Employment figures from both North American nations will be released later on today and for that reason the USD/CAD could be in for a wild ride. Given the mostly negative leading indicators, most analysts expect to see a weak headline US nonfarm payrolls figure. But if it meets expectations (182,000) or surprises to the upside then US dollar may stage a short-covering rally as most of the negativity may already be priced in. The dollar bulls will certainly want to see a bigger-than-expected rise in the average hourly earnings index. But at 0.3% m/m, expectations are running high and as such the scope for disappointment is there. Meanwhile Canadian employment figures are expected to have risen last month at a slower pace of 13,000 compared to last month’s 45,300 figure. However, if the Canadian employment data again surprises to the upside then the CAD could rise sharply, given that the Bank of Canada has turned hawkish and inflation indicators have been strong recently.

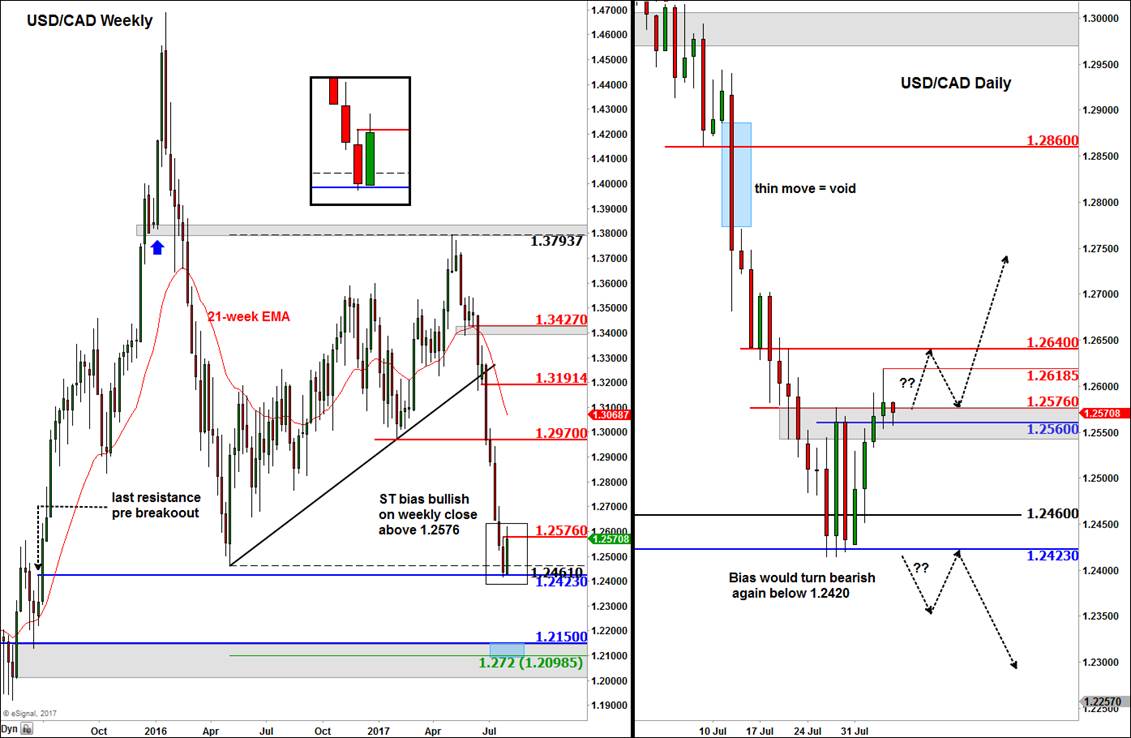

But it is clear from the USD/CAD’s price action this week that there was quite a bit of profit-taking in this pair after its recent sharp falls, as speculators awaited the release of today’s jobs figures. The close today will therefore be very important as it could provide us a clear indication about next week’s most likely direction. For now, the bulls would point to the fact the recent breakdown attempt below last year’s low at 1.2460 clearly failed, and that given the extent of the past declines, this should mean that the USD/CAD is now going to go higher. The bears would argue that this week’s gains mere represent an oversold bounce as bearish speculators banked profit ahead of a key risk event (today’s data).

Given this uncertainty we are holding a neutral bias at this stage. However, a potential close above last week’s high at 1.2576 would probably mark a break in market structure, in which case, the USD/CAD could go higher in early next week. However, a daily close significantly below 1.2576 would suggest the move above last week’s high was a mere stop raid rather than a market structure break. In this case, a quick return to the bottom of the range at 1.2425-1.2460 area would then not come as surprise to us. Indeed, we would then expect to see a further breakdown below this support range in the days to come. In this potential scenario, the bearish bias would well and truly be re-established again.

Risk Warning Notice Foreign Exchange and CFD trading are high risk and not suitable for everyone. You should carefully consider your investment objectives, level of experience and risk appetite before making a decision to trade with us. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any off-exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of the markets that you are trading. Margin and leverage To open a leveraged CFD or forex trade you will need to deposit money with us as margin. Margin is typically a relatively small proportion of the overall contract value. For example a contract trading on leverage of 100:1 will require margin of just 1% of the contract value. This means that a small price movement in the underlying will result in large movement in the value of your trade – this can work in your favour, or result in substantial losses. Your may lose your initial deposit and be required to deposit additional margin in order to maintain your position. If you fail to meet any margin requirement your position will be liquidated and you will be responsible for any resulting losses.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.