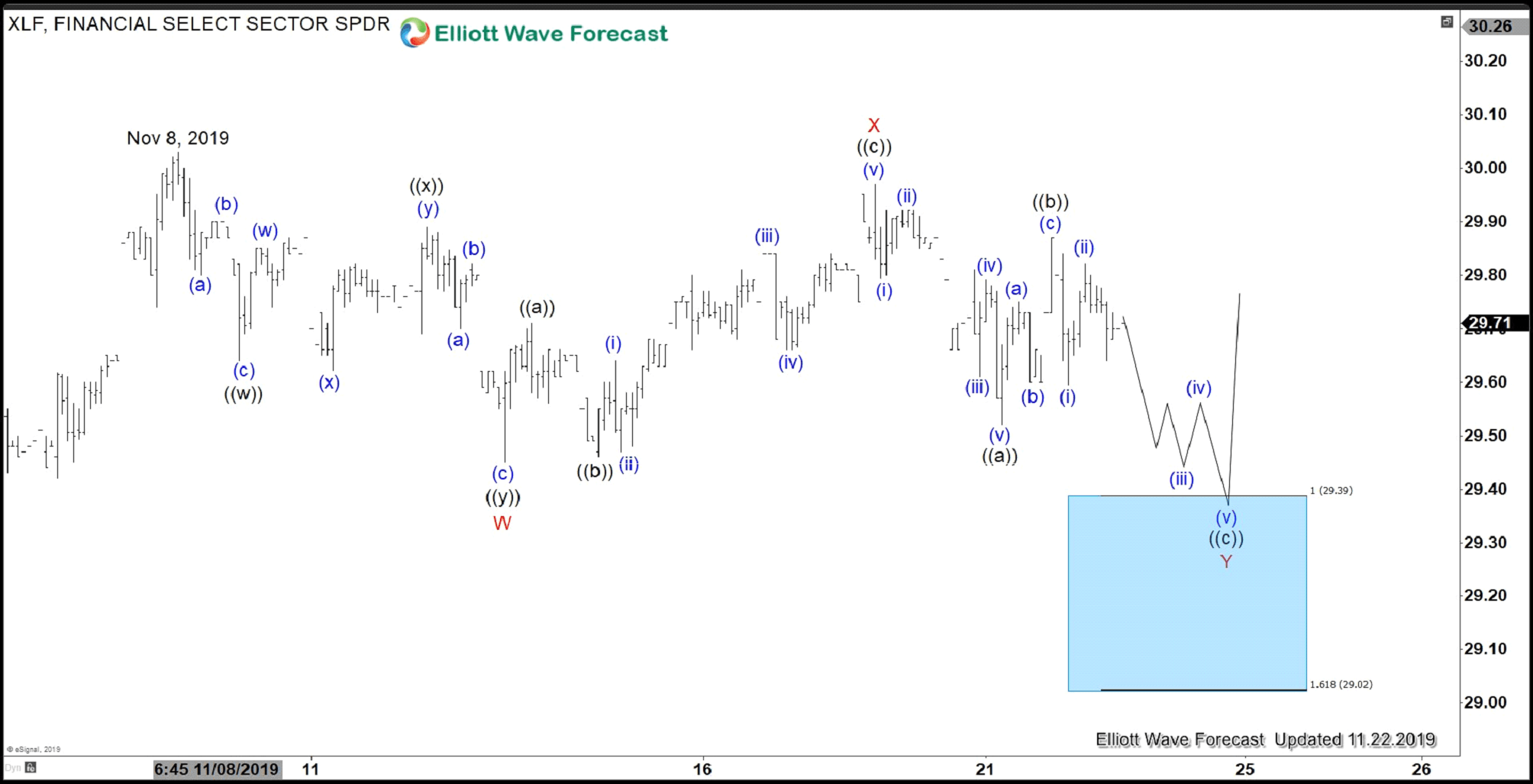

XLF 1 Hour Elliott Wave Chart

Above is the 1 hour chart of XLF, which is the Financial Sector ETF. The decline from November 8, 2019 high is also overlapping and 3 waves. This suggests that the trend remains bullish. The ETF should see buyers at the blue box above. From there, it should extend higher or bounce in 3 waves at least.

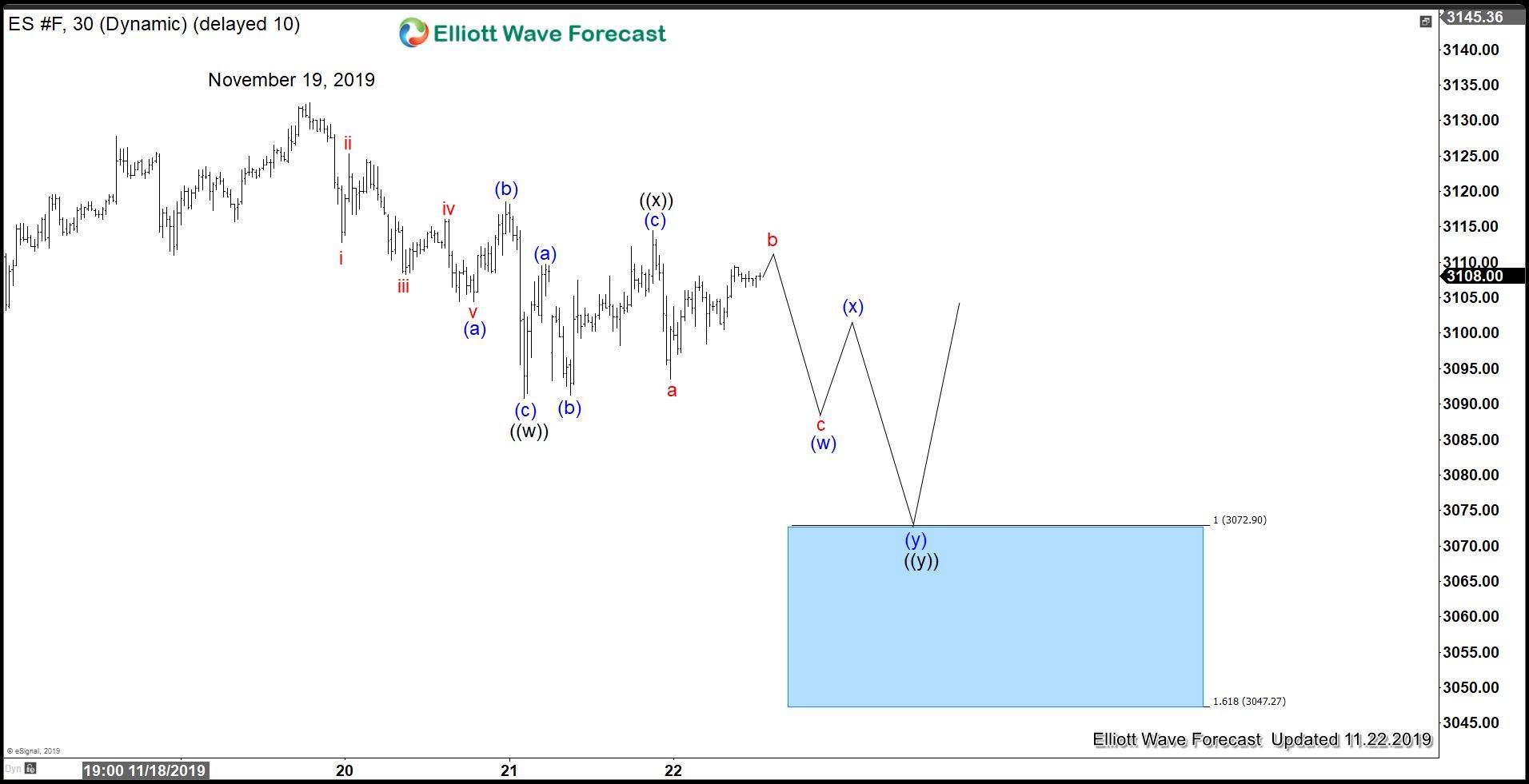

ES_F 1 Hour Elliott Wave Chart

Latest decline in S&P 500 Future (ES_F) from November 19, 2019 high is in 3 waves. Therefore, the trend and bias remain higher. If the Index can see another leg lower to do 7 swing, then the next area of support is 3047 – 3072 area. From here, the Index can extend higher or bounce in 3 waves.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.