Microsoft Corp. appears to be the main loser in the battle of acquiring the North American part of Tik-Tok’s operations, with Oracle coming in as the “preferred technology partner” of the app owned by China’s ByteDance. With teens in no need to use Windows-powered PCs as they did in the past, Microsoft seems to have lost an opportunity to access their world. However, by missing out on the Tik-Tok deal, the firm may have also avoided the pain accompanied by entering the data-collecting field. Let’s not forget the scrutiny Google and Facebook have drawn from regulators in the US and Europe exactly because of that. Although it’s stock may perform somewhat poorly in the aftermath of the Tik-Tok related developments, with its more than USD 1trln market cap, the company may continue to do well on its own in the longer run, with Windows, productivity, and Xbox businesses still being the main source of its revenue.

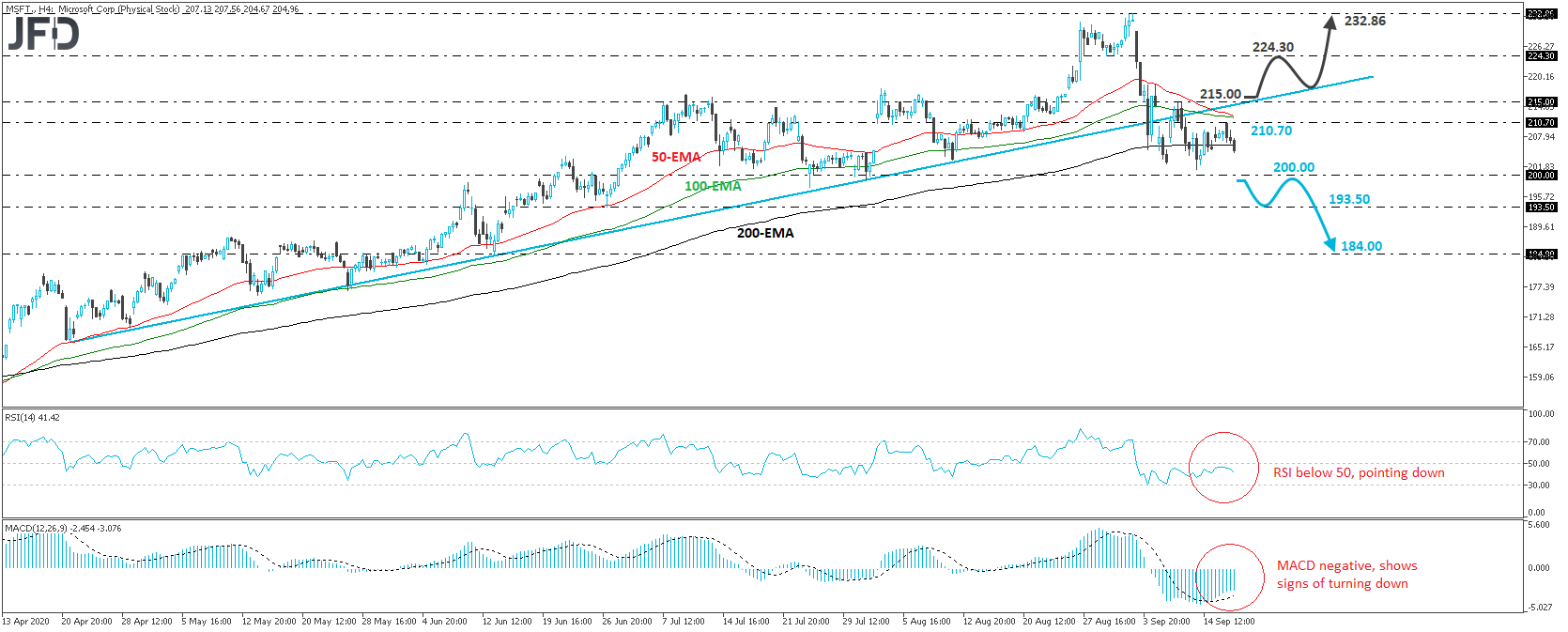

From the technical perspective, we see that the stock has been trading below an upside support line, drawn from the low of April 21st, since September 8th. However, it remains above the 200.00 zone, which has been acting as key support zone after it was broken to the upside on June 6th. Although the break below the upside line suggests that further declines may be on the cards, we prefer to wait for a dip below 200.00 before we get more confident on that front.

If such a dip occurs, the slide may be extended towards the low of June 29th, at around 193.50. If that barrier is not able to stop the fall either, then we may see investors allowing the retreat to continue towards the 184.00 territory, which is marked as a support by the low of June 15th.

Taking a look at our short-term oscillators, we see that the RSI has turned down from slightly below 50, while the MACD, although above its trigger line, lies within its negative territory and shows signs that it could turn south as well. Both indicators suggest that the stock may have started gaining downside speed, which supports the notion for some further short-term declines.

Now, in order to start examining the bullish case again, we would like to see a rebound back above 215.00. Something like that may also take the price back above the aforementioned upside support line and may initially pave the way towards the 224.30 barrier, marked as a resistance by the inside swing lows of August 31st and September 1st. Another break, above 224.30, may encourage advances toward the stock’s record high of 232.86, reached on September 2nd.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.