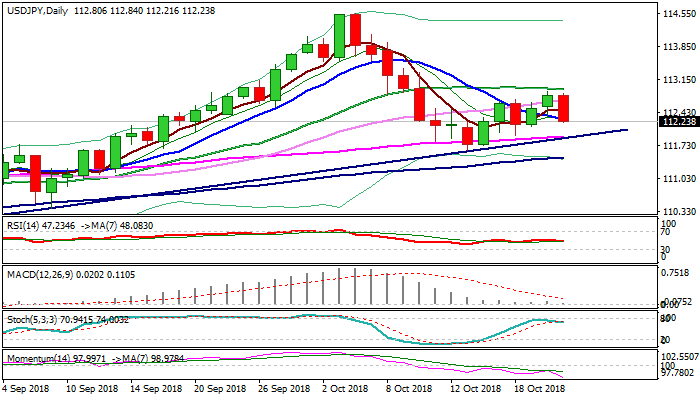

USDJPY

The pair was sharply down in Asia / early Europe on Tuesday, losing around 0.4% as yen benefited on renewed safe-haven demand. Fresh weakness sidelined hopes of recovery extension after Monday's action eventually closed above pivotal 112.74 (Fibo 38.2% of 114.54/111.62) and generated bullish signal. Upside attempts stalled just under 20SMA (112.92), which is turning lower and adding to bearish pressure, along with strong bearish momentum and south-turning slow stochastic which reversed on approach to overbought zone border. Pullback from recovery high at 112.88 retraced so far 50% of 111.62/112.88 recovery leg, signaling that corrective phase might be over. Extension and close below 112.10 (Fibo 61.8% / base of thick 4-hr cloud) would confirm negative scenario and expose 55SMA / trendline support (111.91) with extension towards key support at 111.62 (15 Oct low) not ruled out, as daily cloud twists on Thursday and could be magnetic.

Res: 112.47; 112.74; 112.92; 113.08

Sup: 112.10; 111.91; 111.62; 111.47

Interested in USDJPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.