Market Overview

With the prospect of agreement in Congress over a fiscal support package still some way off, Wall Street sold off into the close last night and leaves a question mark over the tone of risk appetite coming into today’s session. A “bearish engulfing” candlestick on the S&P 500 (also known as a bearish key one day reversal) meant that the index just failed at reaching its all-time high and could now begin to weigh on the outlook for equities. Despite this though, the sharp rise in Treasury yields is still playing out and this is impacting across dollar major pairs and has driven an enormous corrective sell-off on gold and silver. The Dollar Index would take another step forward in recovery on a move above 94.00 (which would equate to moving below 1.1695 on EUR/USD and sub 1.2980 on Cable. The Reserve Bank of New Zealand did little to change its monetary policy stance overnight (as expected), but continues to prepare for the potential of further easing, including the use of negative rates if needed. UK GDP for Q2 showed a growth contraction of -20.4% which shows the extent of the huge economic hit of the pandemic.

Wall Street ended the session on a sour note last night as selling pressure accelerated into the close, with the S&P 500 -0.8% at 3333. Futures have stabilised this morning and are looking mildly positive (E-mini S&Ps +0.5%) which has helped Asian markets (Nikkei +0.4%, although Shanghai Composite was -0.9%). In Europe, markets are looking mixed, with FTSE futures +0.2% but DAX futures -0.2% (when FTSE outperforms DAX it tends to come with mild risk negative tone). In forex, the USD rebound continues to run, with JPY under pressure (as Treasury yields continue to rise) but also AUD and NZD weaker (the latter feeling the hit of the RBNZ meeting). In commodities, it has been a wild night for gold and silver although both are a shade higher coming into the European session. Oil is over +1% higher and it will be interesting to see if the bulls can hang on this time.

On the economic calendar, the main focus is for US inflation at 1330BST which is expected to see US headline CPI growing by +0.3% on the month to leave the year on year CPI +0.8% higher in July (which is an increase from +0.6% in June). US core CPI is expected to grow by +0.2% on the month which would mean the year on year inflation slips back to +1.1% (from +1.2% in June). The EIA Crude Oil Inventories at 1530BST are expected to show another drawdown of -3.1m barrels (-7.4m barrels last week).

There is also a Fed speaker to watch out for with the FOMC’s Robert Kaplan (voter, centrist) at 1600BST.

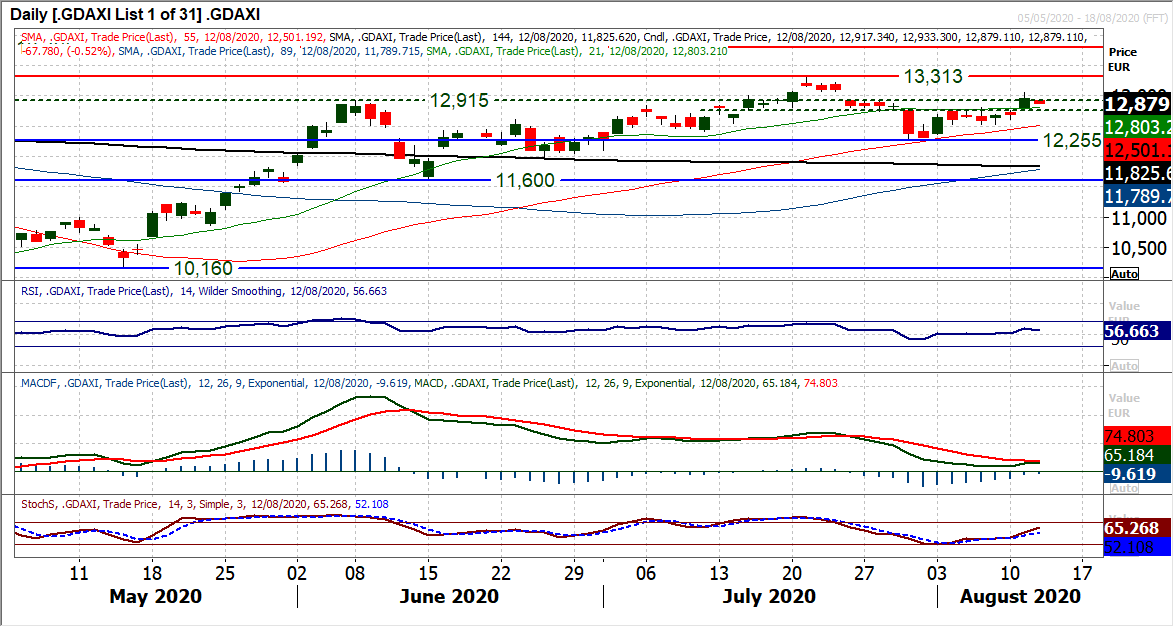

Chart of the Day – DAX Xetra

The outlook for the DAX has improved with yesterday’s strong session which added over +200 ticks. There seemed to have been a shift in sentiment. After several negative candles stuttering at resistance around 12,750/12,800 suddenly the bulls have broken out. The main technical improvement has come in the market ending the sequence of lower highs of the past few weeks. Leaving a higher low at 12,517 now means higher lows and higher highs, the building blocks of a new positive trend. Pulling through the resistance band 12,750/12,915 has put the bulls back in control. This is beginning to drive a more positive configuration on daily momentum indicators, with the RSI accelerating into the 50s and Stochastics also pulling higher, whilst MACD lines are looking set to bull cross. After the disappointing close on Wall Street, there could be some early weakness today, but the bulls will now looking to use 12,750/12,915 as a basis of support to build from. The bulls will now look for a close above 12,915 to confirm the improvement and then to open the July high of 13,313 as the next test. Support at 12,517 is now a higher low above 12,255 which is increasingly important as a basis of support now.

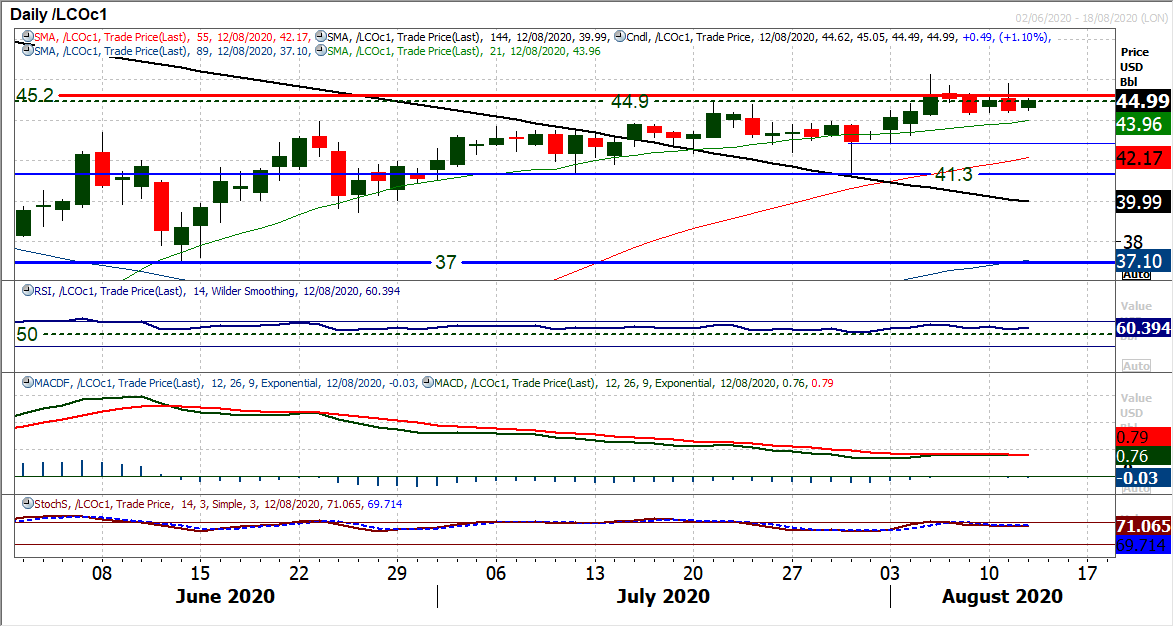

Brent Crude Oil

Anyone who has been trading (or following) Brent Crude in recent weeks will know how frustrating a period is has been to be bullish. Every time it looks as though the market is ready for a breakout, an intraday slip into the close just pulls the reins once more. The market looked to be pushing on again yesterday, but a slip back into the close formed a negative candle and another failure to “close” the gap at $45.20. Finally closing the big bear gap of the key March sell-off remains elusive for the bulls as the rally wheels spins again. Despite all this, we continue to view near term weakness on oil as a chance to buy. The bulls will be looking for $44.25 support to hold but another higher low in the $42.90/$44.90 range will maintain the bullish bias. A move below $41.30 would be the move to see the bulls lose control. Resistance is mounting at $45.80/$46.25 which needs to be overcome to open the way towards the next real resistance at $53.10/$53.80.

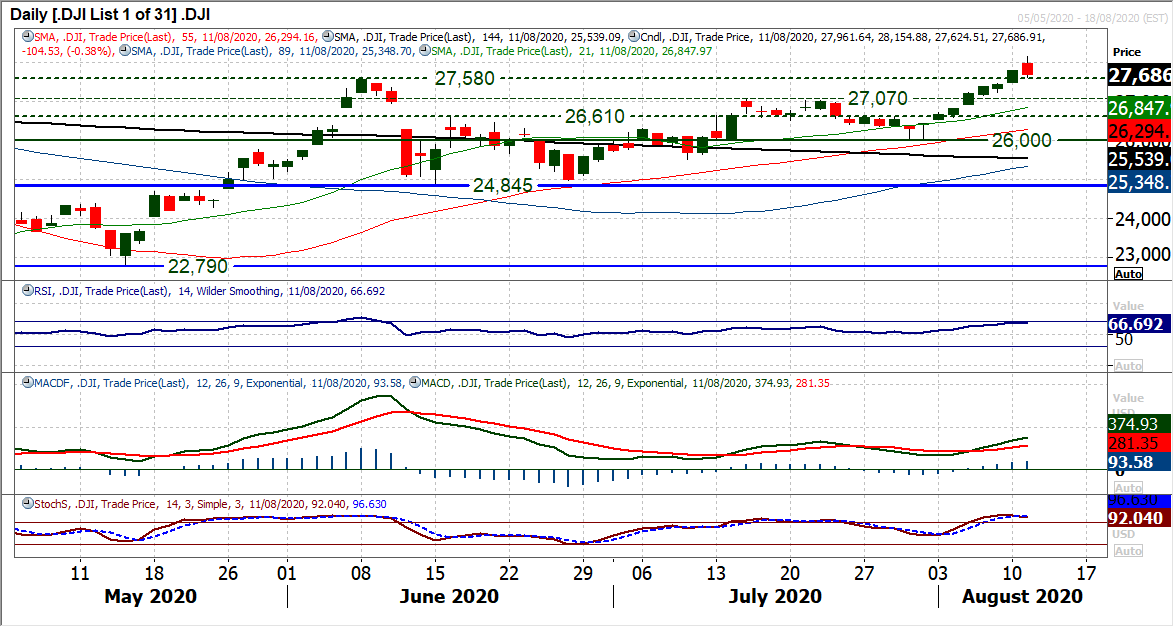

Dow Jones Industrial Average

A run of seven positive closes on the Dow came to a halt yesterday as the bulls faltered into the close last night. Breaking out above 27,580 was a key near term move, but a pullback now threatens. This breakout is now an initial basis of support, but the bulls will now be looking to find the next higher low anywhere between 27,070 and 27,580 (the old highs from July and June respectively). Momentum is strong, but just tailing off now and this could usher a near term slip back in which would be the source of the next opportunity to buy. The hourly chart shows how the selling pressure accelerated into the close (never a great sign for the bulls) and which will leave a negative bias coming into today’s session (futures are broadly flat this morning). The bulls would not want to lose support at 26,610 whilst support of the higher low around 26,000 is now key. Yesterday’s high at 28,155 is the initial resistance now restricting the market in front of the bear gap at 28,400/28,890.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.