USD/CHF has been trapped within an Equidistant Channel on the daily chart. The price had several bounces and rejections on its support and resistance. It had a bounce at its support yesterday as well, and the daily candle closed as a Hammer. Today's intraday price action has been bullish. The price has breached the highest high of yesterday's candle on minor frames. All these equations suggest that the pair may keep heading towards the North until it reaches the channel's upper band, but there are other equations that shall be counted by the buyers.

Let us have a look at the USD/CHF daily chart.

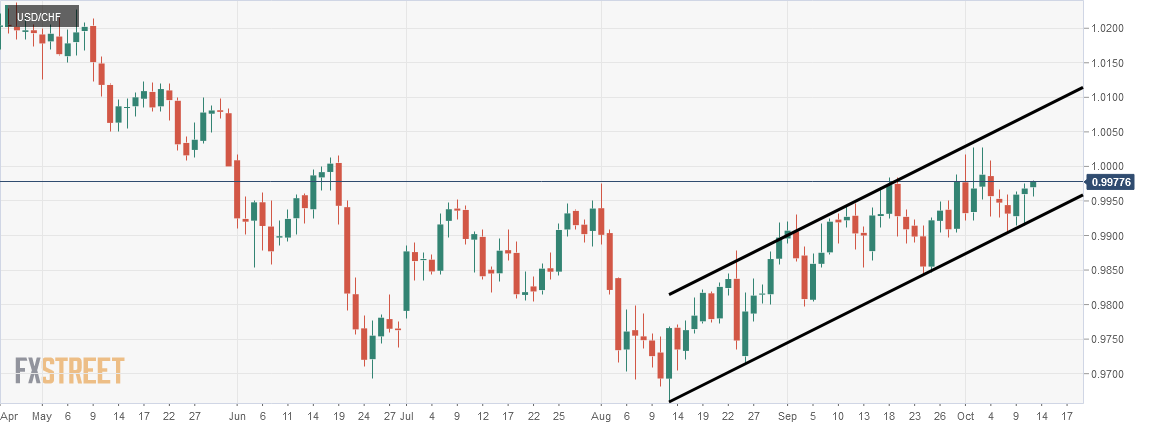

Chart 1 USD/CHF Daily Chart

On the chart above we can observe that the price has been obeying the channel quite nicely. The day before yesterday's, as well as yesterday's daily candles, both had a bounce at the support. The price could have had a bullish day yesterday since the day before yesterday's daily candle was a strong bullish reversal candle. However, yesterday's price action was bearish to start with. Thus the pair could not make a strong bullish move.

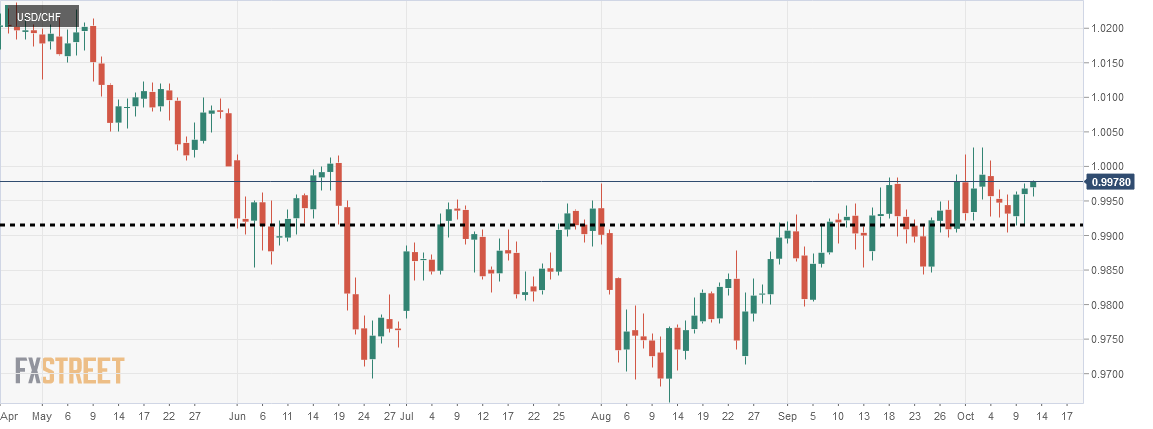

Chart 2 USD/CHF Daily Chart

The chart shows that the level of 0.9910 produced a strong bullish daily candle earlier. After having a rejection from the channel's upper band, it had consolidation around the horizontal support. Since the price has found both horizontal and channel support, this may make the buyers interested in buying the pair and push the price towards the North further.

Let us find out what the H4 chart's price action suggests to us.

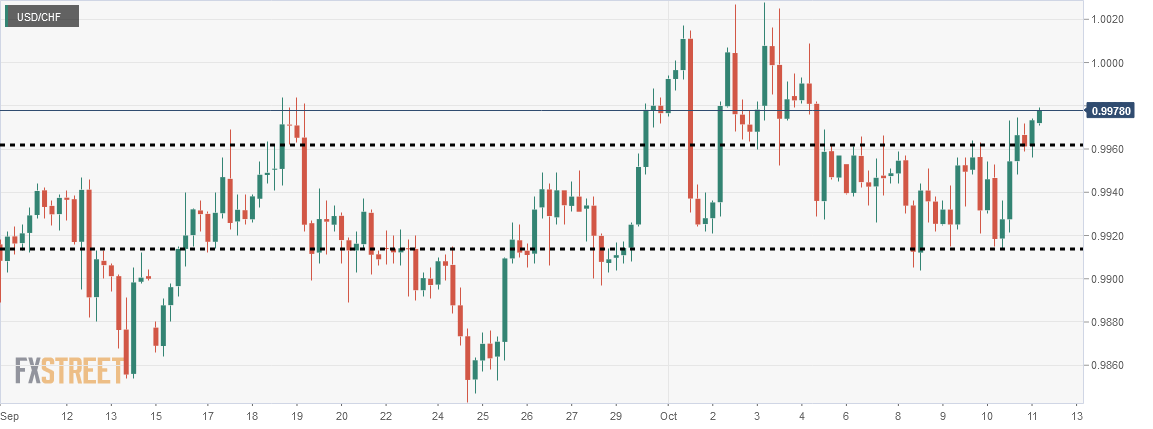

Chart 3 USD/CHF H4 Chart

The chart shows that the price has produced a Double Bottom at a key level of support. Though the first candle of the current bullish wave was an Inside Bar, it has kept heading towards the North. It breached the neckline of the Double Top, produced a corrective bearish H4 candle, which was followed by an H4 bullish engulfing candle. This is a strong bullish price action which may attract the buyers to go long on the pair today. The next resistance may come at 1.0000, which is the strongest psychological number as far as any currency pairs are concerned.

The daily and the H4 chart both look good for the buyers. The risk and reward ratio seems to be lucrative for the H4 traders, but for the daily traders, it is not as good as they would have liked. A massive psychological number is in the way which must be taken into account before setting Take Profit.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.