At the end of this week, 13th January, three of the Wall Street big firms will publish their Q4 financials returns – Bank of America (BoA), JPMorgan Chase & Co (JPM) and Wells Fargo & Co (WFC). This is important as it will give us an indication of whether the US is in a big bubble territory or is truly at the start of a golden era. The US Dollar Index is at the same price area as it was back in 1989 before it continued its depreciation. As I show on the above currency chart and explain in my weekly video forecast (https://youtu.be/umOhCXSRnkQ), I see the end of a strong US Dollar for at least the short/medium term. A confirmation of a corrective down move will occur once the price will break the support (marked by the white line) that has been created from every retracement. I have purposefully ignored the breakout of that support (marked by the red circle) as that first red candle was a negative data on the US ISM non-manufacturing PMI and the other negative data was that more Americans claimed for unemployment back in the first week of November 2016. The big green candle with a long wick was due to the Presidential Election of Donald Trump.

When I then look closely at the technical structure of the US Currency Index I notice a completion of a 5 Elliott Waves Theory which implies that a corrective down wave is close. If my technical analysis is found to be correct, I then see an appreciation in the four major currency pairs – EURUSD, GBPUSD, AUDUSD, NZDUSD.

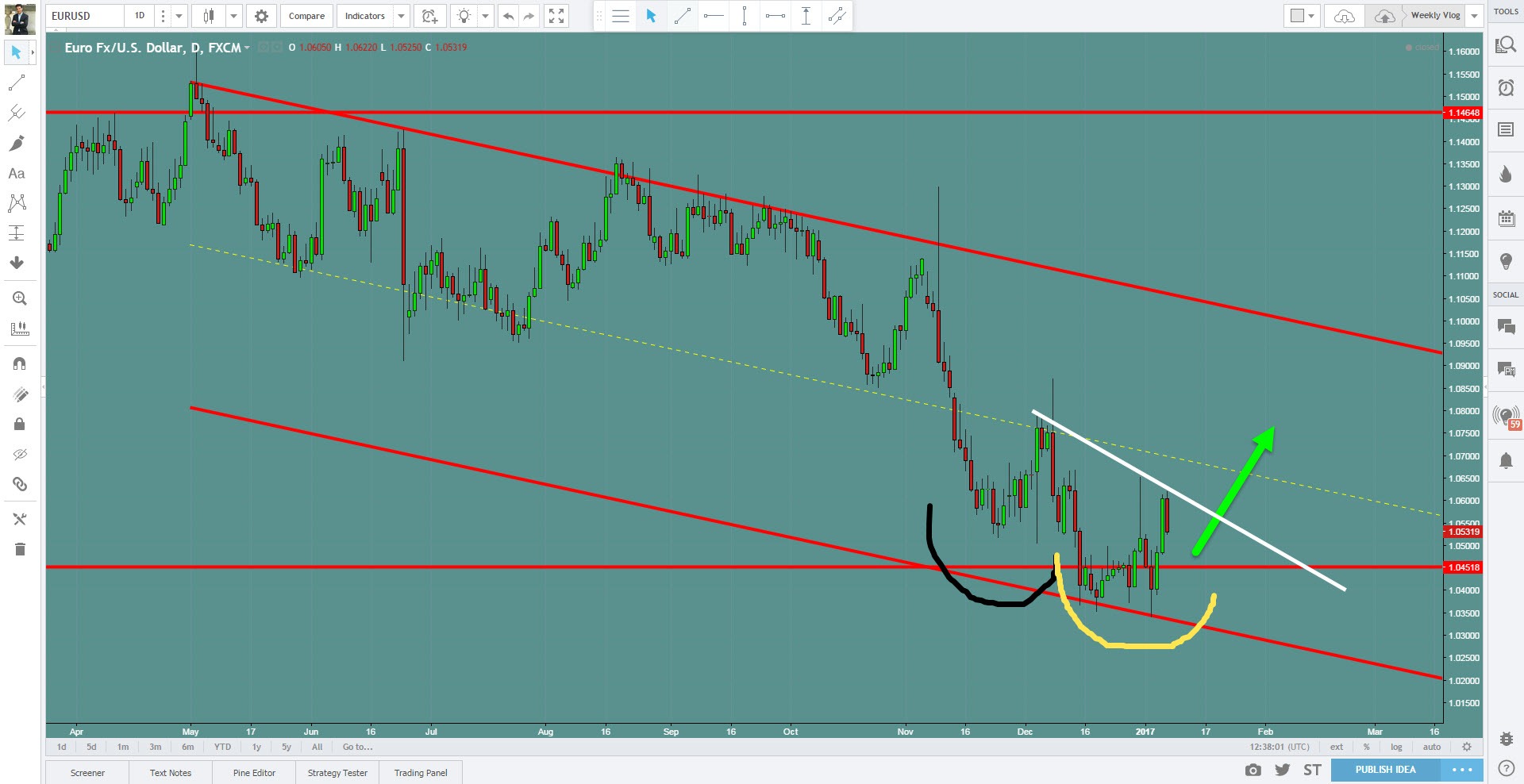

EURUSD

I see the EURUSD from a technical point of view, to have completed a 5 Elliott Wave Theory cycle downwards with a possible Inverted Head & Shoulder, which is at present not yet completed or confirmed. A possible left shoulder (marked by the black colour) and head (marked by the yellow colour) is the only two part of this probably inverted pattern that we have at present so for the time being, I am speculating whilst waiting for the confirmation. One of the things I ALWAYS say in my London Live Trading Room is: the confirmation of this particular inverted pattern will occur when the price breaks the neckline (white line). As I mention in my weekly video currency forecast) before the buyers come into action and start buying, I am expecting a short period of selling so to create the right shoulder.

Trade idea: The first and most likely move at present is a sell trade opportunity even though it might end up being very choppy. I personally will wait for a buying opportunity as currently, the price is at the same level of the left shoulder. Here is my question: will the right shoulder be the second Elliott Wave down correction before starting to buy with the third wave? As I don’t possess a crystal ball I will wait for the market to either bounce where the price is at present or confirm the second Elliott Wave. Once I have a clearer signal I will start getting involved in either the sell or buy with the traders in the London Trading Room.

Take My Trades, Forex signal service and education is provided for the purpose of learning about the Forex market. It does not aim to guarantee that you will be a successful trader overnight, this is a process that takes time and commitment, learning the fundamentals and technicality of the financial market. This service shows how a successful trader reviews the trends and signals of the market and takes trades based on fundamental trading rules. Take My Trades is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which customers should buy or sell for themselves. The analysts and employees or affiliates of Company may hold positions in the currencies or other instruments featured on this website. You understand and acknowledge that there is a very high degree of risk involved in currencies and other leveraged financial instruments. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.