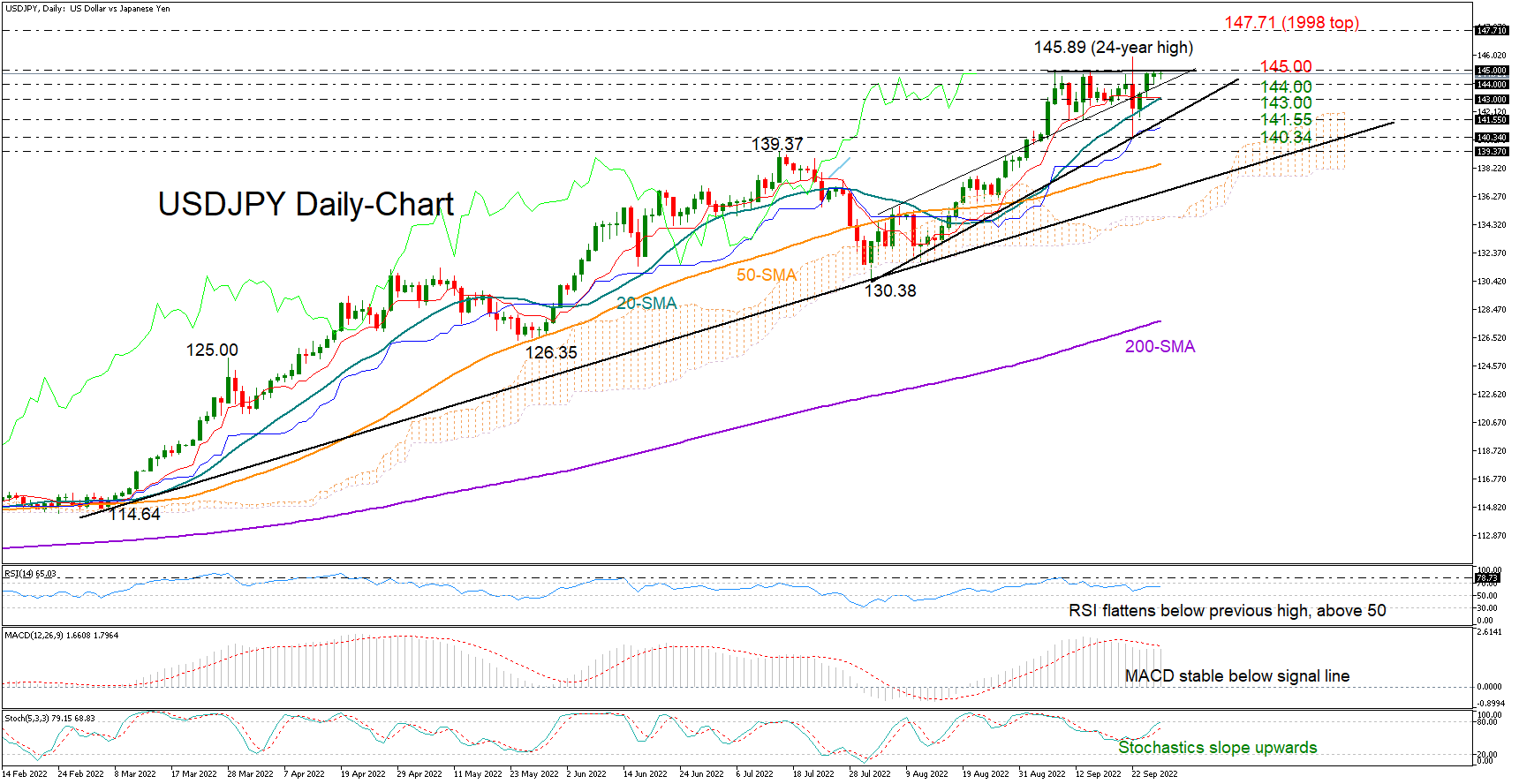

USD/JPY on a mission to claim 145.00; bias cautiously bullish

USDJPY is back on the mission to fight against the 145.00 crucial ceiling after fully recouping the Bank of Japan-led decline to 140.34 last week.

Even though the stochastics are positively charged, the RSI and the MACD are mirroring some skepticism among investors as the former seems to be struggling to post a higher high within the bullish area, while the latter remains stable below its red signal line.

Nevertheless, if the pair manages to secure a foothold around the 144.00 level, the pair may pierce through the 145.00 wall to meet the 1998 top of 147.71. The 149.00 -150.00 region could next come on the radar if the ascent grows further.

Should the bears drive the price below 144.00, the 20-day simple moving average (SMA) at 143.00 could cancel any extensions towards the 141.55 support zone, where the ascending trendline from 130.38 is positioned. Falling lower, the price may retest last week’s low of 140.34 ahead of the key 139.37 region, a break of which would signal the end of the bullish trend.

In brief, USDJPY is looking cautiously bullish in the short-term picture. The next episode of volatility is expected to start either above 145.00 or below 144.00.

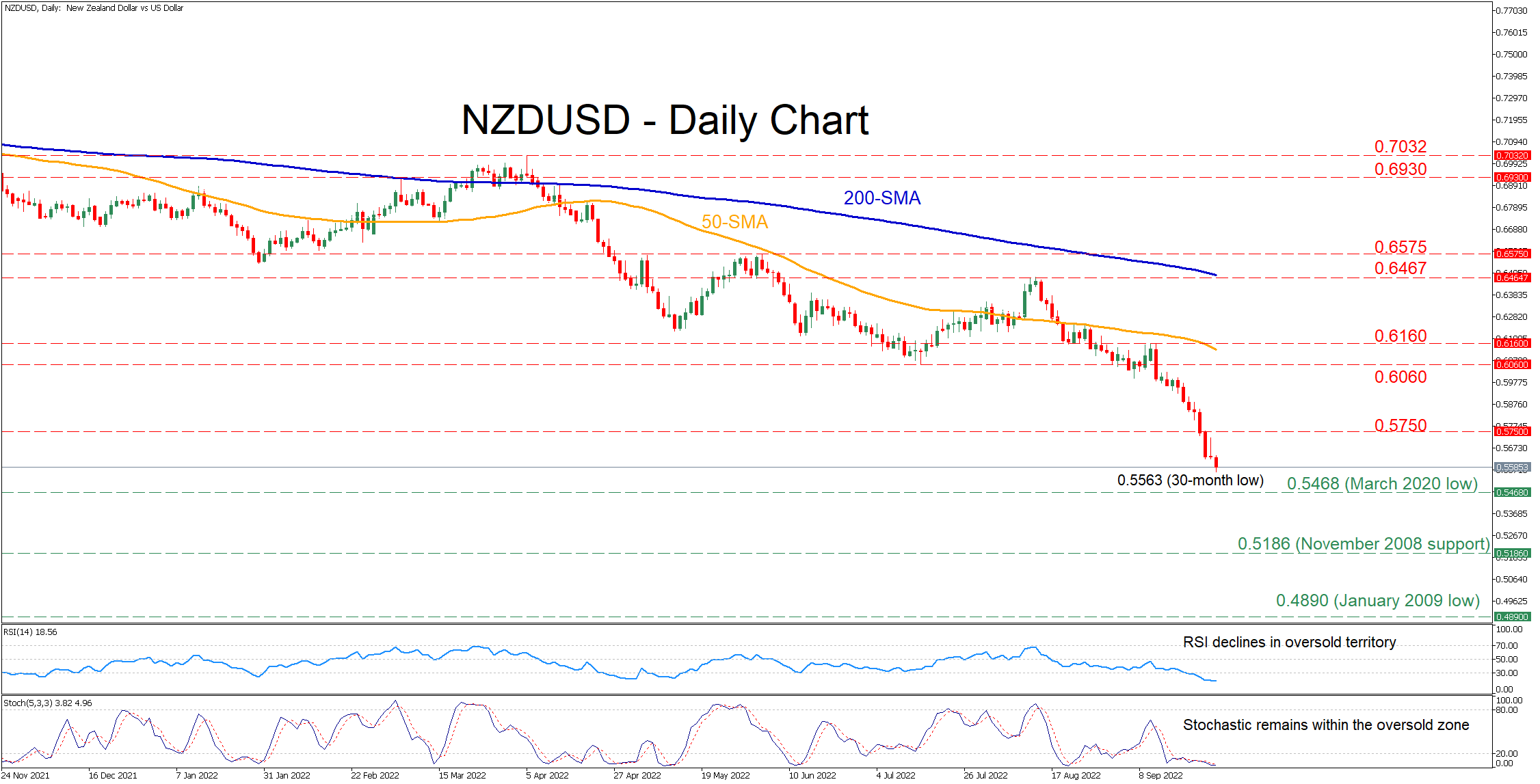

NZD/USD plummets to fresh 30-month lows

NZDUSD has been trending lower since March, generating a profound structure of lower highs and lower lows. Moreover, in the past few sessions, the technical picture has deteriorated even further, with the price recording a fresh 30-month low of 0.5563.

The momentum indicators are currently deep within their bearish areas, which could also signal that a rebound is imminent. The RSI is descending in the 30-oversold zone, while the stochastic oscillator has eased within its 20-oversold territory.

Should selling pressures intensify, the price could encounter support at the March 2020 bottom of 0.5468. If that floor collapses, the pair will dive towards levels not seen in the past 13 years, where the November 2008 support of 0.5186 could provide downside protection. Failing to halt there, the January 2009 low of 0.4890 may halt any further drops.

To the upside, bullish actions could send the price to test 0.5750. Crossing above this region, the pair might ascend towards the July low of 0.6060 or higher to challenge the recent resistance zone of 0.6160. Piercing through the latter, the August high of 0.6457 could prove to be a tough obstacle for the pair to overcome.

Overall, even if NZDUSD has come under tremendous downside pressure, the momentum indicators currently suggest that the market has reached oversold levels. Therefore, it wouldn’t be a surprise if the pair experienced an upside correction soon.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory near 1.0650

EUR/USD clings to modest daily gains at around 1.0650 in the American session on Wednesday. The US Dollar struggles to gather strength amid a modest improvement seen in risk mood and helps the pair hold its ground.

GBP/USD stabilizes at around 1.2450 after UK inflation data

GBP/USD consolidates its daily gains near 1.2450 after recovering toward 1.2500 with the immediate reaction to stronger-than-expected inflation data from the UK. The renewed US Dollar weakness also helps the pair hold its ground.

Gold fluctuates near $2,390 as markets keep an eye on geopolitics

Gold trades in a relatively tight range near $2,390 in the second half of the day on Wednesday. In the absence of high-tier data releases, investors keep a close eye on headlines surrounding the Iran-Israel conflict.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.