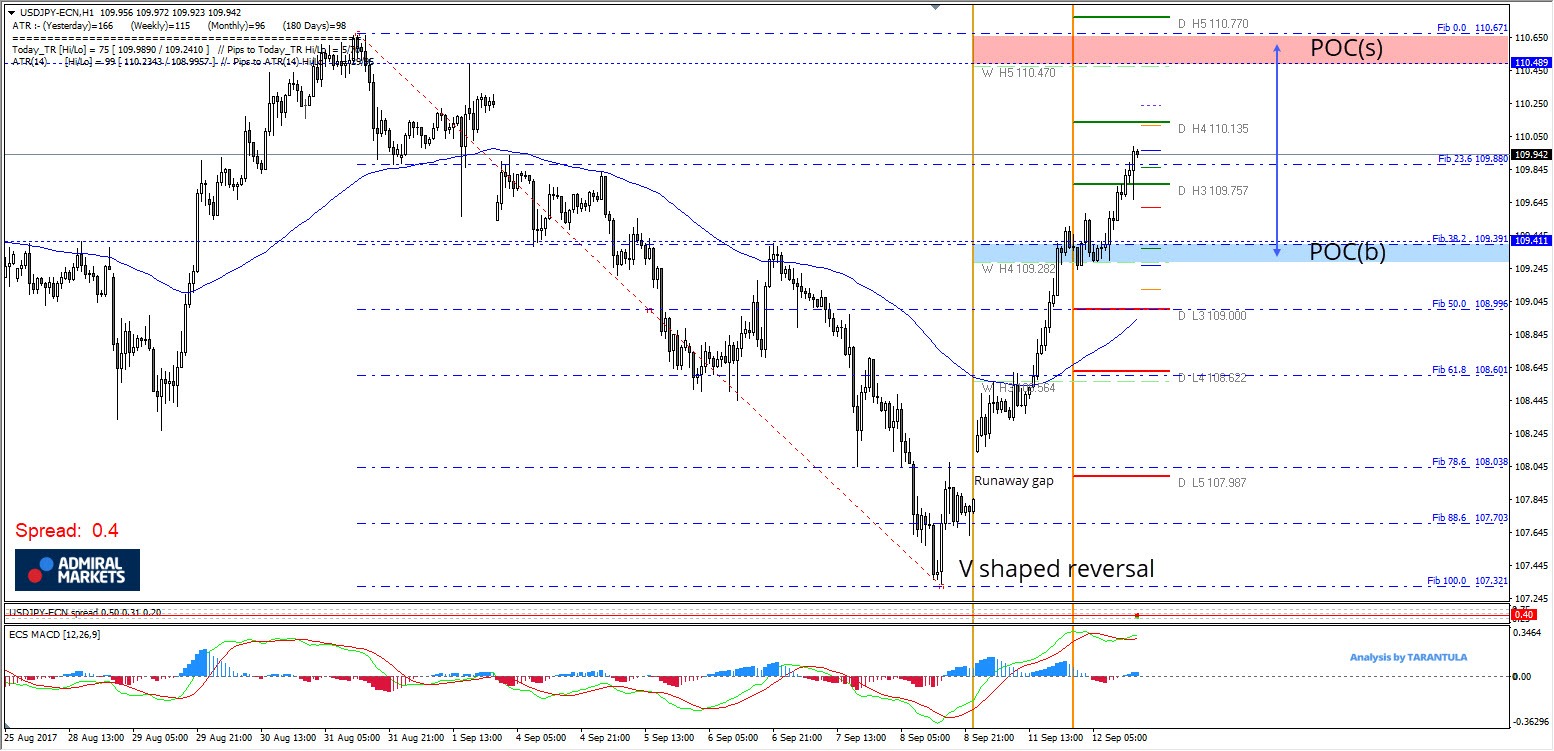

Despite strong Core Machinery Orders in Japan today, signaling strength in their manufacturing sector; UJ continues to move bullish after this weekend's gap up, and this is largely as a result of risk-on sentiments across the risky assets such as Equities. The retracement has started after a V shaped reversal pattern and the intraday/week trend turned to bullish.

Technically, the USD/JPY is still in downtrend but it has a strong recovery, and the gap hasn't been closed yet. 109.25-109.40 is the POC(b) buy zone (order block, W H4, ATR pivot) and 110.45-110.65 is POC(s) sell zone. At this point price is in no man's land. If the price retraces to POC(b) we could see a bounce towards 110.13 and 110.50. If we see the price within the POC(s) then targets are 110.15 and 109.75. Above 110.75 we could see a stronger recovery. Watch for these zones.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.