- The USD/CAD remained capped in a tight range of 100 pips at 1.3220-1.3320 as oil price correction higher stopped.

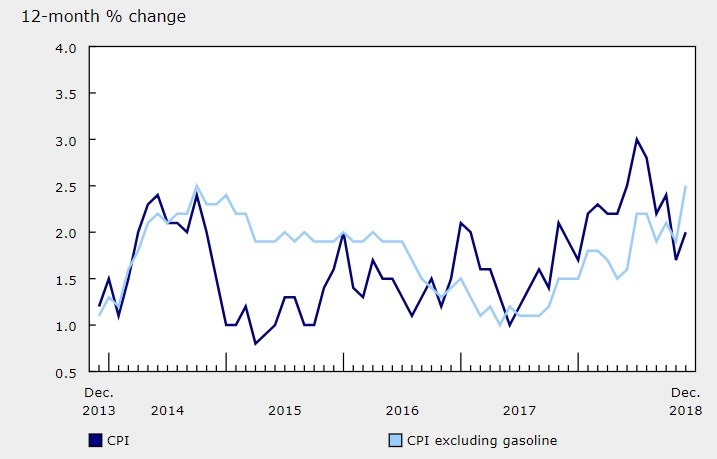

- Canada’s December inflation accelerated unexpectedly to 2.0% over the year with core inflation measure up 1.7% at the same time.

- Only minor economic data are scheduled for both Canada and the US with the technical picture favoring continuation of a sideways trend.

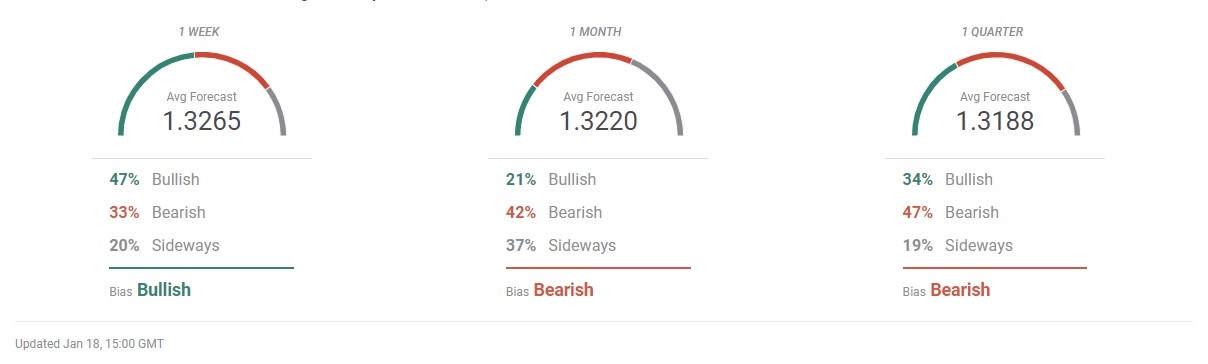

- FXStreet Forecast Poll turned stable with the forecast price for USD/CAD moving within 160 pips range for 3-months ahead.

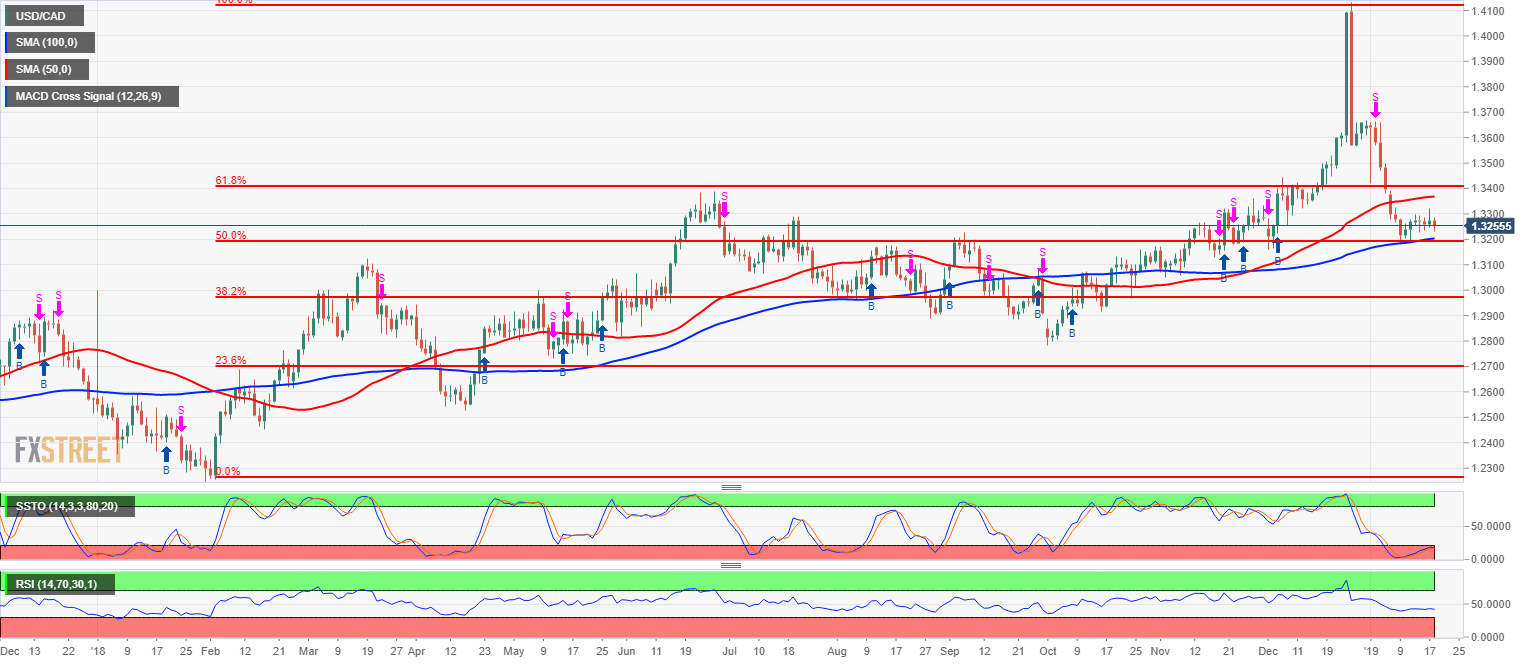

The USD/CAD remained trapped in a very tight range of about 100 pips ranging from 1.3220 to 1.3320 during the consolidation phase of the third week of January. The USD/CAD is moving within a sideways trend after a flash-crash from the beginning of 2019 that saw the pair rising to 1.4134.

With the oil prices also remaining in a tight range of one US Dollar, the commodity market did not provide a reason for the Canadian Dollar to be boosted. It was the release of Canada’s inflation in December that boosted CAD on Friday with the headline inflation surprisingly jumping back to 2% Bank of Canada's targeted level.

The upward price pressure to transportation and travel related components overshadowed the oil price drop in December that saw gasoline prices fall. This is adding a reason for the Bank of Canada to act on rates as the Bank indicated in January that despite the drop in oil prices and inflation, it is still firmly on track to monetary policy tightening towards the neutral level of 2.5%-3.5%.

“Inflation is projected to edge further down and be below 2% through much of 2019, owing mainly to lower gasoline prices,” the Bank of Canada wrote in its last monetary policy decision on January 9.

On the other hand, the Bank of Canada is expecting depreciation of the Canadian Dollar to have pro-inflationary impulse largely negating the oil price development.

“Lower level of the Canadian dollar will exert some upward pressure on inflation. As these transitory effects unwind and excess capacity is absorbed, inflation will return to around the 2% target by late 2019,” the Bank of Canada further stated.

Canada’s inflation

Source: Statistics Canada

On the other side of the Atlantic, the economic calendar is paralyzed by the US government shutdown with only Bureau of Labor actively releasing the macro data, but nothing important came out to influence the markets much. The set of the US Federal Reserve officials was speaking out last week with the “patience” in relation to the rate hiking outlook becoming the unisono language.

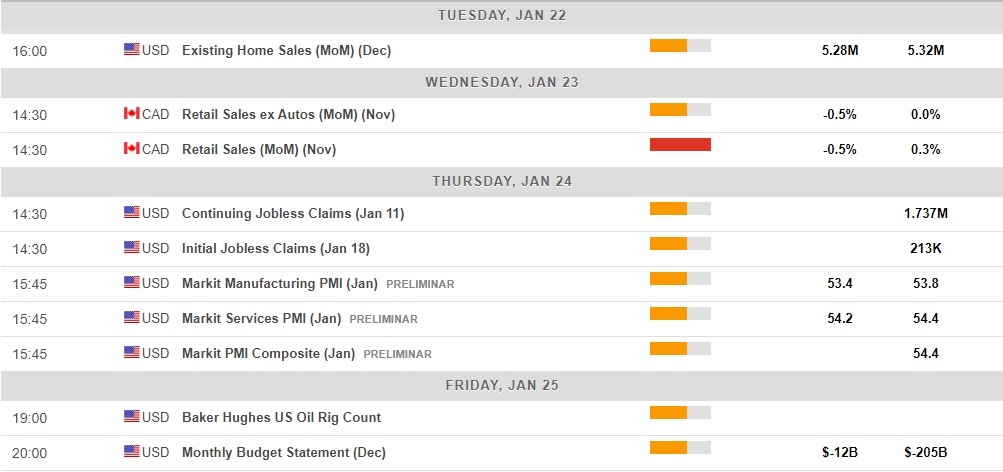

The upcoming week will see Canada’s retail sales expectedly dropping by -0.5% over the month in November.

The upcoming week is set to remain driven by the further direction of oil prices and the monetary policy comments, especially from the Federal Reserve officials, although there is no important speech scheduled. The technical picture indicates continuous sideways trend framed by a 50-day moving average of 1.3200 and a 100-day moving average of 1.3370 with the technical oscillators depressed in the Oversold territory.

Technical analysis

USD/CAD daily chart

Technically, the USD/CAD is moving within a sideways trend after slumping from the flash-crash high of 1.4134. The USD/CAD is facing support at 1.3200 representing a confluence of a 50-day moving average on a daily chart and a 50% Fibonacci retracement of the upmove from last year’s low of 1.2260 to 1.4134 high. The technical oscillators are depressed after the USD/CAD made a correction from the highs, with sideways trend framed by a 50-day moving average of 1.3200 and a 100-day moving average of 1.3370 with the technical oscillators depressed in the Oversold territory.

Statements from Fed officials in the week from January 14-18

Chicago Federal Reserve President Charles Evans said for the Bloomberg TV on January 17:

- Fed is at a good point for pausing in raising interest rates.

- It is entirely plausible that the Fed could raise rates two times this year, could be less.

- Tariff and trade issues do not have a great impact on the economic outlook.

Federal Reserve Vice Chairman Randal Quarles said on January 17:

- Real US economic data are very strong.

- US job creation in December was “very big number”.

- Inflation is very well contained, especially with oil prices falling.

- The financial markets recently reacting to doubt about the strength of global growth including China and Europe.

- Markets now more attuned to downside risks but “core base case” scenario for the US economy is still very strong.

- I am seeing some stretched valuations in equities, commercial real estate; but overall risk to US financial stability remains moderate.

Dallas Federal Reserve President Robert Kaplan said on January 15:

- Patience on interest rates should last at least a quarter or two and should be a matter of "months" not weeks.

- A call for patience does not necessarily mean the FED should stop raising rates altogether.

- We are not ready to conclude yet that balance sheet policy needs any changes.

- There is no “textbook” on Fed balance sheet rundown, it must be open to learning and ready to make adjustments if data like market liquidity point to a problem.

Kansas City Federal Reserve Bank President Esther George and a voting member of the FOMC said on January 15:

- “It might be a good time to pause” on rate hikes.

- Fed should proceed with caution and be patient on rate hikes.

- Rates are not yet at neutral, though close.

- Pause in normalization would give time to assess the effect of rate hikes so far.

- It is unclear whether, and how much, the Fed's balance sheet trim is removing accommodation.

- If inflation pressures emerge, more rate hikes could be needed.

- Fed rate-setting panel will be focused on data when it meets in two weeks.

- Fed needs to continually reassess how its balance sheet is affecting the economy.

The Minneapolis Federal Reserve President and a well-known monetary policy dow Neel Kashkari said on January 15 that he has not seen post-tax-reform repatriated cash delivering a boost to business investment.

The Federal Reserve Vice Chairman Richard Clarida said while talking to Fox Business on January 14:

-

It is not the case that Fed policy is a headwind for US economy.

- The US economy has good momentum; the Fed can be “very patient” this year.

- December rate hike was the right decision.

- Federal Open Market Committee will take policy decisions “meeting by meeting” as it sees that some global data has been softening.

- The slowdown in global outlook is not yet “severe”, but would tend to impact the US exports.

- “I won't hesitate” to adjust asset-portfolio runoff if needed.

- “I don't see a recession on the horizon.”

Week ahead in economic data

Canada’s economic calendar highlights the retail sales report on Wednesday, January 23 with the retail sales seen falling -0.5% over the month in November.

In the US the economic calendar is limited to the releases from the Bureau of Labor statistics due to the US government shutdown. The weekly jobless claims data and the US homes sales headline as the US canceled its delegation for the World Economic Forum in Swiis Davos this year.

Canada’s and the US economic calendar for January 21-25

FXStreet Forecast Poll

The FXStreet Forecast Poll is short-term bullish with the spot rate of USD/CAD expected at 1.3265 in the 1-week horizon, up from 1.3240 the FX spot rate on Friday evening in Barcelona. The majority of forecasters see US Dollar rising (47%) compared with 33% of bearish and 20% of sideways projections.

The FXStreet Forecast Poll is slightly bearish for the 1-month ahead with USD/CAD seen reaching 1.3220, and 42% of bearish to 21% bullish predictions. The sideways trend prediction actually reaches 37% for the one month period.

The three months' forecast reflects rising Brexit uncertainty with average FX rate for USD/CAD seen at 1.2188. Bullish forecasts reached 34% and bearish projections reached 47%. The sideways trend was predicted by 19% of forecasts.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.