22 Nov – 26 Nov, 2021

APAC should be hogging most traders’ attention in the first half of the coming week. China and New Zealand take the spotlight up to Wednesday. A sprinkling of US and European data helps to round out the offerings.

What Will Traders Be Watching This Week?

22 Nov – 26 Nov, 2021

Monday November 22:

China opens the week and reveals its 1Y Loan Prime Rate. The People’s Bank of China (PBoC) has kept the 1Y Loan Prime Rate at 3.85% for the past 18 months. No change in the rate is expected on Monday. However, looking to a long-term change, China’s Premier Li Keqiang noted on Friday that China is facing “many challenges” in managing the downward pressure on its economic growth and rising commodity prices.

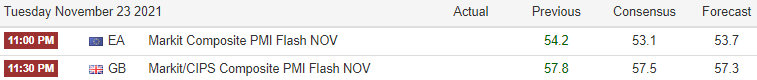

Tuesday November 23:

New Zealand releases data on Retails Sales (Q3) in the lead up to the country’s Central Bank Interest Rate decision on Wednesday. Retail Sales in the last two quarters rose 3.3% and 2.8% respectively. A projected -0.5% is expected in Q3 as the country’s largest city has been in lockdown for the entire Q3 period.

European and Great Britain Markit PMI Composite data (NOV) is also released on Tuesday. Aggregating the data from the economies’ Manufacturing and Service sectors, the PMI is a broad indicator of economic expansion or retraction. Although still firmly within an expansionary range, a slight pullback in the PMI values is expected for both economies.

Wednesday November 24:

US Markit PMI Composite data (NOV) is up next. Unlike Tuesday’s PMI data, US PMI is expected to lift ever so slightly from 58.4 to 58.8.

As mentioned above, the Reserve Bank of New Zealand (RBNZ) will be updating the market as to its Interest Rate decision. A 25 basis point hike to 0.75% is all but guaranteed at this point. Speculation of a 50 basis point hike has emerged in reaction to Inflation Expectation in the country, reaching 2.96% in two years. Although, such a significant hike is unlikely and deviates from RBNZ precedence.

Thursday November 25:

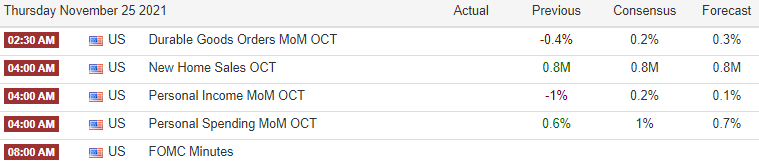

Thursday is all about the United States. For October, durable Goods Orders, New Home Sales, and Personal Spending data are released in quick succession. Any beat or miss in the slightly optimistic forecasts for these data points should be pounced upon by traders.

The FOMC minutes are then released later in the morning. Fed representatives have been vocal about their stance on inflation, employment, and the need to keep a loose monetary policy for the short term, all last week. These notes should be reflected in the FOMC minutes.

Friday November 26:

A quiet Friday closes the week. South Korea’s Interest Rate decision should be watched closely. A 25 basis point increase is possible, which would bump the Interest Rate to 1% from 0.75%. Analysts are split as to its likelihood as the South Korean Government has other tricks up its sleeve to curb rising prices (such as removing fuel taxes).

*Please note; Author is working from UTC +13 when determining the timeline of data releases.

Risk Warning: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money you cannot afford to lose. You should make yourself aware of all the risks associated with foreign exchange trading and seek advice from an independent financial adviser if you have any questions or concerns as to how a loss would affect your lifestyle.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.