A slight thaw in trade tensions and a minor rebound has seen the CAD strengthen, yet with several crosses pointing to CAD strength, perhaps this could have some follow-through. If a single currency is about to embark on a reversal or strong run, typically we’d expect to see setups on at least a few (if not all) major crosses. And this has a potential reversal with USD/CAD on our radars.

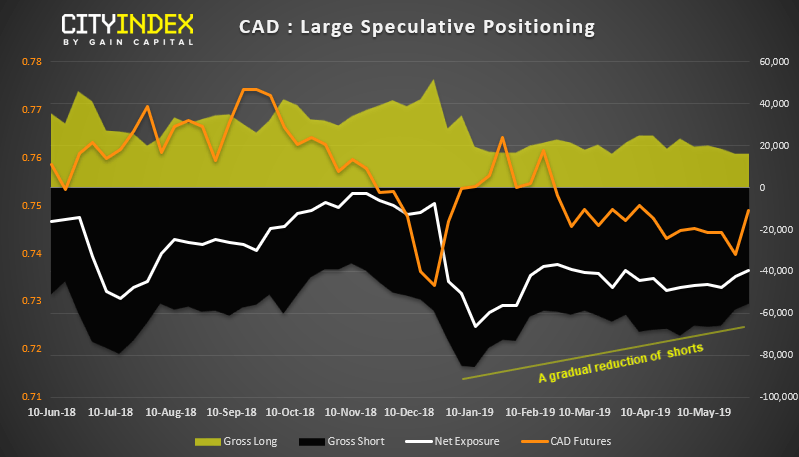

Of course, with weak GDP and a contracting Markit PMI, its difficult to be too bullish on the Canadian economy just yet. But, if we look at market positioning, bearish views on CAD are slowly diminishing.

Whilst traders remain net-short CAD futures, the underlying trend of gross shorts has been steadily declining this year. Over the near-term, large speculators have reduced -10.9k contracts compared with a reduction of -3.6k long contracts and, whilst this is far from an outright bullish sign, it is at the least a less bearish one. This is certainly a trend we’ll watch as it develops because it could be the beginnings of a longer-term reversal for the Loonie.

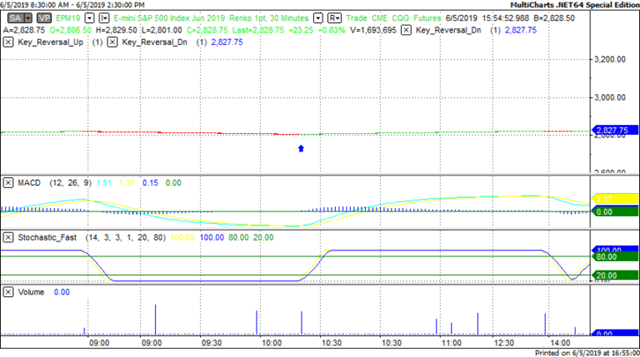

Switching to the near-term, price action on USD/CAD is testing a long-term bullish trendline. Trendlines are useful as a pivotal level as a respected one signals trend continuation, whereas a broken trendline warns of a trend reversal.

However, it’s worth noting the loss of momentum to the dominant trend as it tests this pivotal trendline for the 7th time.

-

The ‘bullish distance’ between the trendline and the May high is far les impressive than the distance between the trendline

-

The May have has failed to break above the 2019 high (so far)

-

A bearish divergence has been forming between price action and the MACD since March

Whilst we could see a minor bounce from this level, a clear break of the trendline could trigger a bearish follow-through as stops are triggered and ‘long’ held views are changed. And, if we are to see fresh long initiated in the weekly COT report, we can consider a longer-term reversal is in play.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.