- The USD/JPY rode higher on US Dollar and only briefly reacted to growing trade tensions.

- Final US GDP, Durable Goods Orders, and end-of-quarter flows will be in play.

- The technical picture looks upbeat as the pair reaches the edge of the wedge.

This was the week: trade concerns somewhat brushed off

The Trump Administration is contemplating slapping a 10% tariff on no less than $200B worth of Chinese goods in addition to the duties already announced. The news hurt global markets and sent the USD/JPY down, but the movement was relatively short-lived. The recovery in stocks had a positive impact on the pair.

The hawkish hike by the Fed in the previous week kept the US Dollar bid. Fed Chair Jerome Powell repeated the optimistic messages in a panel with Bank of Japan Governor Haruhiko Kuroda. The latter also refrained from making ground-breaking news, and the BOJ continues its loose monetary policy. The divergence between the central banks continues supporting it.

US data was focused on housing and was OK with a rise to 1.35 million annualized units in housing starts a small drop in building permits at 1.301 million, and a minor change in Existing Home Sales that stood at 5.43 million annualized units.

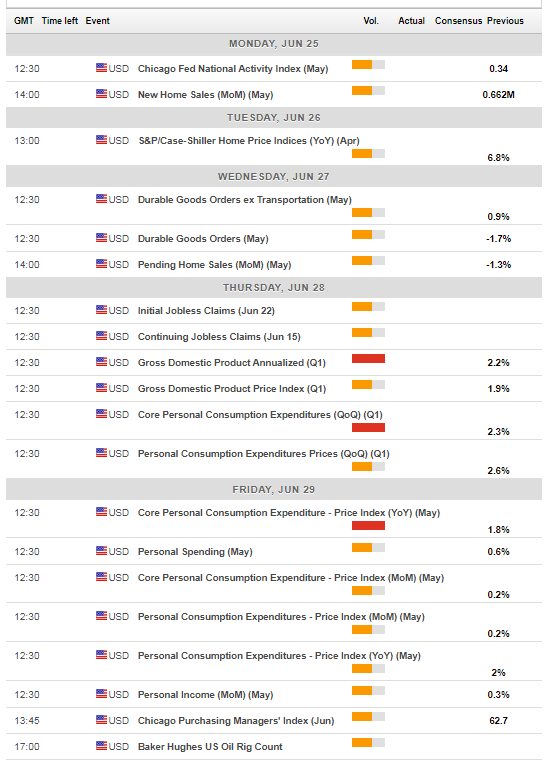

US events: Final GDP, Durable Goods Orders, Core PCE

The week begins with another housing figure: New Home Sales, which will likely continue showing a healthy housing sector. Wednesday features the Durable Goods Orders for May, providing an updated picture on the US economy, in a figure that feeds into Q2 GDP. Core orders, which increased by 0.9% in April, will be in the limelight.

The main event for Thursday is the final read for Q1 GDP. The last release tends to have a weaker impact, but surprises are always possible. The second estimate showed a growth rate of 2.2% annualized, slower than in previous quarters but better than other developed economies and typical for the first quarter of the year.

Friday is the last trading day of the month and also the second quarter, and it could result in last-minute moves to adjust portfolios after a turbulent quarter.

Also, the US publishes the Fed's favorite inflation measure, the Core PCE Price Index. We already know that Core CPI advanced from 2.1% to 2.2% YoY in May, so the Core PCE is expected to follow suit and pick up from 1.8% to 1.9%. An increase to 2%, the holy grail of central banks, would give the greenback the green light to continue higher.

Here are the top US events as they appear on the forex calendar:

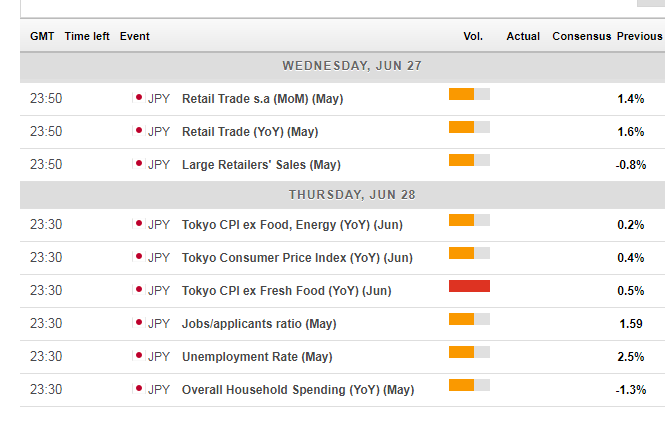

Japan: Tokyo CPI, and potential safe-haven flows

Retail trade data will be of interest, but the main event is the publication of the Tokyo Inflation report for June. The most critical component, Tokyo CPI excluding Fresh Food, stood at a meager 0.5% YoY increase in May. The Bank of Japan is far from the 2% target. The increase in energy prices does not spill over into core prices. As long as this continues, the BOJ has no reason to change its ultra-loose monetary policy.

The Japanese Yen remains the ultimate safe-haven, attracting flows in times of trouble. However, adverse developments around global trade do not directly impact the currency, but the reaction depends on the behavior of stock markets. If stocks are worried, the Yen is in demand. If stocks shrug off such developments, the Yen does not enjoy safe-haven flows.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The USD/JPY is eyeing higher levels with the Relative Strength Index standing above 50 and positive Momentum as well. The pair is also above the 50-day Simple Moving Average. Approaching the edge of the wedge, the textbook says the pair should choose a direction and move sharply to that direction.

110.50 capped the USD/JPY early in the year and served as a magnet for the pair in recent days. 110.80 capped the pair in mid-June. 111.40 was the high point in May. The round number of 112.00 is next up.

110.00 is a round number and remains essential. 109.50 was a swing low on June 19th and also a stepping stone on the way in April. 109.20 supported the pair earlier in June. 108.60 was a support line in early May, and the swing low of 108.10 seen in late May is another level to watch.

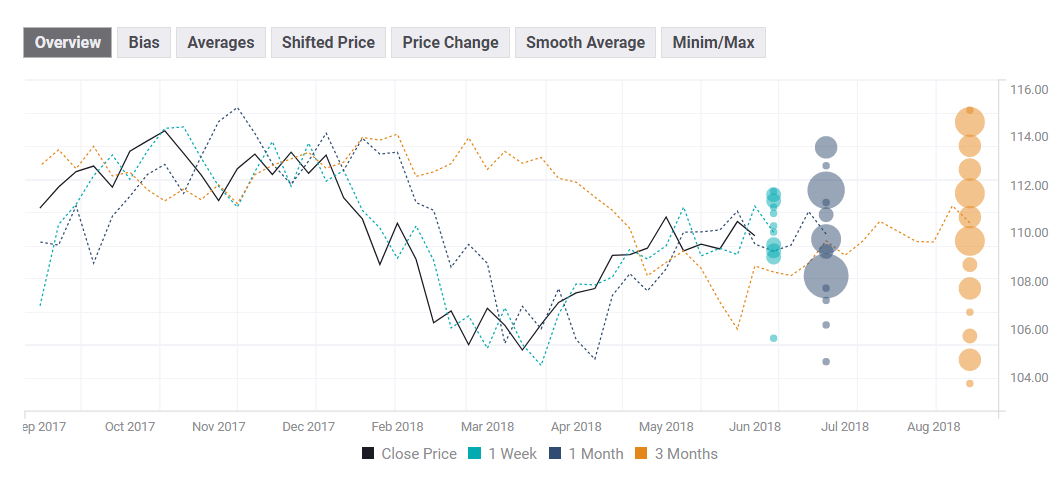

USD/JPY sentiment poll

Sentiment toward the USD/JPY pair continues being positive, as bulls dominate the weekly, monthly and quarterly views. However, investors are unwilling to risk away from the current 110.00 area. Bulls have lost their enthusiasm lately, but so far didn't make room for bears. The pair seems dominated by uncertainty an in the 1-month and 3-month perspectives, the overview chart shows a wide range on possible target with a more even distribution in the longer perspective. With the pair seen as low as 103.75 and as I high as 115.13.

What's next for USD/JPY?

How long can markets ignore the specter of trade wars? Once stock markets catch up with reality, the pair could tumble down rapidly. When will it happen? Pinning down the timing is hard. Until that happens, the upbeat data from the US economy and the optimistic Fed support the pair.

The FXStreet FX Poll provides interesting insights.

Related Forecasts

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.

-636651676072886017.png)