- Loonie suffered a pullback as Canadian inflation decelerated sharply to 2.2% in September.

- The expectations of the Bank of Canada hiking rates by 25 basis points next week with might undermine the position of CAD as sudden inflation miss possibly delays the hike.

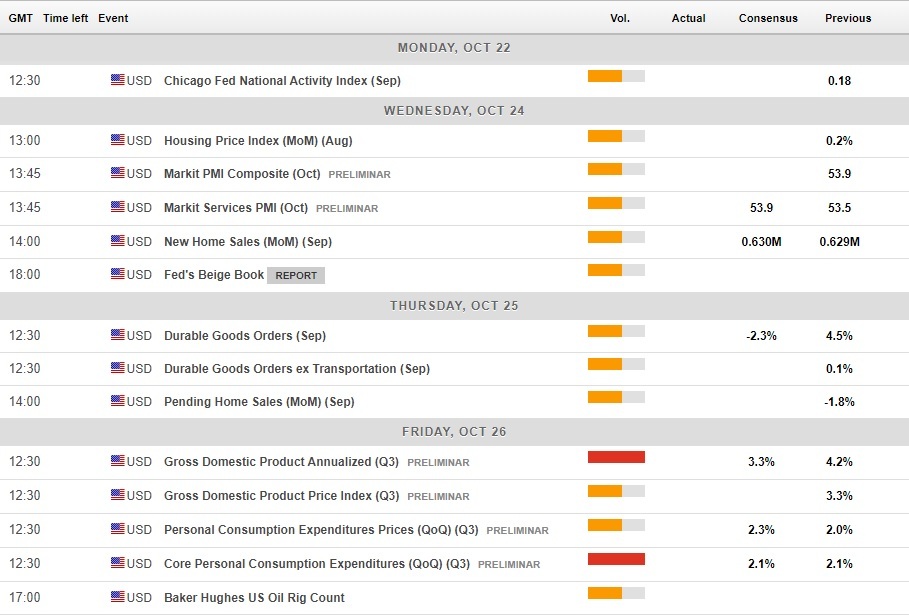

- The USD/CAD is currently stuck to sideways trend and the currency pair needs to break above 1.3090 to resume the uptrend targeting cyclical highs of 1.3380.

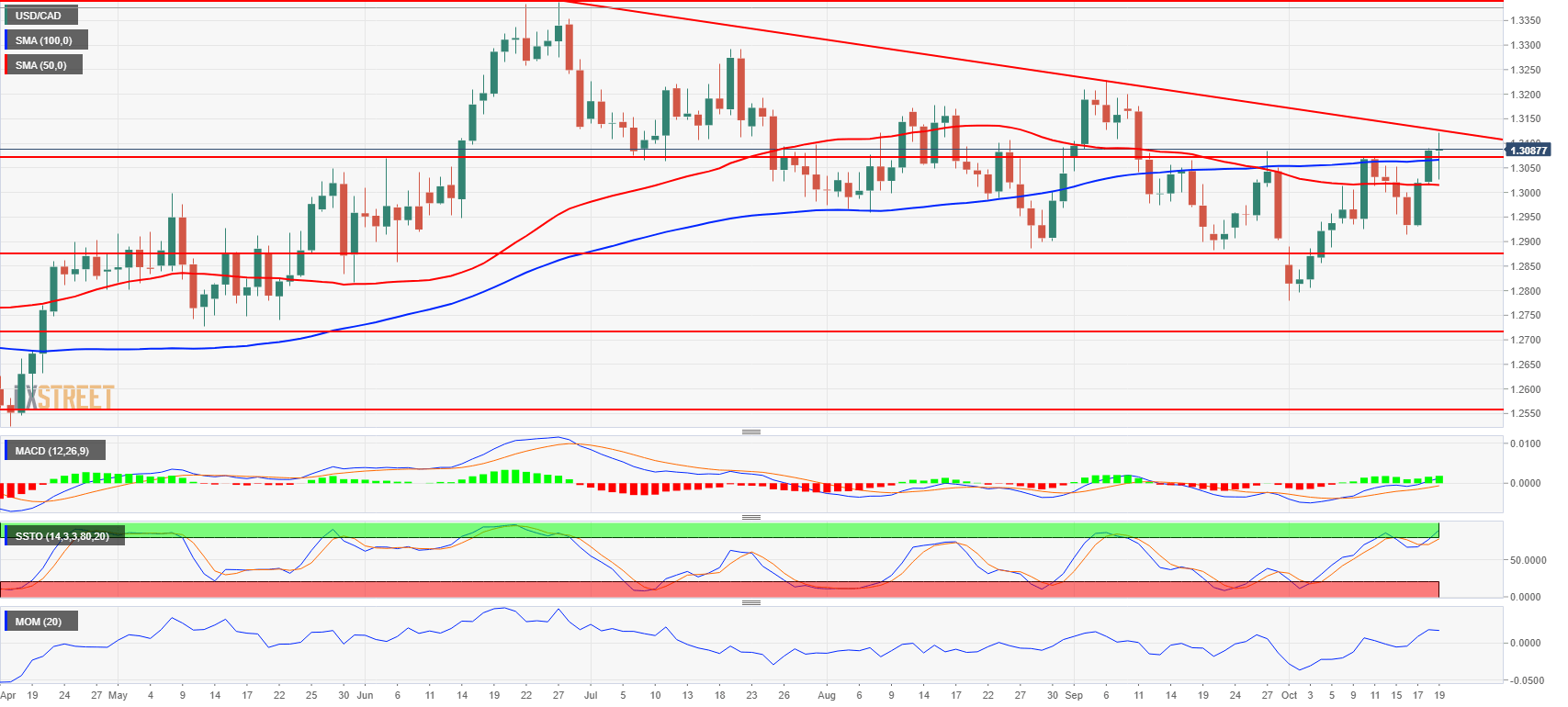

- The FXStreet Forecast Poll expects bullish trend on USD/CAD to prevail in 1-month time, while a 3-month forecast is already bearish.

The USD/CAD was trading within a range of 1.2915-1.3120 over the third week of October, little changed from the previous week. While the beginning of the last week saw Canadian Dollar strengthening against the US Dollar, Friday’s inflation and retail sales data dented the expectations for the Bank of Canada hiking rates next week with negative implications for Loonie.

Canada's headline inflation decelerated to 2.2% y/y in September compared with expectations of a 2.7% increase. The Bank of Canada core inflation measure decelerated to 1.5% y/y in September compared with expectations of a 1.8% increase.

Moreover, Canada’s total retail sales fell -0.1% m/m in August while 0.3% monthly increase was expected by the market and core retail sales excluding car sales fell -0.4% over the month in August.

In the week ahead, the Bank of Canada monetary policy meeting releasing the Monetary Policy report was expected to deliver 25 basis points rate hike, but with Canada’s inflation decelerating sharply, the chances for a rate hike are lower. Should the Bank of Canada be consistent with its mission of “preserving the value of money by keeping inflation low and stable,” the target rate in Canada should remain unchanged at 1.50%.

The line-up for the Bank of Canada hiking rates is almost perfect. The economy is in Bank’s own view operating near full capacity, the employment is rising and the headline inflation is well above the target. Moreover, the Big Brother over the lakes (meaning US Federal Reserve) on the south has already hiked rates in September, so now it is the time for the Bank of Canada to follow.

Both rates hikes by the Bank of Canada this year were done during meetings releasing the Monetary Policy Report in January and in July and this is the last meeting releasing the report this year, so this is basically the last chance for the Bank of Canada to hike rates this year and have a press conference at their disposal after the policy meeting to justify the move.

Technically the US Dollar is in a sideways trend against the Canadian counterpart as it trades just around 1.3075 representing 23.6% retracemnet on the uptrend from 1.2040 to 1.3390. The direction of the USD/CAD will be fundamentally driven in the week ahead as the Bank of Canada rate hike is expected to support the Canadian Dollar while the US Dollar is fundamentally driven by the expectations of the gradual interest rate hikes from the US Federal Reserve with next rate hike expected n December this year.

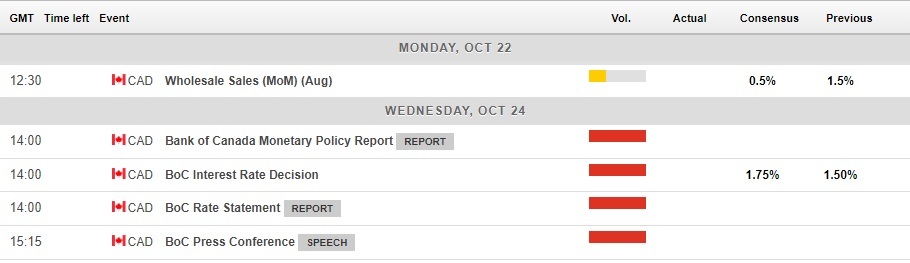

Canada’s economic calendar October 22-26

US economic calendar October 15-19

The US GDP and core personal consumption expenditures price index headline the economic agenda. The US economic calendar is complemented with the US durable goods orders expected to fall by 2.3% m/m the Commerce Department is scheduled to say on Thursday next week.

Technically, the USD/CAD is trading within the sideways trend since reaching the cyclical peak at around 1.3380 on June 27. The 1.2930 line representing the 38.2% Fibonacci retracement of the uptrend from 1.2270 to 1.3350 served as a solid support for USD/CAD. Only the break below that barrier would open further potential on the downside. Given the fundamental and interest rate outlook, the upward potential for USD/CAD seems more feasible. The currency pair needs to break above 1.3090 representing the confluence of the trendline resistance and 23.6% Fibonacci retracement of the above-mentioned move to break further higher. Momentum is in elevated by pointing downwards and both MACD and Slow Stochastic are pointing upwards on a daily chart.

USD/CAD daily chart

FXStreet Forecast Poll

While the FXStreet Forecast Poll was expecting extreme FX market stability for the USDCAD for 1-week, 1-month and 3-months forecasts last week, the surprisingly sharp deceleration in Canada's inflation diminished the chances of the Bank of Canada hiking rates next week and that is also reflected in the forecasts.

The FXStreet Forecast Poll expect USD/CAD to reach 1.3105 in a 1-week time from now compared to 1.3046 expected last week. The share of bullish versus bearish forecasts is 55% to 36%.

While forecasters remain bullish also for the 1-month ahead period expecting USD/CAD to reach 1.3172 compared to 1.3057 expected last week, for the 3-months time the forecast is more stable expecting 1.3073 compared to 1.3050 for the corresponding period last week.

The majority of the forecasters still expects bullish trend on USD/CAD to prevail in 1-month time with 56% of forecasters bullish compared to 31% bearish, while for the 3-months time bearish forecasters constitute 55% compared with 38% of bullish.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.