- USD/JPY added to its weekly gains and climbed to over one-week tops on Thursday.

- The prevalent risk-on mood weighed on the safe-haven JPY and remained supportive.

- A softer tone surrounding the USD held bulls from placing fresh bets and capped gains.

The USD/JPY pair built on this week's goodish rebound from sub-105.00 levels and gained traction through the early part of the trading action on Thursday. The momentum pushed the pair to over one-week tops during the Asian session, albeit struggled to find acceptance above the 106.00 mark. The uptick was exclusively sponsored by the underlying bullish sentiment in the financial markets, which tends to undermine demand for the safe-haven Japanese yen. Bulls further took cues from the recent runaway rally in the US Treasury bond yields, though a softer tone surrounding the US dollar kept a lid on any further gains for the major.

Investors remain optimistic about a stronger global economic recovery amid the progress in COVID-19 vaccinations and US President Joe Biden's proposed $1.9 trillion stimulus package. In fact, the pandemic-relief legislation will be put on the House floor for a potential vote on Friday or over the weekend. Adding to this, Fed Chair Jerome Powell's reassurance that interest rates would stay low for a long time gave a fresh impetus to reflation trade and further boosted the global risk sentiment. The risk-on flow, along with rising inflation expectations, pushed the yield on the benchmark 10-year US government bond to the highest level since February 2020.

The USD, however, struggled to gain any meaningful traction and remained depressed on the back of the Fed's dovish stance. This, in turn, held bulls from placing aggressive bets and capped any meaningful upside for the major, at least for the time being. The pair was last seen hovering around the 105.90 region as market participants now look forward to the US economic docket, highlighting the release of the Prelim (second estimate) Q4 GDP print. Apart from this, the US Durable Goods Orders data and speeches by influential FOMC members, will influence the USD later during the early North American session and produce some meaningful trading opportunities around the pair.

Short-term technical outlook

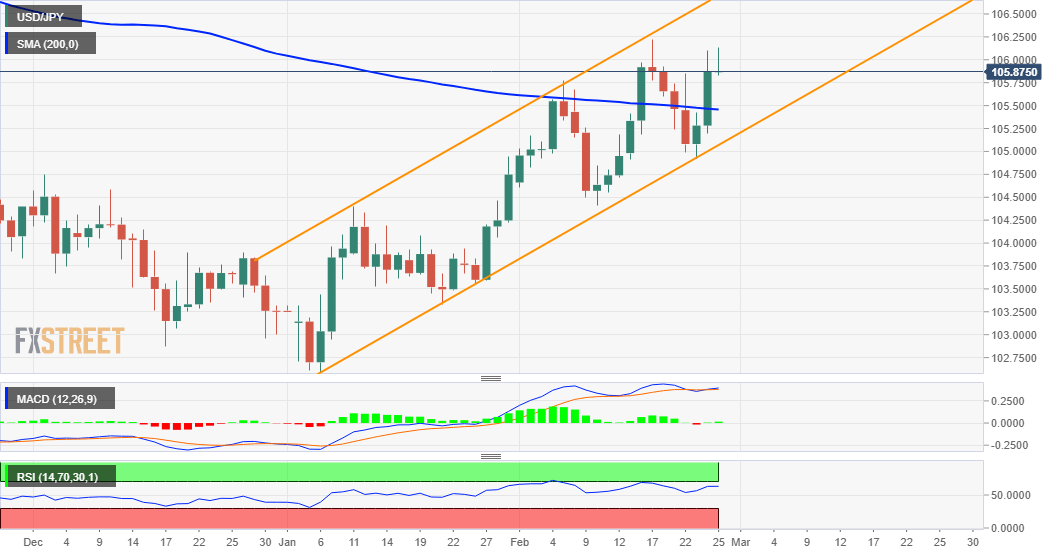

From a technical perspective, the pair has been trending higher along an upward sloping channel over the past two months or so. The formation points to a well-established short-term bullish trend and supports prospects for additional gains. Hence, a subsequent strength beyond monthly swing highs, around the 106.20-25 region, looks a distinct possibility. The pair might eventually climb to test the trend-channel resistance, currently near the 106.70-75 zone. Some follow-through buying will be seen as a fresh trigger for bullish traders and set the stage for a further near-term appreciating move.

On the flip side, any meaningful slide might now find decent support near the very important 200-day SMA, around the 105.40 region. This is followed by the key 105.00 psychological mark, which coincides with the channel support and should now act as a strong base for the major. A sustained breakthrough, leading to a further slide below the 104.40 region (monthly swing lows) will negate any near-term bullish bias and turn the pair vulnerable.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.