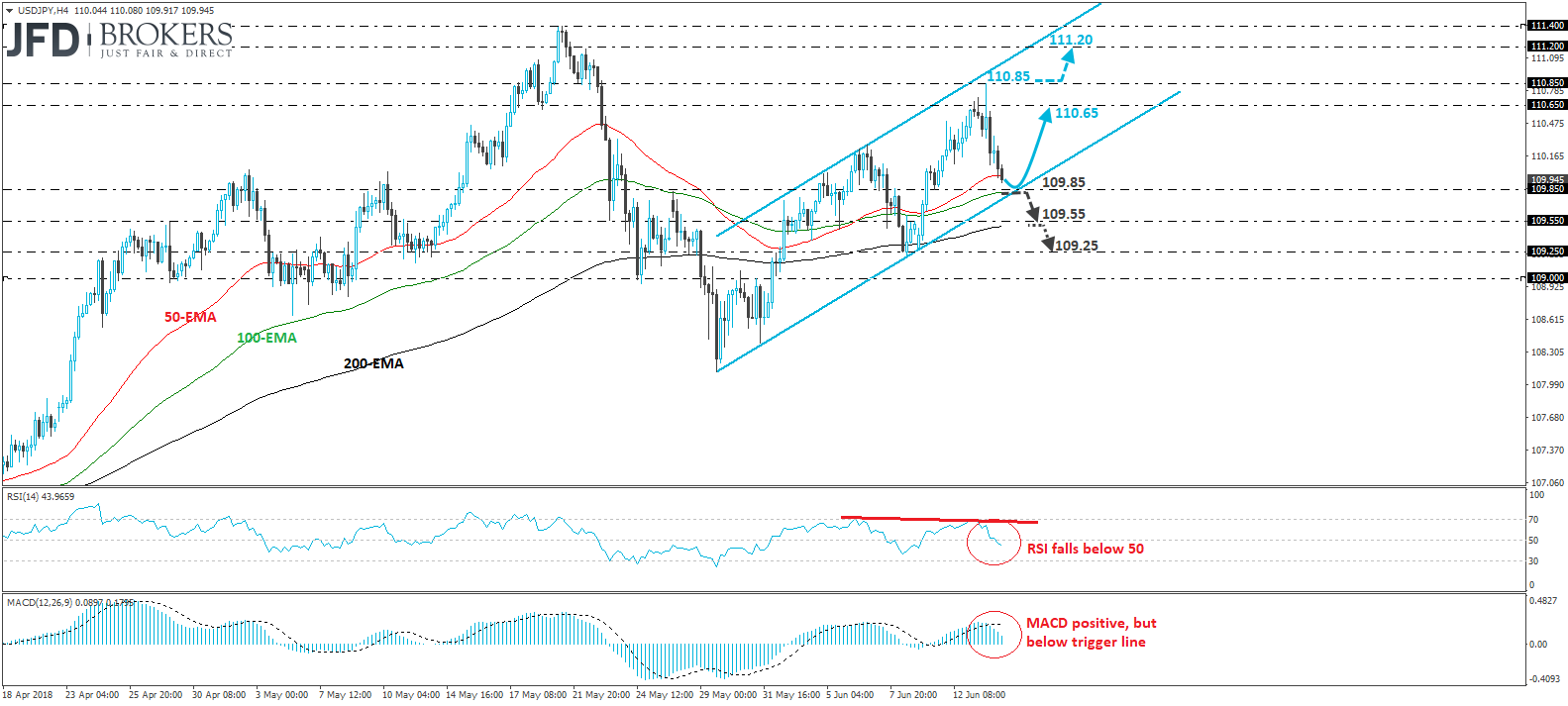

USD/JPY traded lower on Thursday. The slide started on Wednesday, after the rate hit resistance at 110.85. Looking at the price structure on the 4-hour chart, we see that the pair has been printing higher peaks and higher troughs within an upside channel since the 29th of May. So, despite the latest slide, as long as the pair continues to trade within the channel, we will consider the short-term outlook to be cautiously positive.

We still see a decent chance for the bulls to take charge from near the 109.85 support, or the lower end of the channel, and perhaps drive the battle up for a test near 110.65. However, we would like to see a clear break above 110.85 before we get confident on more upside extensions. Such a move would confirm a forthcoming higher high on the 4-hour chart and is possible to pave the way for the 111.20 obstacle, defined by the peak of the 22nd of May.

Looking at our short-term oscillators, we see that the RSI slid and crossed below its 50 line, while the MACD, although positive, lies below its trigger line and looks to be heading towards 0. What’s more, there is negative divergence between the RSI and the price action. These signs suggest that the rate could continue sliding for a while more.

Having said that though, we would like to see a decisive break below 109.85 before we abandon the bullish case, at least for the near term. Such a dip would signal the downside exit out of the channel and could initially target our next support of 109.55. Another break below 109.55 could carry more bearish extensions, perhaps towards the 109.25 zone, fractionally above the low of the 8th of June.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.