Outlook:

We have two big data r eleases this week, Eur opean inflation tomor r ow and US payr olls on Friday. European inflation seems to be on rise, with analysts forecasting a rise from 0.6% to as much as 1% but with core CPI holding at the same 0.8%. A high number might set off some euro buying, but that would be to assume Mr. Draghi is overly influenced by a single number. Similarly, payrolls may not impress with the actual number of jobs, but forecasters imagine a nice rise in average earnings (which fell in Nov).

We care about these two numbers because they feed the so-called reflation trade. The reflation trade is not a fiction—see the equity indices—but it's not based on anything real, either. In fact, most of it is based on shaky data that looks good only in the context of what came before, and on expectations of what Trump will do. Let's face it, nobody knows how real the reflation trade is. In fact, we know less this year than in any other year, because of Trump's erratic and impulsive behavior. "In making predictions and judgments under uncertainty, people do not appear to follow the calculus of chance or the statistical theory of prediction. Instead, they rely on a limited number of heuristics which sometimes yield reasonable judgments and sometimes lead to severe and systematic error." From Kahneman and Tversky, cited in Michael Lewis' latest book, The Undoing Project.

In order to select what to think about, we have to assume "all other things being equal," i.e., no earthshattering surprises from the White House. Not a good bet to make. This year is going to be the biggest year for geopolitical surprises since the Iraq war, and even that could be seen from far off.

But here goes, anyway. At the top of the list is the Fed, currently thought to have its sights on the March 14-15 meeting as the earliest date for the next rate hike. Others put it farther out, in June. In fact, analysts are unwilling to accept the three dots, which were a surprise at the time, and are sticking to two—one hike in June and another in December. Thus, we will again spend the entire year wondering whether and when the Fed hikes, just like 2016.

And now that full employment is actually here, we must turn to inflation, and when we turn to inflation, we immediately think of oil. Energy economist Jim Williams (www.energyeconomist.com) prefers not to offer forecasts, like any smart economist, but in his year-end missive manages to give us one, anyway. He says "The major shale plays now have a breakeven below $40 per barrel and a $50-$55 per barrel oil price will support a rig count in excess of 800 by the end of March." Costs go up at the same time and the breakeven prices goes up, too, but also rising are employment and earnings.

"We should see an increase in completion activity along with the rig count leading to higher U.S. production in early 2017. We anticipate the Trump administration will allow the construction of the North Dakota access pipeline to proceed. The lower oil transportation cost will lower the cost of shipping oil out of the Bakken and effectively raise the price Bakken producers receive. This should increase the incentive to complete existing wells. Additionally, there may be a loosening of rules for drilling on federal land."

The gem in all Williams' data is the breakeven under $40 now, making a rise to $50-55 affordable even with rising costs. We're baaaaack. It goes without saying that OPEC's output cut deal, which still leaves the world oversupplied, does not affect the US producers. From the Fed's point of view, oil prices should not deliver a Shocks or such a big price increase as to threaten seriously rising inflation. At the same time, a stable oil price at $55-65 at the high end doesn't contribute much to US inflation, either.

So, if there is going to be inflation to inspire the Fed at the March meeting, where is it going to come from?

It is possible to devise a scenario in which the Trump presidency results in high growth without inflation. In a NYT op-ed last week, the CIO of Guggenheim Partners, Scott Minerd, outlines a nearly plausible path. Fiscal stimulus coupled with tight monetary policy raises the real rate of interest and lifts the dollar. "Higher real rates help to tamp down inflation while a stronger dollar reduces import prices." Besides, deregulation and support for domestic energy production are disinflationary.

Prices won't rise but wages will, repairing the income inequality problem and restoring confidence to public institutions. A sticking point: "Policies that result in trade wars or mass deportations would undermine the success of a Trump economic revolution. These policies would not only create severe headwinds to growth but could result in recession or worse. These pitfalls must be avoided." But if the Trump plan comes to pass, the Fed will be raising rates more rapidly than the market expects, "not because inflation is rising but because the natural rate of interest is rising in line with higher potential output."

We need to question some of the assumptions. First, Trump doesn't actually have a "plan" for fiscal stimulus. The core idea is to let private companies build and repair infrastructure in return for tax breaks. Nobody knows how this would work, unless the Treasury devises a plan for the government to buy the bonds that fund initial capital costs. Conservatives would scream bloody murder. Weirdly, we can imagine the scenario in which Trump says "We rescued the banks and Detroit, why should we not rescue the roads and bridges?"

Second, is deregulation disinflationary? We'd like to see some facts. We went searching for some and found... none. Note that deregulation is not necessarily the same thing as privatization, which is, on the whole, disinflationary. Remember that lower costs, if in fact we get lower costs, say nothing about quality.

Third, we have no evidence Trump will avoid a trade war. In fact, we have some strong evidence this is one campaign promise he will keep. To be fair, we have been fighting a mild form of trade war with China for 15 years. The US has bought 20 cases against China (and 19 against the EU)—see https:// www.wto.org/english/tratop_e/dispu_e/dispu_by_country_e.htm. The dollar does not respond to WTO cases but will almost certainly respond to an outright trade war.

And finally, that awful term, the "natural" rate of interest. Before you can estimate the natural rate of interest—the rate that would keep inflation steady when the economy is working at full capacity—you have to know "full capacity," aka potential GDP. Many generations of Econ 101 students have run screaming in horror forever from economics because of this one idea. It's as though chemistry kept alchemy as a central assumption. As it happens, it's not a worthless assumption. Converting a base metal into gold has been done, 300 years after Isaac Newton, using a particle accelerator and at great cost. But if chemists had stuck with alchemy and only alchemy, they wouldn't have found the periodic table.

At Jackson Hole last August, San Francisco Fed Williams offered the idea that growth and thus the nat-ural rate are permanently lower these days. The WSJ rejoined that confidence in the statistics used to generate such a judgment is very low. "The error margins [in the Williams study] produced allow a 95% confidence interval to be calculated, and for some regions it is just silly: They are 95% sure that the natural rate of interest in the eurozone is currently somewhere between plus 12% and minus 12%. Frankly, I'm 100% sure the natural rate sits in a much narrower band than that, without even picking up a calculator.

"The estimates for the U.S. ... are still wide: There's a 95% chance they currently sit somewhere be-tween plus 3.5% and minus 2.7%. The range has shifted down sharply since 1990, but there's still an overlap. Worse still, the size of the uncertainty is higher now than on average over the past quarter-century. Put another way, it's entirely plausible that the natural rate of interest hasn't moved at all." This debate about the natural rate has surely cut into respect for the Fed, not to mention economists in general. Potential GDP is one of those fictions that doesn't have--and by definition cannot have--a de-finitive reading. Therefore, the natural rate is also a fiction. If the Fed is spending a lot of time and making decisions based on two fictions, to hell with the Fed.

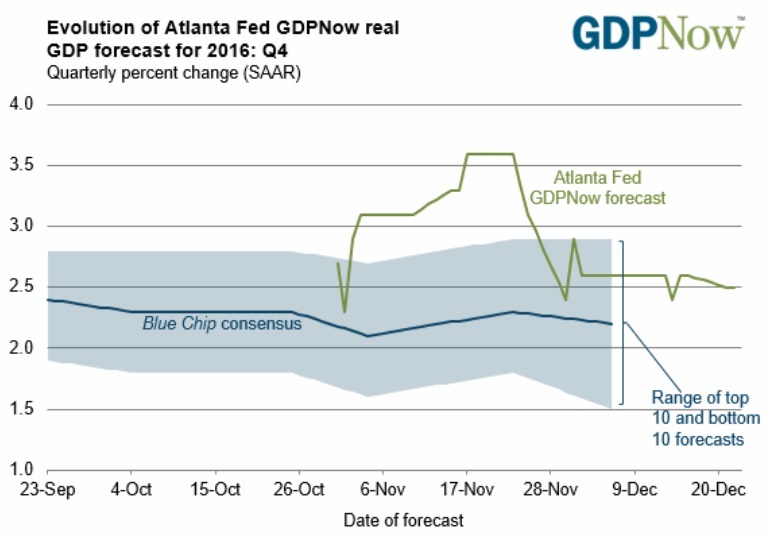

And while growth has been pretty good, it's not going to get to Trump's 4-5%. The Atlanta Fed's latest GDPNow from Dec 22 is 2.5%, down from 2.6% the week before. We get the update today (after ISM manufacturing and construction spending). The chart is for Q4, but note that the Blue Chip range and the GDPNow line would have to gap upward tremendously to make 4-5% look even remotely possible.

Bottom line, the Trump-will-be-okay thesis requires a big fiscal stimulus and a hawkish Fed. We may get neither. About the stock and bond markets, Morgan Stanley disses the "reflation trade:" the yield on the 1-year note will get to 2.50% by the end of Q1 but growth is going to disappoint, only 1.6% in Q1 (also the NY Fed's forecast). We may get the corporate tax cut in Q2 but the yields won't deliver until after the summer and into Q3. "For the second half of the year, we forecast Treasury yields making new highs in the third quarter as the personal income tax cuts come into view and speculation over the next Fed Chair heats up over the summer. Our economists expect the US government to deliver the per-sonal income tax cuts in 4Q17, though uncertainty over the composition of the Fed could remain."

In other words, the stock market is way ahead of itself and making too big a bet on reflation (and against Congressional gridlock). In practice, uncertainty (and volatility) will be high next year.

That's more like it. And if this dose of pessimism is right, the consensus forecast of the dollar rally con-tinuation is wrong. The FT's survey of 28 economists (Dec 13-29) comes up with two-thirds predicting euro parity in 2017 on the assumption US rates are rising as the Fed responds to Trump fiscal stimulus. The euro has not been under parity since December 2002, the year euro notes and coins were intro-duced.

The respondents also think Europe will void major shocks although they are a little worried about LeP-en-- and considerably more worried about emerging market economies and currencies. The ECB will stick to QE at €60 billion/month, as announced, from €80 billion, and be a whole lot more careful about taper talk. "On average, economists expected eurozone growth of 1.47 per cent and inflation of 1.26 per cent next year. Twenty-six of 28 respondents said the recovery would outlast 2017." A large number, 43%, expect a hard Brexit, and only 14% expect a soft one.

Separately, the WSJ reports "Analysts at Morgan Stanley expect another 5% rise for the trade-weighted dollar by the end of 2017, while JP Morgan forecasts suggest it will fall by 8%." We say the next year-end is much too far away. We will probably get both. We should stick to thinking about the first quar-ter.

If the US gets growth of 1.6% (Morgan Stanley and the NY Fed) while the eurozone gets 1.47%, and the Fed stays on hold until June, what is there to push the dollar higher? Only wishful thinking about Trump fiscal policies and the absence of any trade war shocks or other Trumpian attention-seeking moves.

We therefore deduce that while the euro may well go to parity and do it in Q1, it's going to be a bumpy road and the trend is extremely vulnerable to reversal.

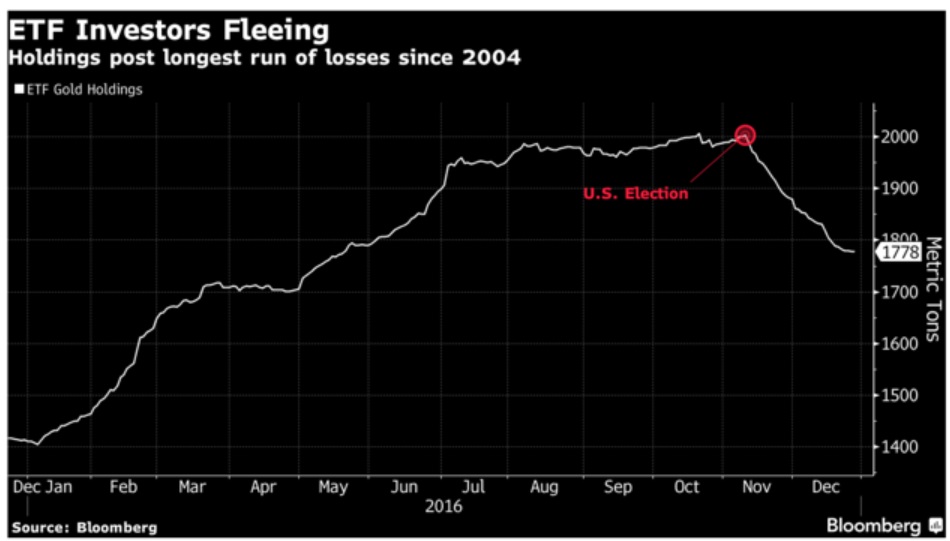

A final point: gold is seriously oversold by any measure. In the latest COT report, longs shed 6,017 contracts for the 7th straight week of selling to end with about 41,000 contracts and shorts rose by 6,647 contracts. And see the Bloomberg chart. Contrarians are out in force saying the assumptions making gold unpopular are not good assumptions.

Politics: The do-nothing Congress, which met for the fewest days ever last year, intends to make major changes in the new year. It started by abolishing the House independent Ethics Office. There is still an ethics committee, but it doesn't have to report to the public. Oh, dear. This may be the precursor to the American public having to accept a president with massive conflicts of interests that Congress won't even try to deal with. Trump's self-aggrandizement is already a disgrace. The reflation trade could morph into the crony capitalism trade (Freeport Mac?).

Note to Readers: We streamlined the chart package. Comments (or complaints) welcome. Also, we will not publish the Morning Briefing on Wed, Jan 18, due to a court date.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 118.18 | LONG USD | WEAK | 11/10/16 | 106.47 | 11.00% |

| GBP/USD | 1.2291 | SHORT GBP | WEAK | 12/16/16 | 1.2444 | 1.23% |

| EUR/USD | 1.0403 | SHORT EURO | STRONG | 12/10/16 | 1.0605 | 1.90% |

| EUR/JPY | 122.95 | LONG EURO | STRONG | 11/03/16 | 114.30 | 7.57% |

| EUR/GBP | 0.8463 | SHORT EURO | WEAK | 11/14/16 | 0.8598 | 1.57% |

| USD/CHF | 1.0284 | LONG USD | WEAK | 11/10/16 | 0.9678 | 6.26% |

| USD/CAD | 1.3426 | LONG USD | WEAK | 12/20/16 | 1.3428 | -0.01% |

| NZD/USD | 0.6925 | SHORT NZD | STRONG | 12/19/16 | 0.6963 | 0.55% |

| AUD/USD | 0.7204 | SHORT AUD | STRONG | 12/19/16 | 0.7282 | 1.07% |

| AUD/JPY | 85.14 | LONG AUD | WEAK | 10/06/16 | 78.48 | 8.49% |

| USD/MXN | 20.7256 | LONG USD | STRONG | 10/31/16 | 18.9054 | 9.63% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.