USD/JPY, EUR/JPY, CAD/JPY

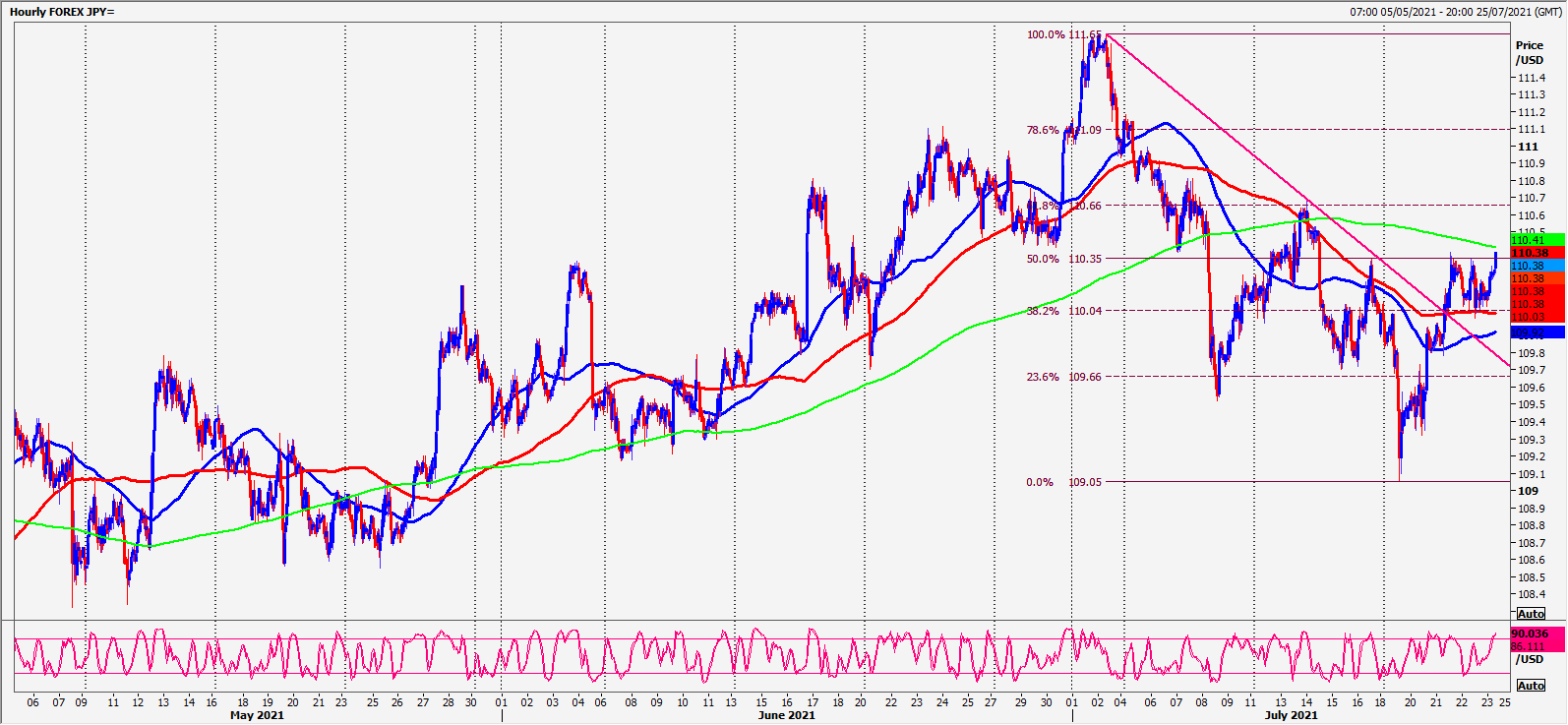

USDJPY topped exactly at strong resistance at 110.35/45 & bottomed exactly at the first target of 110.10/00. Same levels apply for today.

EURJPY unfortunately overran very strong resistance at 129.80/130.00. Stop above 130.20 was 10 pips too tight. However we are now holding below this level.

CADJPY beat strong resistance at 8670/90 for a buy signal targeting 8750/70 & strong resistance at 8800/20. We topped exactly here. A potential 100 pip profit on longs. We reversed to support at 8745/35 & bottomed exactly here.

Daily analysis

USDJPY holding 110.35/45 again today targets 110.10/00 perhaps as far as first support at 109.70/60. Longs need stops below 109.50. A break lower is a sell signal initially targeting the 200 week moving average at 108.90/80. A break below 108.70 is another sell signal initially targeting 108.40/30.

Strong resistance at 110.35/45. Shorts need stops above 110.60. A break higher targets 111.00/10.

EURJPY tests very strong resistance at 129.80/130.00. Stop above 130.30!! A break higher is a buy signal for today targeting strong resistance at 130.70/80. Stop above 130.95.

Holding very strong resistance at 129.80/130.00 targets 129.30/20 then 128.95/90 for some profit-taking. Expect very strong support at 128.50/40. Longs need stops below 128.20.

CADJPY beat strong resistance at 8670/90 for a buy signal targeting 8750/70 & strong resistance at 8800/20. We topped exactly here. Shorts need stops above 8830. A break higher targets 8855/60, perhaps as far as 8890/8900.

Shorts at 8800/20 targets minor support at 8745/35 (we bottomed exactly here yesterday) but below here can target support at 8680/70.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.