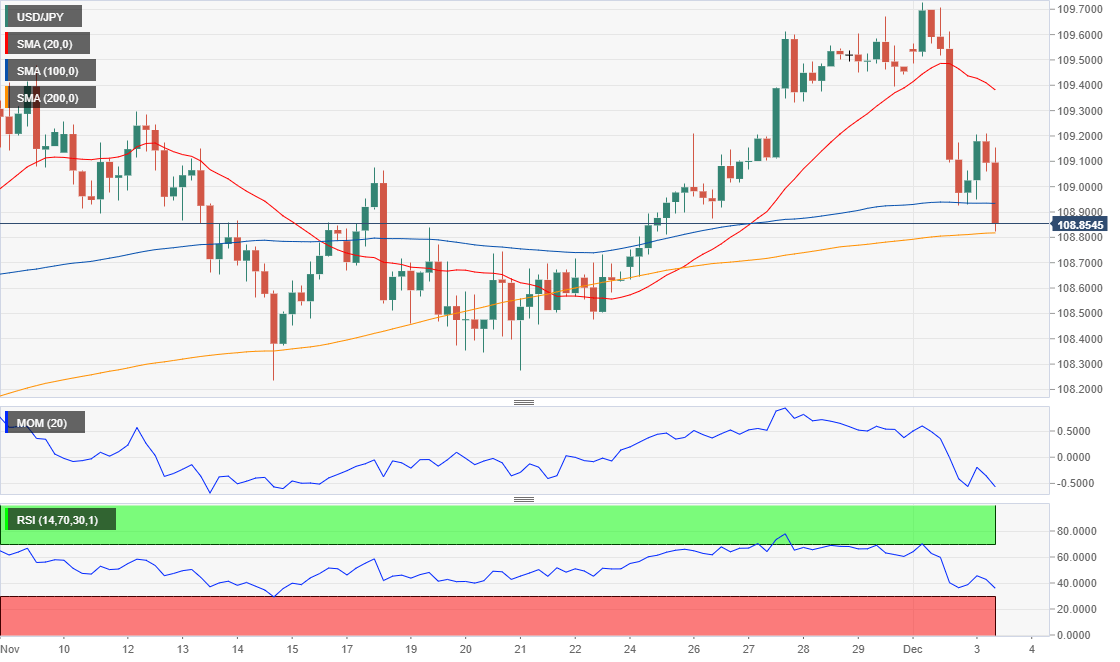

USD/JPY Current price: 108.85

- US President Trump keeps menacing several countries with tariffs.

- Equities extend their collapse, Wall Street set to open at almost a one-month lows.

- USD/JPY pressuring 108.80 support, room to extend its decline toward the 108.00 level.

The USD/JPY pair remains under selling pressure, having extended its decline to 108.82 following London’s opening. US President Trump continues triggering fear across the financial world, this time, menacing with slapping tariffs on France on goods worth $2.4 billion, in response to France's digital tax. The negative sentiment was exacerbated by comments from Trump, who said that he likes the idea of “waiting until after the election for the China deal, but they want to make a deal now and we will see whether or not the deal is going to be right.”

Asian equities followed the lead of Wall Street, which collapsed Monday, while European indexes are also under pressure, although mixed at the time being. Meanwhile, US Treasury yields ticked lower, with the yield on the 10-year note at 1.79% after peaking at 1.85% this week.

Japan published November Monetary Base, which increased by 3.3% YoY, better than the 2.6% anticipated by the market. The US will publish today the November ISM-NY Business Conditions Index, seen at 44.7, down from 47.7 in October.

USD/JPY short-term technical outlook

The USD/JPY pair is pressuring daily lows and bearish, according to the 4-hour chart, as it extended its decline below the 100 SMA, while the 20 SMA turned south well above the current level. The 200 SMA provides dynamic support at around 108.80. Technical indicators, in the meantime, maintain their strong bearish slopes, nearing oversold territory. A break below the mentioned 200 SMA, should lead to a steeper decline toward the 108.00 threshold.

Support levels: 108.80 108.50 108.20

Resistance levels: 109.30 109.60 109.90

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.