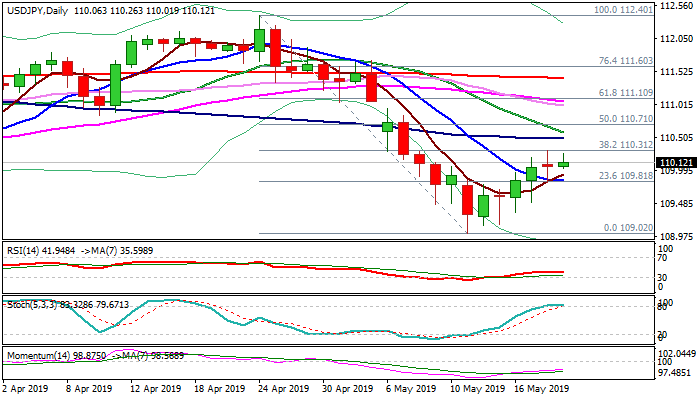

USDJPY

Bulls attempt to regain traction after Monday’s recovery stalled at key Fibo barrier at 110.31 (38.2% of 112.40/109.02) and daily action ended in long-legged Doji, signaling strong indecision.

The dollar moved higher in early Tuesday’s trading on comments from Fed Chief Powell, who argued against cutting interest rates and relief on Huawei case, but still lacking strength for final push through 110.31 pivot.

Overbought daily stochastic adds to concerns about repeated failure at 110.31 that would add to the downside risk, but initial signal of reversal would require fall and close below 10 SMA (109.83).

Conversely, close above 110.31 would generate initial signal of bullish continuation.

Res: 110.31; 110.49; 110.58; 110.71

Sup: 110.01; 109.93; 109.83; 109.49

Interested in USDJPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.