On the back of Wednesday’s Fed economic policy projections indicating that only a further two US rate hikes are likely in 2017, the dollar weakened and commodities rallied.

Given this backdrop the miners rallied powerfully. To put this in perspective, FTSE 100 mining stocks were up on average over 4% yesterday (vs. +0.6% for the index) and the six FTSE 100 miners were the six best-performing stocks on the day.

Having seen the mining sector surge higher throughout 2016, many investors are now asking whether yesterday’s rally is a sign of things to come, or simply a flash in the pan.

Miners Stall in 2017

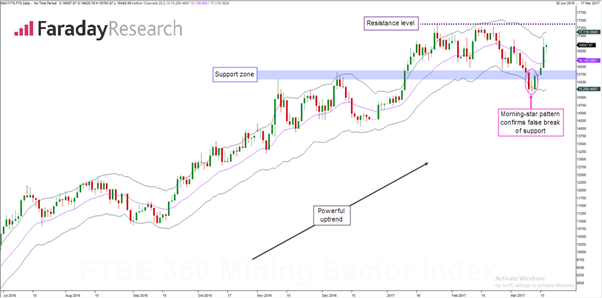

Looking at the FTSE 350 Mining Sector Index (below) reveals that prices peaked at just over 17,400 in late January.

Price action in early February saw the index approach and fail to break above this level on several occasions - a clear indication that a resistance level is in play at the low 17,300s.

More recently we have seen a sell-off ensue. Following a relatively sharp move lower last week we saw a morning star pattern confirm a false break of a support zone. As with any false break, this further validates the significance of this key zone / level.

Buying opportunity?

Following Wednesday’s FOMC meeting, short-term momentum has undoubtedly swung positive for the sector. This has led to some investors suggesting now is buying opportunity.

However, for us, a more interesting buying opportunity would present itself if the index were to break above the January swing high. In this scenario, we would have clear evidence that the sector’s stellar uptrend is back in play.

Here, I need to caveat the above by emphasizing I am reviewing the index in this piece. Yes, similar patterns are witnessed across individual miners, but they each have their individual nuances. For example, some are currently trading much closer to their trend highs than others and resistance and support levels vary notably across the peer group as well.

Of course, were the index to snap back in the coming sessions, then we would be watching closely to see if the previously mentioned support zone holds. Whether it does or not would in turn significantly impact our outlook for the sector.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.