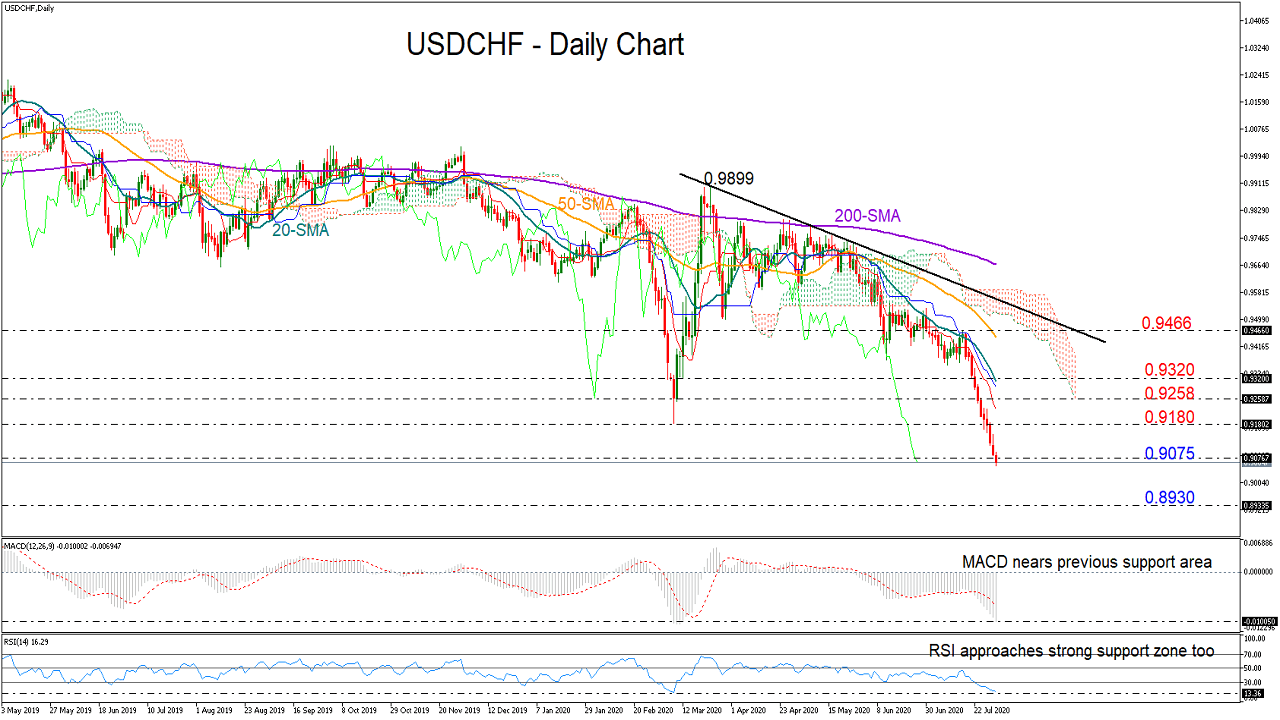

USDCHF is set to complete its sixth consecutive bearish week and close below the 0.9075 tough support area from May 2015, further confirming the break of a long-term range zone.

The bias remains strongly negative as reflected by the downward-sloping simple moving averages (SMAs) and the weakening momentum indicators. However, hopes that the sell-off may soon lose steam are rising in the daily chart as the RSI is approaching a former base zone within oversold territory, while the MACD could also bounce near a familiar support level.

Should the price extend its downleg clearly below 0.9075, the next stop could occur near 0.8930, taken from the 2012 lows. Another violation at this point could stage a more aggressive downfall that may fade within the 0.8690 and 0.8610 borders.

Otherwise, if the pair rebounds near 0.9075, the bulls may need to jump above the 0.9180 barrier and then run beyond the 0.9258 obstacle to reach the 20-day SMA currently around 0.9320. Higher, the spotlight would shift to the swing high of 0.9466, a break of which would confirm the end of the bearish wave. Yet, only a rally above the descending trendline could raise speculation that a bullish trend is in progress.

In brief, USDCHF keeps facing negative risks, though technical signals suggest that the sell-off could be overstretched.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.