- USD/JPY has been rising amid upbeat US data and optimism about trade.

- The last month of the year kicks off with top-tier figures, including Non-Farm Payrolls.

- Early December's daily chart is painting a bullish picture.

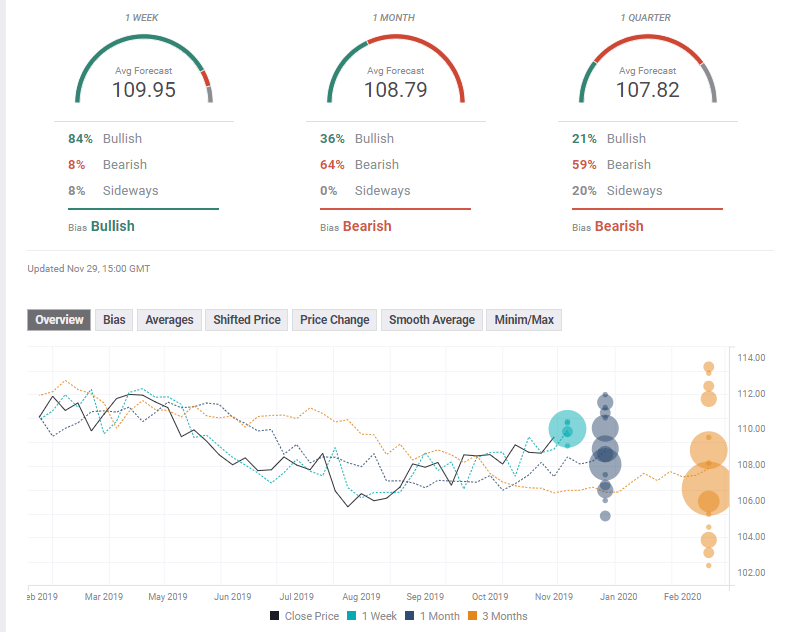

- The FX Poll is pointing to short term gains but falls afterward.

"A glass more than half full" – the words of Jerome Powell, Chairman of the Federal Reserve, have been echoed by upbeat economic figures. USD/JPY has been on the rise and now depends on further data, as well as substantial trade developments.

This week in USD/JPY: Upbeat data

The US economy grew by an annualized pace of 2.1% in the third quarter, 0.2% better than initially reported. Details about the world's largest economy's expansion have been less impressive. While investment figures have been upgraded, so have inventories – which may suffer a depletion after the recent replenishment.

However, more recent figures for October have undoubtedly been encouraging. Durable Goods Orders rose by 0.6%, Core orders by 0.1%, and excluding defense and aircraft, by a whopping 1.2%. The latter figure – the "core of the core" – reflects a rebound in investment, which has been a weak spot in the US economy.

The Conference Board's Consumer Confidence has dipped but remains at high levels at 125.5 points. Housing figures have been encouraging with New Home Sales hitting a new cycle high of 733K annualized in October. The Housing Price Index is rising by 0.6% in September.

The US dollar has been bid throughout the short Thanksgiving week, also amid optimism related to trade talks. Chinese officials said that the world's largest economies reached a "consensus" on a deal while President Donald Trump stated that negotiations are in the "final throes" – but that agreement depends on him.

Perhaps to prove it, Trump signed Congress' Hong Kong bill into law just before Thanksgiving. The move angered Beijing, which sees any support of the pro-democracy movement as an intervention in its internal affairs. However, China's retaliation may be limited to the city-state's issues and not trade talks.

Nevertheless, the safe-haven yen came under pressure. Even though investors are still waiting for white smoke – they seem to be losing some interest. The impact of commerce-related headlines appears to be diminishing.

The yen also suffered from downbeat inflation figures from Tokyo. The data for November has shown that inflation remains far from the Bank of Japan's 2% target.

US events: Packed week culminating in NFP

Trade headlines may return to prominence as the December 15 deadline approaches. Washington is scheduled to slap additional tariffs on Beijing on that day unless a deal is struck.

Markets are pricing in some understanding that would prevent not only additional duties but also remove previous ones. However, hawks in the administration are fighting back against such a move and may push back against such a move.

Trump has the final word.

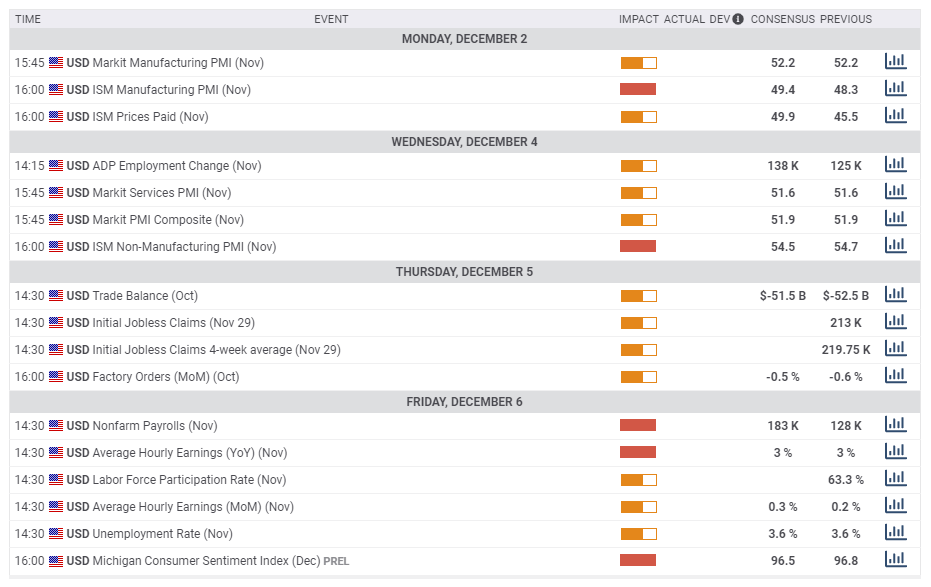

Economic figures will keep traders busy even if trade headlines are dull. ISM's Purchasing Managers' Index for the manufacturing sector is set to advance, but remain below the 50-point threshold – reflecting contraction. The indicator serves as the first hint towards Friday's jobs report.

ADP's Employment Change measure for the private sector is forecast to show an increase in net job gains in November. The correlation between America's largest payroll provider's figures and the official Non-Farm Payrolls is sometimes absent. Nevertheless, the data shapes expectations.

Investors have little time to digest ADP's data before ISM's Non-Manufacturing PMI is due out. Contrary to the industrial sector, the services one is expanding at a solid pace, with a score of 54.7 back in October. A similar figure is likely for the headline, and the employment component provides another hint toward the NFP.

Thursday's releases include Trade Balance and Factory Orders, which are both are set to stay in the red.

And finally, Friday's Non-Farm Payrolls are projected to show a return to previous averages – close to 200K jobs gained. The US labor market has been jittery during 2019, but the latest report for October – and its revisions for previous months – have calmed investors. Some had feared that employment was slowing down.

Wage growth is expected to show a satisfactory annual increase of 3% while the jobless rate carries expectations of hovering just above the 50-year lows of 3.5%. The jobs report feeds into the following week's Fed decision.

The last word of the week belongs to the preliminary University of Michigan's Consumer Sentiment Index for December, as Christmas shopping kicks off. Shoppers' confidence has recovered from a dip several months ago but has yet to cling to the previous highs.

Here are the top US events as they appear on the forex calendar:

Japan: Safe-haven flows

The Japanese yen remains the safe-haven of choice, and it may come into play if the US and China fail to clinch an accord to prevent new levies. The currency may also see inflows upon a potential flare-up in the Middle East or around North Korea.

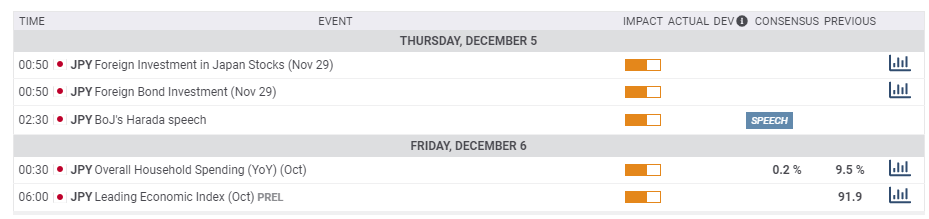

The Japanese calendar is light, with Overall Household Spending being of some interest late in the week. This consumption gauge has risen by 9.5% in September and may continue showing high levels of growth in October.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The daily chart is showing a substantially improved technical picture. Momentum has turned to the upside, and dollar/yen broke above the former double-top of 109.35. Moreover, it recaptured the broken uptrend support line and topped the all-important 200-day Simple Moving Average.

Resistance awaits at the November high of 109.60, and it is closely followed by 109.95, which was a swing high in May. Next, 110.65 was a high point back then, and it is followed by 111.05, a gap line from May as well. 111.65, and 112.10.

Support awaits at 109, which capped USD/JPY in October and converges with the 200-day SMA. It is followed by 108.25, which provided support earlier this month. Next, we find 107.90, a swing low from that time, followed by 107, which dates back to September.

USD/JPY Sentiment

Data has entered the void left by repetitive trade headlines, but markets are still awaiting a deal – which is priced in. Therefore, the risk is skewed to the downside. However, if investors are kept waiting, further upbeat data – especially from the labor market – may boost dollar/yen.

The FX Poll is pointing to gains in the short term but falls afterward. On average, experts have upgraded their forecast for all time frames in comparison to the previous week's survey. The persistent rally may have convince some to warm up to a US-Sino deal.

Related Forecasts

- GBP/USD Forecast: Buying big Boris lead and the Golden Cross? Corbyn can still curb gains

- EUR/USD Forecast: Fireworks will be back before year-end

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

-637105513960116536.png)