- S&P 500 recovers to the close as option expiry boosts stocks.

- S&P 500 is now though officially in a bear market.

- Nasdaq closes in the red while Dow Jones Index is flat.

Another wild and volatile week which seems to be the tone so far for 2022. Wild swings throughout the week were mirrored on Friday with wild intraday swings. The S&P 500 did manage to slide into a bear market territory on Friday. While there is no real official designation for a bear market the generally accepted consensus is that it's 20% from peak. The Nasdaq long ago meet this criterion but the S&P 500 has been flirting all week with the level. The job nearly looked to be done on Wednesday after Target (TGT) sounded alarm bells with its margin pressures and lowered guidance. Friday got the job done but with options expiry, in the afternoon the anticipated flows were always likely to see a late-session rally.

Next week sees more retailers lined up to report earnings and after Target and Walmart the bar has been set pretty low. This could set up a counter-rally with any sort of relief on earnings and or outlook likely to see a big move to the upside. Next week Costco (COST) Dollar Tree (DLTR) and Dollar General (DG) are the big earnings up.

Sentiment and positioning continue to suffer in the wake of recent volatility. The CNN Fear and Greed is at extreme lows. The American Association of Individual Investors (AAII) is at a recent low and the Investors Intelligence survey is also at lows not seen since the last rally post the Ukraine invasion. Back then we got a confusing rally but investors are slightly more attuned to the potential countertrend rally so that is perhaps the main reason we are not getting it! But next week sees corporate buybacks step up as earnings season ends. Also of note is hedge fund and mutual funds positioning being notably underweight equities. This will likely mean if we do get any sustained rally, the hedgies and fund managers will eventually rush into reposition and push it higher. Also worth noting is the latest Commitment of Traders report from the CME showing commercials are net long equities while speculators are short. Commercials are generally a better indicator although the correlation is not strong.

But now that we are in a bear market with the 20% intraday decline let's take a look at the stats. We are nearly 5 months in but the average bear market lasts just under 10 months and sees an average 38% fall. So looks like we are halfway there then in terms of time and percentage drop. Valuations would certainly point in this direction. The S&P 500 is still trading at nearly 20 times price to earnings, P/E ratio. This is historically high and indicative of a bull market. The right metric for a recession and or inflationary environment is nearer to 10! Over the past 140 years, the average P/E is 15 for US stocks. So definitely more room to the downside then.

SPY stock forecast

So we are going with a short term rally up to perhaps $435. But we still face challenges in the long-term macro picture. Inflation looks like it is spreading and sticking. This is not yet anticipated by either the bond market or the equity market. A recession is now priced in by the bond market with long-end yields falling. But the front end is not pricing in an aggressive enough move in our view. We have recently had incredibly hawkish statements by the Bank of England saying inflation will hit double figures. Wholesale Prices (PPI) in Germany just increased by over 30% yearly. There is a lag between PPI flowing into CPI. Germany is not the USA but its economies do share distinct similarities. The inflation storm looks to be only starting. With US employment markets incredibly tight, wage demands will rise and will have to be met as employers are struggling to fill vacancies and keep existing staff. This is how inflation becomes entrenched. Eventually, demand destruction will set in.

Now not only did Friday's intraday sell-off result in a 20% bear market decline. But it also hit the 38.2% retracement of the move from pandemic lows to the peak in January. The first resistance is at $415 and then $435.

SPY chart daily

Nasdaq (QQQ) forecast

The Nasdaq chart looks even worse. Notice the big volume gap we are now in. This does not resolve until $200. Yikes. A quick short sharp rally may not be far away as both RSI and MFI look very close to oversold levels. But with inflation sticking around and the Fed having to fight then the Nasdaq outlook is decidedly grim.

Nasdaq (QQQ) chart, daily

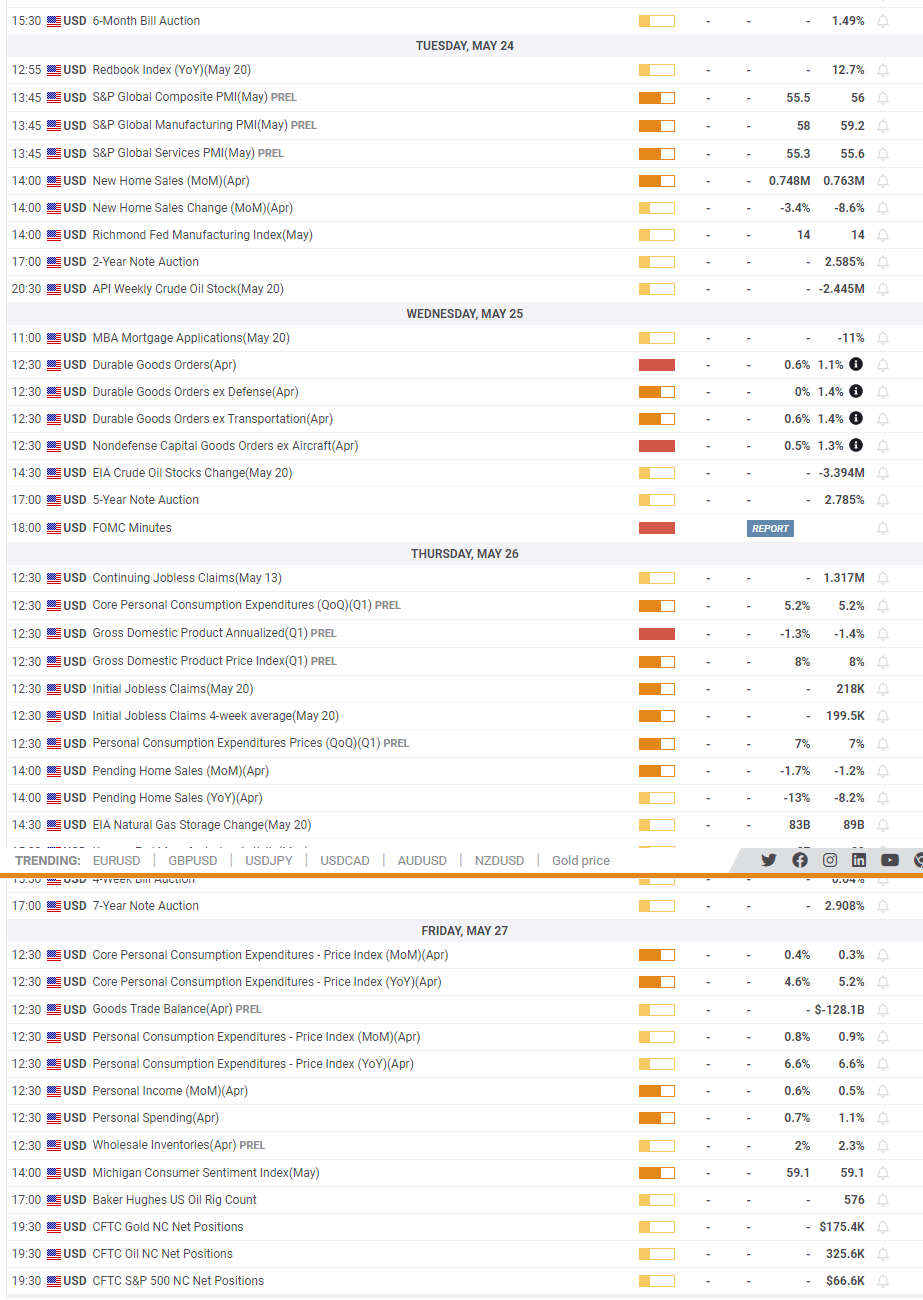

Economic releases

The author is long IUSA and short Tesla and Twitter

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.