USDCAD

The USDCAD surged in early US trading after data showed Canada’s inflation rate dipped in April.

Annualized figure dipped to 2.2% in April, missing forecast for 2.3% which was also last month’s result.

On the other side, Canada’s retail sales climbed in March, as 0.6% rise overshot expectations for 0.3% increase while previous month’s figure was revised upward to 0.5% from 0.4%.

However, better than expected retail sales were not able to improve negative impact from weak inflation numbers, as the greenback remains well supported and accelerated across the board at the beginning of the US session.

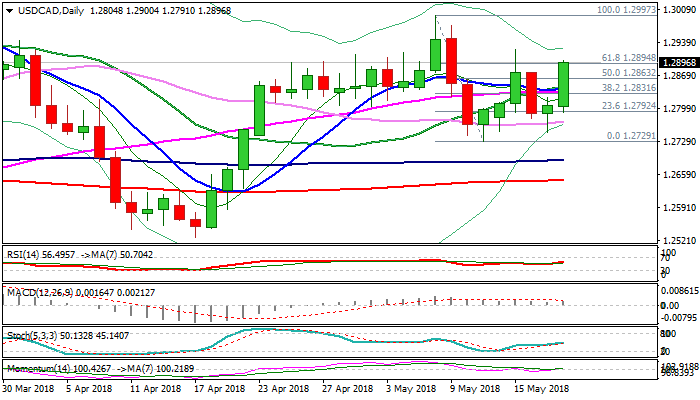

Fresh strength surged through thick 4-hr cloud and probes through double-Fibonacci barrier at 1.2896 (Fibo 61.8% of 1.3124/1.2527 fall and Fibo 61.8% of 1.2997/1.2729 bear-leg), close above which would generate bullish signal for renewed attack at psychological 1.30 barrier after initial attempt stalled just ticks ahead on 08 May.

Today’s rally broke above converged 10/20/55SMA’s, bringing daily MA’s into full bullish configuration.

Strengthening 14-d momentum broke into positive territory and adds to bullish outlook.

Cluster of MA’s at 1.2846/33 zone marks solid support which is expected to protect the downside.

Res: 1.2927; 1.2974; 1.3000; 1.3076

Sup: 1.2863; 1.2846; 1.2833; 1.2791

Interested in USDCAD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.