Outlook:

Somebody said “The probability of recession is 100%” and if he didn’t, he should. The IMF woke up long enough to confirm, yes, a global recession is likely. No kidding, Sherlock.

We are not looking into the PMI’s reported today in Japan, UK and eurozone because they are preliminaries for March. What’s going to knock our socks off are the number for April. And US jobless claims on Thursday will be at least 1 million, or two (Goldman) or three million (Merrill Lynch). Any pretty rise in US home sales today will quickly get a reality check.

We doubt it had any effect on market prices, but Goldman warned yesterday that “If the dollar were to continue rising, we would see a reasonably strong case for coordinated and targeted intervention.” The Goldman version of the dollar index is up almost 8% over the past two weeks, enough to subtract almost half a percentage point from GDP. Besides, the market is clearly “disorderly.” We wouldn’t want to buy euros or yen, but a third of the dollar index is comprised of the CAD, AUD, peso, real, Korean won and Norwegian krona, and those would be good candidates, according to the Goldman analyst.

Talk of intervention was always going to happen. It falls on welcoming ears in the White House, too. Trump believe a weaker dollar is good for exports and never mind any other consideration. Fortunately, TreasSec Mnuchin is busy trying to intermediate a truce between the political parties on a spending bill, for the moment.

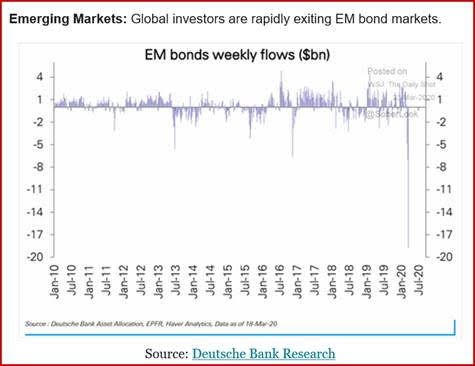

We don’t follow emerging markets as a class, but we do keep an eye on the Mexican peso. Yesterday’s action was more of the same horror—the peso was 18.5580 on Feb 19 and closed yesterday at 25.3615, or 37%. Granted, investors are fleeing EM bonds—see the chart. But it’s likely mostly the unwinding of carry trades, for which the peso is a favorite.

Mexico has several disadvantages—its FX and bond markets are pretty big and liquid, and that has made it popular. Locals are savvy traders, too, with a long history of crises during which to play the peso, including local banks and institutional investors. And while the current devaluation may have little to do with economic conditions, devaluations tend to push inflation, and then you can’t say that anymore and blame the rest of the world.

We wonder whether the Bank of Mexico is not considering regulatory constraints. They should (did we just write that?). A ban or limit on short sales, for example. A tax on FX trades. A lot less allowed leverage. Mexico should not have to intervene or raise rates—especially in an already weak economy now facing crashing oil prices—to counter a mechanical currency effect that is not Mexico’s fault. Back in the Asian crisis, Malaysia imposed capital and currency controls and got a lot of bad press (although some of it was due to childish rants by the president). But eventually the IMF came around to the idea that in special circumstances, like contagious devaluations, maybe capital and currency controls are just the ticket. In fact, Malaysia instituted a ban on short sales in equities overnight.

Why do we not hear of Mexico or hardly anyone else imposing regulations? For the same reason regs have been shunned for centuries in every economy—it’s the friends and relatives of government officials doing the speculating. While Mexico may continue to have its own tradition and brand of corruption, this is one instance where the interconnected financial/political elite is not any different than the elites in any other country throughout history. Constantine probably had some cousins and in-laws, too.

As for the US coordinating intervention with parties as diverse as the UK and Mexico and Brazil, the very word coordination is not one that goes with the name Trump. This is the guy who wants to stand on the top of the pile, not be part of the scrum. At a guess, coordinated intervention is practically impossible, capital and currency controls will remain scattershot in a few places—the IMF is hardly contributing anything here—and Trump will talk about intervention sometime soon, if not actually do any. Never mind—talk can often suffice, even from someone who so clearly has no idea what he’s doing.

Does the correction proceed and the dollar retreat, or is it another whipsaw? We don’t know, and neither does anyone else. Trades have to be kept very short-term.

Crisis Mismanagement: On Sunday night, Trump tweeted that he will want to drop social distancing and get the economy moving again soon, so that the cure is not worse than the disease. This is so stupid we ignored it. Mistake. Now EconAdvisor Kudlow, who had to admit he was wrong (without an apology) about the US being airtight, on the same day says we will be making “difficult tradeoffs.” Just as CDC expert Messonnier refuted Kudlow when he said airtight, warning we will see “community spread,” experts are appalled at the idea of an early end to social isolation—like next week.

The press briefing last evening, which was hardly brief, had one notable addition, the Attorney General, pretending to talk about punishment for hoarding and price gouging, and one notable absence—Dr. Fauci. Oh, dear.

Meanwhile, the unseemly Senate fight is actually more of the same. The majority Republicans prepared a bill that did not extend unemployment insurance and also does not tie any strings to federal bailouts or loans. The Dems worry corporate fat cats will do what they always do with a government handout—give themselves bonuses and buy back stock (just as they did with the Bush II tax forgiveness on foreign capital brought home and the Trump tax bill).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.