The price of crude oil held steady as the market reflected on the crisis at the Suez Canal, where a giant ship has blocked the narrow channel. Activity to dislodge the ship, The Ever Given, continued today, with experts saying the process could take more than a week. The blockage has forced some ships to take the longer route of moving around the African continent. Analysts believe that a continued blockage will lead to possible oil supply shortages, which could push prices higher.

The British pound rose slightly after the relatively mixed UK retail sales numbers. According to the Office of National Statistics (ONS), the total retail sales rose by 2.1% in February after falling by more than 8.2% in the previous month. The sales declined by 3.7% on an annualised basis, an improvement from the previous decline of 5.9%. The core retail sales rose from - 8.8% to 2.4%. These numbers came a few days after the ONS published the relatively mixed employment and inflation numbers.

The euro rose against the US dollar after the EU agreed to limit vaccine exports after the bloc realised that it sent more vaccines to the rest of the world than it had given its citizens. In total, companies have shipped more than 77 million doses abroad while the bloc has vaccinated more than 62 million people. Still, this measure could attract retaliation from other countries and put the overall process in jeopardy. This happened as the EU battles with another wave of the virus.

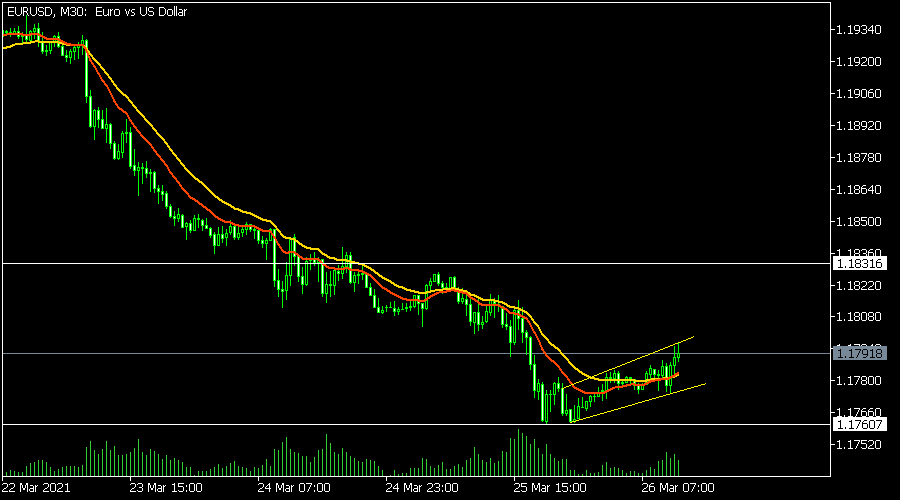

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1800 after the announcement by the EU. On the 30-minute chart, the price has formed an ascending channel that resembles a bearish flag pattern. The highest point today was along the upper side of this channel. It is also slightly above the 15-day moving average. Therefore, there is a possibility that the pair will resume the downward trend and retest the support at 1.1760.

XBR/USD

The XBR/USD pair rose as the market continued to react to the stuck cargo ship in the Suez Canal. On the 30-minute chart, the price moved above the short- and longer-term moving averages. It also appears to be forming an inverted head and shoulders pattern whose neckline is at 64.37. It is also along the upper side of the Bollinger Bands while the Relative Strength Index (RSI) has also kept rising. The pair may keep rising during the neckline at 64.37.

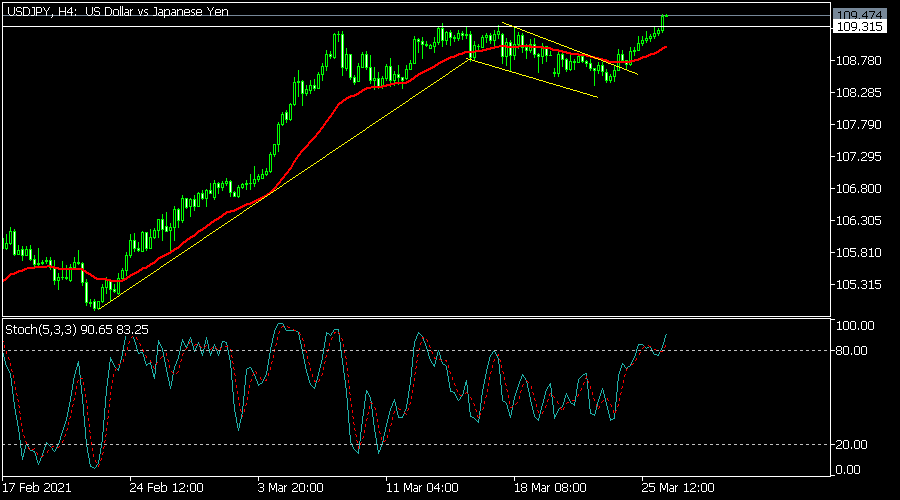

USD/JPY

The USD/JPY rose to a multi-month high of 109.48. On the four-hour chart, the price had formed a bullish flag pattern a few days ago. It also moved above the important resistance at 109.31, and above the short and medium-term moving averages, while the Stochastic oscillator has moved above the overbought level. The pair may keep rising as bulls target the next key resistance at 110.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.