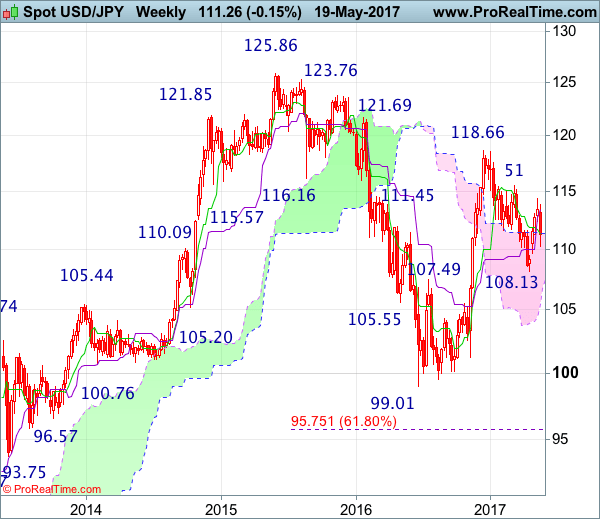

Weekly

-

Last Candlesticks pattern: Marubozu

-

Time of formation: 14 Nov 2016

-

Trend bias: Down

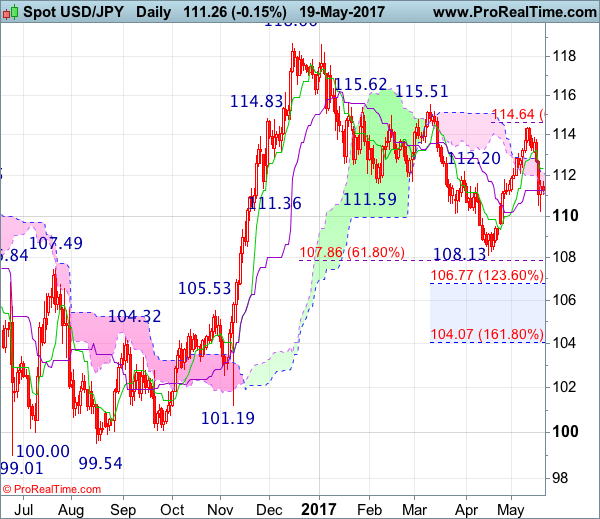

Daily

-

Last Candlesticks pattern: Shooting star

-

Time of formation: 15 Feb 2017

-

Trend bias: Down

USD/JPY – 111.48

Despite rising to 114.37 earlier this month, the subsequent stronger-than-expected retreat suggest top has been formed there and downside risk remains for weakness to 110.00-10, however, reckon downside would be limited to 109.59 support and minor support at 108.88 should hold, price should stay well above recent low at 108.13, bring rebound later.

On the upside, whilst the recovery from 110.24 may bring recovery to 111.70-75, reckon upside would be limited to the upper Kumo (now at 112.12) and the Tenkan-Sen (now at 112.31) should hold, bring another decline. Above 112.73 would bring recovery to 113.10-15 but only a daily close above there would suggest low is formed, bring a stronger rebound to 113.85, having said that, upside should be limited and price should falter below resistance at 114.37.

Recommendation : Stand aside for this week

For intraday trade ideas, visit the candlesticks and ichimoku intraday section.

On the weekly chart, last week’s stronger-than-expected retreat dampened our bullishness and suggesting the rebound from 108.13 has ended there, hence consolidation with mild downside bias is seen for weakness to 110.00-10, however, break of 109.59 support is needed to add credence to this view, bring further fall to 108.85-90 but said support at 108.13 should remain intact. In the event dollar drops below said support at 108.13, this would signal the fall from 118.66 top has resumed and extend weakness towards previous resistance at 107.49.

On the upside, expect recovery to be limited to 112.00-05 and previous support at 112.39 should hold, bring another decline later. Above 112.70-75 would risk a stronger rebound to 113.10-15, however, break there is needed to signal the retreat from 114.37 has ended instead, bring further gain to the Kijun-Sen (now at 113.40) but break of 113.85 is needed to confirm and bring retest of 114.37 later. Looking ahead, only break of said resistance at 114.37 would extend the rise from 108.13 to 114.60-65 (61.8% Fibonacci retracement of 118.66-108.13), then towards resistance at 115.51 which is likely to hold from here.

Content in ActionForex.com website is for informational purposes only. Contributors submitted forecast, commentaries, analysis, articles are based upon information gathered from various sources believed to be reliable, complete, and accurate. However, no guarantee can be made as to the validity of the believed sources. All statements and expressions in the website are opinions, and not meant as investment advice or solicitation. Forex Markets can be volatile and opinions may change without notice.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.