XAUSD, H1

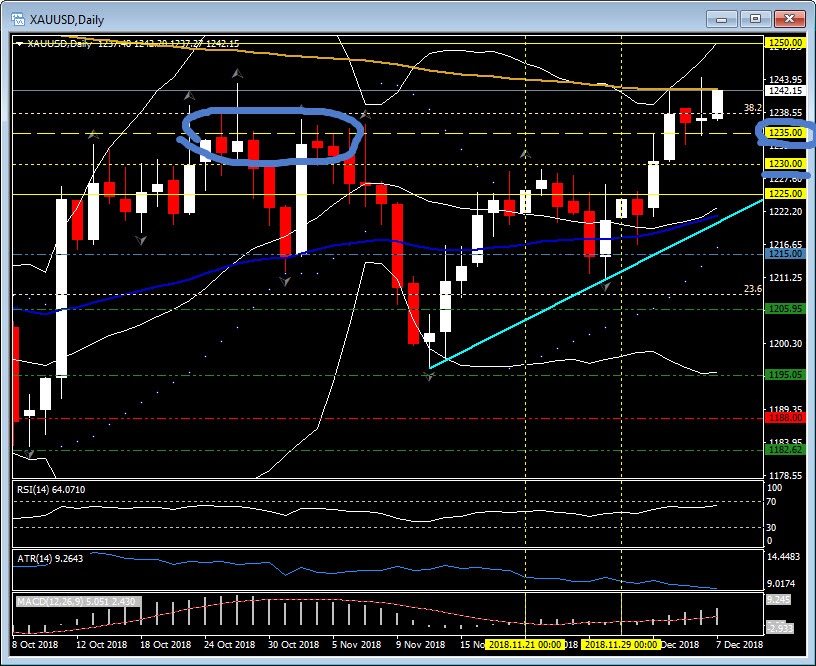

On Monday (December 3), I noted that Gold’s “new “line in the sand” at $1230 was also tested, breached and eventually broken. R3 at $1235 is pushing the price into over bought territory and the more significant daily resistance area. The October high was $1243.50″. The follow through bid on gold has continued this week and in low volumes, ahead of the US jobs data later today, Gold remains bid. Yesterdays (December 6) spike higher stalled at $1244.31, above the October high at $1243.50. However, the key for Gold this week was the close on Tuesday (December 4), north of the $1235 level and the congestion zone that had not been breached significantly during the October move up.

Daily resistance now sits at $1242.50-1243.00 (R1 and the key 200-day moving average) a close above here will be required for a continued move higher. Weekly resistance sits at $1248.00. The 38.2 Fibonacci level at 1238.30 now becomes first support, with S1 and S2 at $1233.35 and 1229.00 respectively. In conclusion, $1230.00 remains the “line in the sand” and the breach and hold of $1235 is positive for future Gold price appreciation. The US jobs data at 13:30 GMT is the key risk event.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.