The USD was seen trading weaker across the board on Thursday. The biggest gains came from the Japanese yen which surged 0.82% on the day.

Economic data from the U.S. was mixed. Producer price index data from the U.S. showed a 0.4% increase matching estimates and rising to an annual pace of 2.7%. Industrial production figures showed a 0.1% decline in January with previous month's data being revised lower as well.

The capacity utilization rate slipped to 77.5%. The regional manufacturing index data showed that the Philly Fed manufacturing index rose to 25.8 beating estimates while the NY Fed manufacturing index eased from 17.7 in the previous month to 13.1 in February.

Looking ahead, the retail sales data from the UK is expected to show a 0.5% increase after falling 1.5% the month before. The data comes amid UK households facing faster inflation and slower wage growth. Data from the U.S. today will see the housing starts and building permits data coming out.

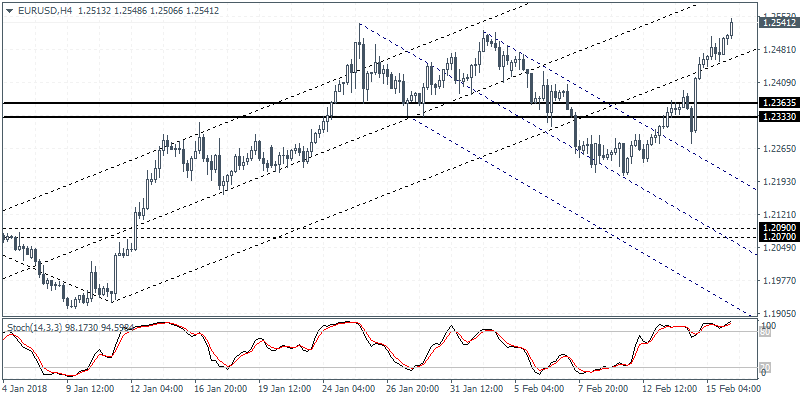

EURUSD intra-day analysis

EURUSD (1.2541): The EURUSD maintained the gains yesterday as price rallied to a fresh 3 year higher earlier today. The gains in the euro came as the U.S. dollar failed to hold on the gains giving a lift to the common currency. With the strong gains, any downside correction could be limited to the 1.2365 level which previously served as resistance. A retest of support at this level could signal a potential rebound with the upside bias intact.

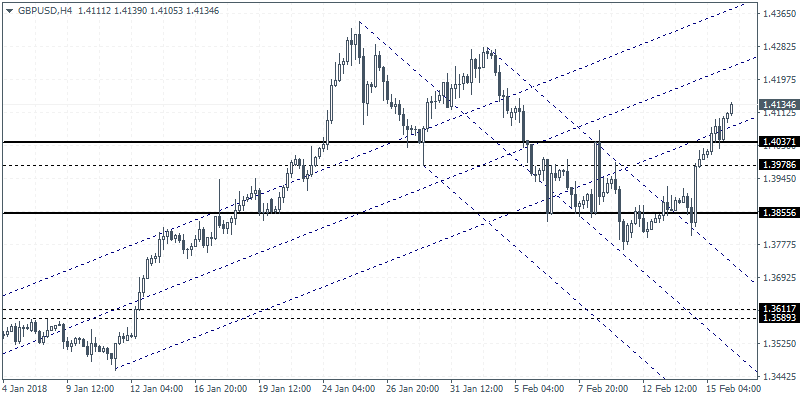

GBPUSD intra-day analysis

GBPUSD (1.4134): The British pound managed to push higher with price breaking out from the upside. The breakout from the resistance level at 1.4037 could indicate further upside gains in the currency pair. Watch for a short term correction towards 1.4037 for support to be established. This could potentially see further gains targeting the previous highs around 1.4279. To the downside, the declines will be limited to the support level but a break down below this level could keep GBPUSD range bound in the short term.

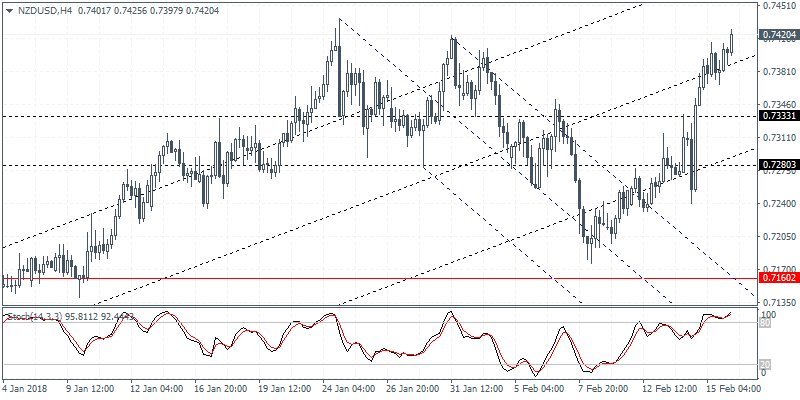

NZDUSD intra-day analysis

NZDUSD (0.7420): The New Zealand dollar is seen testing the highs around 0.7420 level, marking the highs established from two weeks ago. The reversal in the price action suggests upside momentum with the U.S. dollar continuing to remain weak. Watch for a retest of support near the 0.7333 region which served as resistance. To the upside, NZDUSD could be targeting 0.7480 level where the next main resistance level will be tested.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.