We live in a world where we wake up to news (and a shocking image) of a drowned father and daughter on the banks of the Rio Grande and threats from North Koreans about not letting the U.S. “bring them to their knees.” Tensions between the U.S. and Iran are rising all the while politicians continue to waste time and energy on irrelevant shit like Mueller testifying publicly.

It all makes me want to escape to the beach where I can soak up the sun and cool off in a turquoise ocean oasis. Escape doesn’t take the problems away or resolve them… but the beach…

Wouldn’t you agree?!

The Colder The Happier

Granted, I live in Puerto Rico and have a house on the island Culebra. Escape is literally on my door step…

But did you know that, while most of us developed-world citizens dream of and seek moments of peace in a warm environment, it turns out that heat is bad for our happiness.

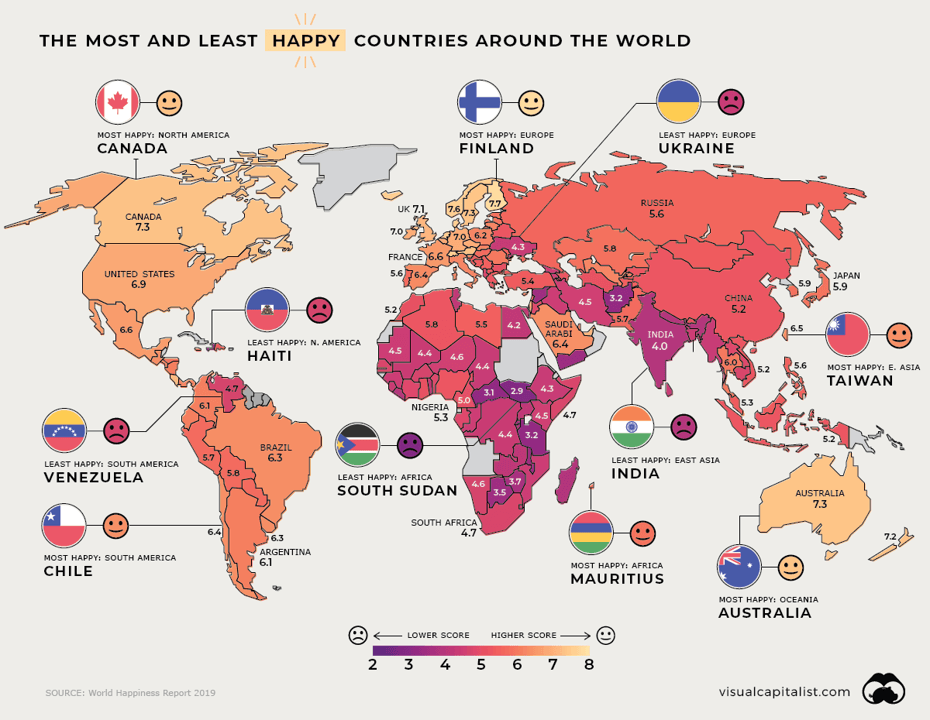

The World Happiness Report 2019 produced this colorful and intuitive map of the world rated by the happiest and unhappiest countries.

A few simple insights stand out to me…

The coldest countries tend to be the happiest. Seriously. Cold, harsh weather is one of the first things that creates unhappiness for me… one big reason why I’m in Puerto Rico where the year-round average hi-low temperature range in San Juan is 75 to 87 degrees. But then I’m known for being an odd duck.

The highest happiness ratings are in the northern zone, from Canada through Scandinavia… with Finland the highest at 7.7. Other rare 7-plus ratings are in numerical order: Norway, Sweden, Canada, U.K., Ireland, and Germany.

Then other happiest 7-plus countries are deep below the equator: Australia and New Zealand. The Latin American countries way down south, like Chile and Uruguay, also tend to be happier.

The thing is, it isn’t the temperatures themselves that make us happy or unhappy, but what the recorded degrees on the thermometer force us to do.

It’s not the cold weather that makes people happier – obviously. It’s that a cold environment requires more innovation and evolution, which in turn results good investments and greater wealth.

Forging Toward Challenges

When humans began to populate the world, there were three massive migration cycles “Out of Africa:” 70,000 to 80,000 years ago around the India Ocean, 30,000 to 50,000 ago into Northern Europe and Russia, and 10,000 to 20,000 years ago into North and South America after the last ice age.

The migrants that went into colder climates faced greater challenges and hence were forced to innovate and urbanize more – and innovation drives wealth, as I discussed on Monday.

Even in similar southerly climates, many Asian countries are more productive than in Latin America and Africa simply from higher population density and competition after the last ice age pushed masses of humanity into southern Asia – i.e. southern China, Southeast Asia, and India – the clear growth regions into the future.

The Correlation Between Wealth and Happiness

Happiness has proven in psychological studies to increase markedly up to about $75,000 in income – upper middle class. After that there’s little measurable gains, except bragging rights about your wealth. The wealthiest western and east Asian countries tend to range largely from $40,000 GDP per capita PPP (purchasing power adjusted) to $60,000. The U.S. is on the highest side of that with happiness ratings of 6.9. High income inequality works against us a bit, and of course, Canada is colder.

I have always said that there’s a band that contains most of the affluent countries in the world. It spans roughly from Toronto to Miami through Northern and Southern Europe and through Saudi Arabia, northern India, Thailand, and China. They are the up-and coming wealthy nations of the world.

Taiwan at 6.5 is the happiest in Asia as it’s the wealthiest and most urban. India is the least happy currently as it’s one of the poorest in Asia and as slow to urbanize as Sub-Saharan Africa.

That northern cooler band is so dominant because it has the largest and most parallel land mass. And it’s where innovations, especially in agriculture, could be adopted in similar climates with less transportation barriers. Jared Diamond first explained that brilliantly in his best-selling book: Guns, Germs and Steel.

The northern countries tend to be more technologically-sophisticated and urban. The southern hemisphere countries tend to be more focused on commodity exports, which is lower value-added: Africa and South America. But then there is the cooler band from Chile and Uruguay through South Africa and Australia/New Zealand that is more-affluent and happy.

Affluence Asia

Another global trend: The leading edge of affluence has moved systematically westward from Europe to North America to East Asia. And increasingly into the rest of Asia. Africa will be the last to urbanize and become middle class, but with the least rewards as the first to innovate get the rewards and greater cumulative learning curve.

The paradox is that the initial innovators of the human race came exclusively out of Africa. And now Africa is the poorest as the ones who stayed and faced the least challenges and innovation.

Lighting the Way

If you ever look at the global map of “lights” from satellite images, it’s startling how dark Africa is… and then South America. Higher light correlates with electricity, urbanization… and higher affluence.

If you look at the Caribbean, Puerto Rico is the brightest bulb in that tropical sphere, another reason I am here. I could not live full-time in a city that did not have first world infrastructures, restaurants, and entertainment (I do have to overlook the potholes). In the last 30 years GDP per capita PPP in Puerto Rico, at $40,000, has caught up with Spain and Italy and has surpassed Portugal and Greece. It is 2.5 times higher than its neighbor, the Dominican Republic.

There is always a reason for trends. A simple understanding of history most often offers explanations. Regardless, seeing the trends means you can make good investments. And profitable investments are always something to be happy about.

The content of our articles is based on what we’ve learned as financial journalists. We do not offer personalized investment advice: you should not base investment decisions solely on what you read here. It’s your money and your responsibility. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments such as futures, options, and currency trading carry large potential rewards but also large potential risk. Don’t trade in these markets with money you can’t afford to lose. Delray Publishing LLC expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.