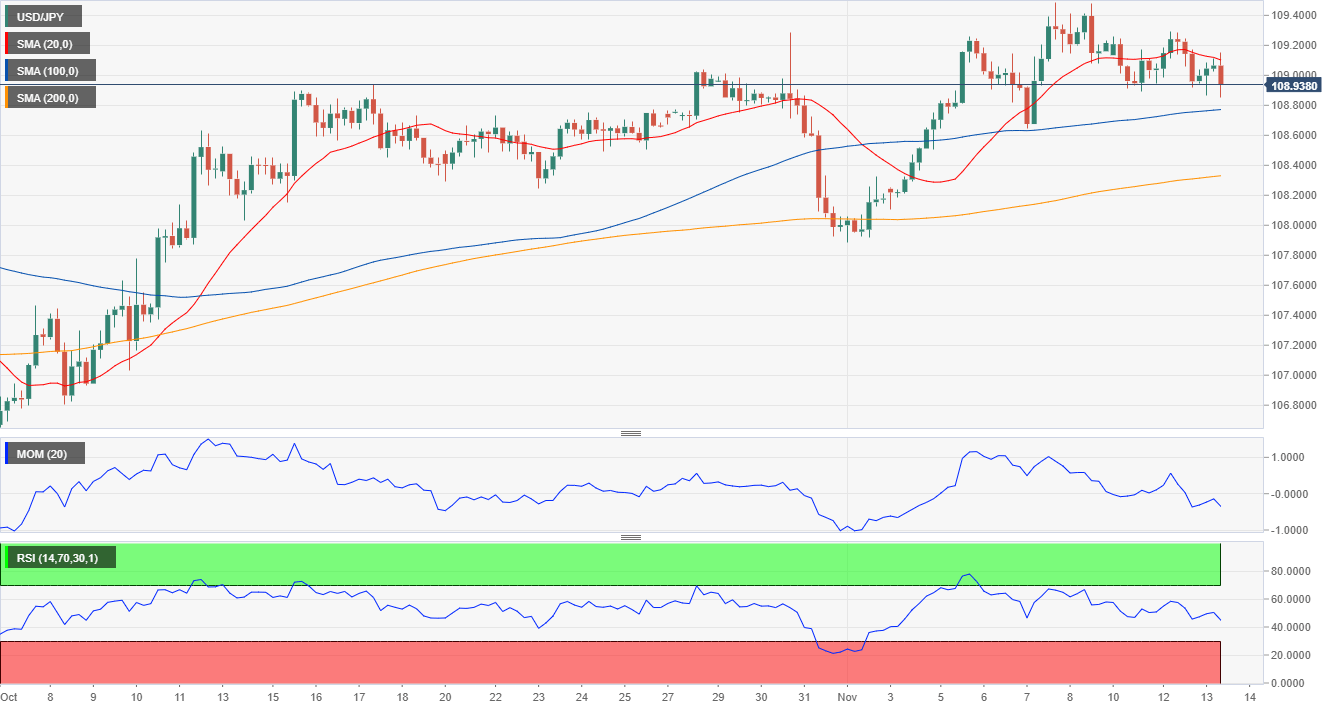

USD/JPY Current price: 108.93

- Equities are under pressure ahead of Powell and after a disappointing Trump’s speech.

- US inflation seen posting a modest advance in October, steady at 2.4% YoY.

- USD/JPY at weekly lows, decline to steepen on a break below 108.65.

The USD/JPY pair is pressuring weekly lows around 108.90, as demand for safety increased ahead of the US Federal Reserve’s chief Powell testimony before the Congress. Also, US President Trump, who spoke in the Economic Club of New York Tuesday, failed to bring relief to markets. He centred his speech on economic growth, criticising the Fed and menacing to add more levies on Chinese imports if a deal isn’t reached.

Stocks’ markets are firmly lower in Asia and Europe, while renewed demand for government debt pushed Treasury yields to weekly lows. On the data front, Japan released the October Producer Price Index, which declined by 0.4% when compared to a year earlier. For the month, prices at factory levels were up by 1.1%, below the market’s expectations.

Later today, the US will release October CPI data. Core monthly inflation is expected at 0.2% while, when compared to a year earlier, it is foreseen at 2.4%. There are a couple of Fed’s speakers scheduled through the American afternoon, but no doubts, Powell testimony will be the star of the day, as he is expected to explain to a special commission why the Fed decides as it does.

USD/JPY short-term technical outlook

The USD/JPY pair is offering a neutral-to-bearish perspective in the short-term, as, in the 4-hour chart, the price remains below its 20 SMA, which slowly grinds lower, but above the 100 and 200 SMA. Technical indicators remain within negative levels, although without directional strength. With the pair at the current level, the net relevant support comes at 108.65, with a break below it opening the door for a steeper slide.

Support levels: 108.90 108.65 108.20

Resistance levels: 109.35 109.60 110.00

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.