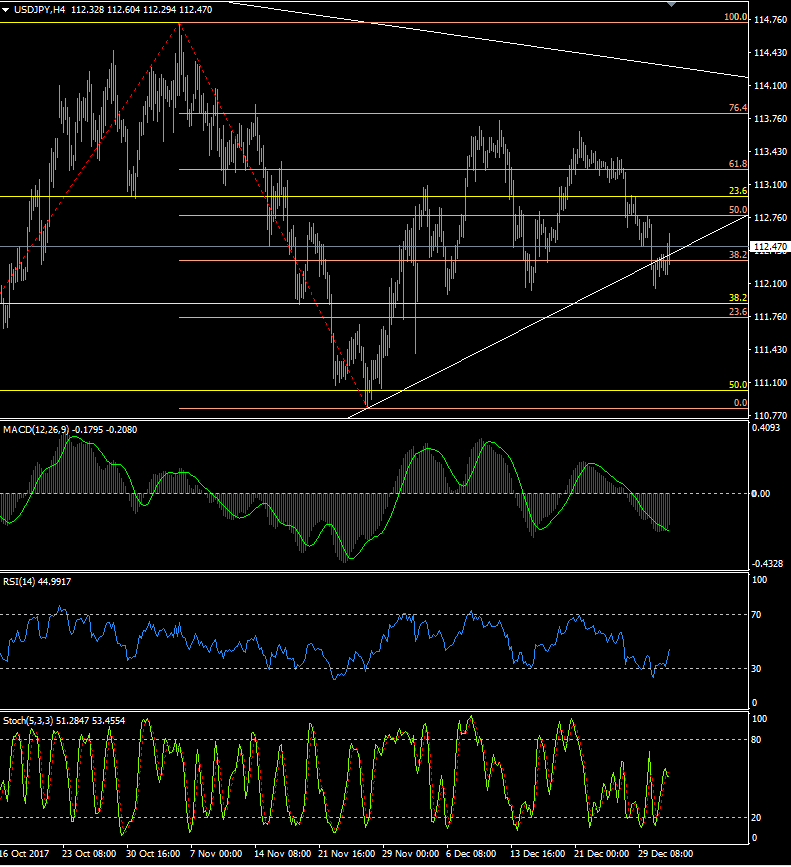

US$Jpy jumped to a session high after the release of the FOMC Minutes (112.60) but has since fallen back to sit at levels similar to yesterdays, leaving the range-trade outlook unchanged.

1 hour/4 hour indicators: Turning higher.

Daily Indicators: Neutral

Weekly Indicators: Neutral

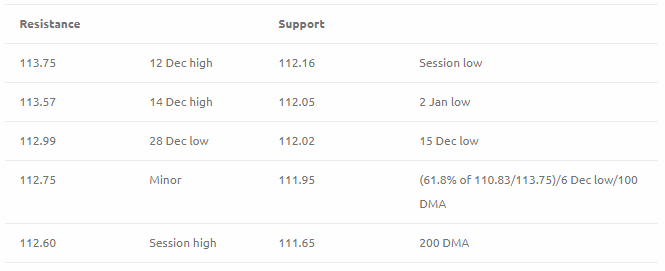

Preferred Strategy: The dailies seem to suggest that we are likely to see further decent support at 111.95/05, which I think will hold today, but below which would open the way to the 200 DMA at 111.65.

On the other hand the short term momentum indicators are more positive and if 112.60 can be overcome we could then see a return to 112.80 and possibly on to 113.00 and above, where 113.30/35 should see sellers ahead of the December high of 113.75.

Most likely a range of 112.00/113.00 would not surprise for the coming session.

Range trade@ 112.00/113.00. SL 30 points either side.

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD extends its downside below 1.0630, focus on ECB’s Lagarde speech

EUR/USD extends its downside near 1.0620, bouncing off the Year-To-Date low of 1.0600 during the early Asian session on Wednesday. However, the hawkish comments from the Fed officials and the safe-haven flows might boost the US Dollar and cap the upside of pair in the near term.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

OKX executives depart from exchange while its XLayer Chain goes live

Two senior executives at crypto exchange OKX, Tim Byun and Wei Lan, have left the company after years of heading key roles, according to a CoinDesk source. However, the company is making expansion moves through the launch of its own Layer 2 chain.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures are expected to demonstrate further evidence of disinflation.