Swiss retail sales and manufacturing activity declined in February and March respectively. Will the USDCHF continue rebounding?

The Swiss National Bank decided to keep the target range for the three-month Libor at between minus 1.25% and minus 0.25% at its March 15 meeting. Recent economic data were negative: the manufacturing Purchasing Managers’ Index (PMI) fell sharply in March to 60.3 points from 65.5 in February, and retail sales contracted 0.2% in February from the same month a year ago, though the decline was smaller than the 0.4% fall in January. Earlier the KOF economic sentiment index fell to 106.0 In March from 108.4 in February. Weak economic data are bearish for Swiss franc.

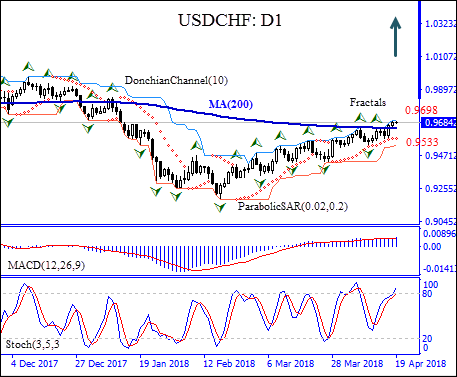

The USDCHF is rising on the daily chart after hitting thirty thre month low in mid-February. It has closed above the 200-day moving average MA(200).

-

The Parabolic indicator gives a buy signal.

-

The Donchian channel signals uptrend: it is tilted up.

-

The MACD indicator is above the signal and the gap is widening, which is a bullish signal.

-

The stochastic oscillator has breached into the overbought zone, it is a bearish signal.

We believe the bullish momentum will continue after the price breaches above the upper Donchian bound at 0.9698. This level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 0.9533. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

|

Position |

Buy |

|

Buy stop |

Above 0.9698 |

|

Stop loss |

Below 0.9533 |

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.