The Canadian dollar has ticked higher in the Monday session. Currently, USD/CAD is trading at 1.3193, down 0.07% on the day. Canadian and U.S banks are closed for a holiday, so traders should not expect much movement from the pair on Monday. There are no Canadian events and just one minor event in the United States.

Inflation continues to rise higher in the United States. On Friday, the Producer Price Index (PPI) jumped 0.6%, its sharpest gain since January 2017. This easily beat the estimate of 0.2%. Core PPI was also sharp, with a gain of 0.5%, compared to a gain of 0.2%. Stronger inflation will reinforce expectations that the Fed will hike rates hike in December. Currently, the odds of a quarter-percent rate hike stands at 76%. On the consumer front, UoM consumer sentiment dropped to 98.3, down from 99.0 points. Still, this beat the forecast of 98.0 points.

The Canadian economy continues to perform well, but strong numbers have not been enough to boost a struggling Canadian dollar. This was underscored on Thursday by a superb reading from Ivey PMI, a key gauge of economic activity. The indicator surged to 61.8 in November, up sharply from 50.4 in October. This reading easily beat the estimate of 50.9 points. Earlier this week, Bank of Canada Governor Stephen Poloz said that the Bank would continue gradually raising rates from the current 1.75% to a “neutral stance” of between 2.5% and 3.5%. The magic question for investors is how quickly the BoC will move in this direction. The BoC has raised rates some five times in the past 15 months, and upcoming rate hikes will help make the Canadian dollar an attractive option for investors.

European open – Brexit and Italy risks this week

US Dollar Flying High on Hawkish Fed Statement

USD/CAD Fundamentals

-

Tentative – US Loan Officer Survey

-

14:30 US FOMC Member Mary Daly Speaks

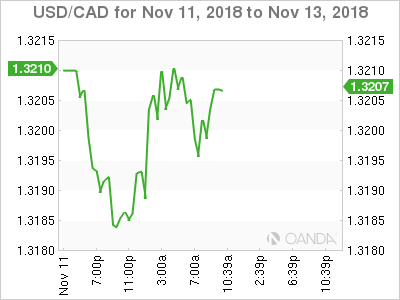

Open: 1.3205 High: 1.3214 Low: 1.3183 Close: 1.3193

USD/CAD Technical

|

S3 |

S2 |

S1 |

R1 |

R2 |

R3 |

|

1.2831 |

12970 |

1.3099 |

1.3198 |

1.3292 |

1.3383 |

USD/CAD ticked higher in the Asian session and the trend has continued in European trade

-

1.3099 is providing support

-

1.3198 has switched to a resistance role following gains by USD/CAD on Friday. It remains a weak line

-

Current range: 1.3099 to 1.3198

Further levels in both directions:

-

Below: 1.3099, 1.2970, 1.2831 and 1.2733

-

Above: 1.3198, 1.3292 and 1.3383

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.