- A combination of factors pushed USD/CAD to one-month tops on Thursday.

- The risk-off mood benefitted the safe-haven USD and remained supportive.

- Sliding oil prices undermined the loonie and provided an additional boost.

- The US Q4 GDP report will be looked upon for a fresh directional impetus.

The USD/CAD pair added to the previous day's strong momentum and climbed to one-month tops during the Asian session on Thursday. The US dollar was back in demand amid a fresh wave of the global risk aversion, which, in turn, was seen as one of the key factors driving the pair higher. Against the backdrop of growing market worries about the potential economic fallout from the coronavirus pandemic, doubts over the timing and size of a new US economic stimulus package dampened the market mood. This was evident from a selloff in the US equity markets, which forced investors to take refuge in the safe-haven greenback.

The USD bulls seemed rather unaffected by Wednesday's dovish sounding FOMC. As widely anticipated, the Fed left its monetary policy settings unchanged and downplayed speculations of tapering bond purchases sooner than expected. The US central bank, however, raised concerns about the pace of recovery and said that the ongoing public health crisis continues to weigh on economic activity, employment, and inflation, and poses considerable risks to the outlook. Hence, the focus now shifts to Thursday's release of the Advance US Q4 GDP report, which will now play a key role in influencing the near-term USD price dynamics.

On the other hand, a softer tone surrounding crude oil prices undermined the commodity-linked loonie and provided an additional boost to the major. Oil prices remained depressed on the back of fresh concerns about weakening global fuel demand amid the reintroduction of strict COVID restrictions. The UK Prime Minister Boris Johnson indicated on Wednesday the lockdown in England would last until March 8 and also announced new measures to clamp down on travel to/from Britain. Adding to this, China – the world's second-largest oil consumer – also sought to limit Lunar New Year trips to stem a surge in COVID-19 cases.

Short-term technical outlook

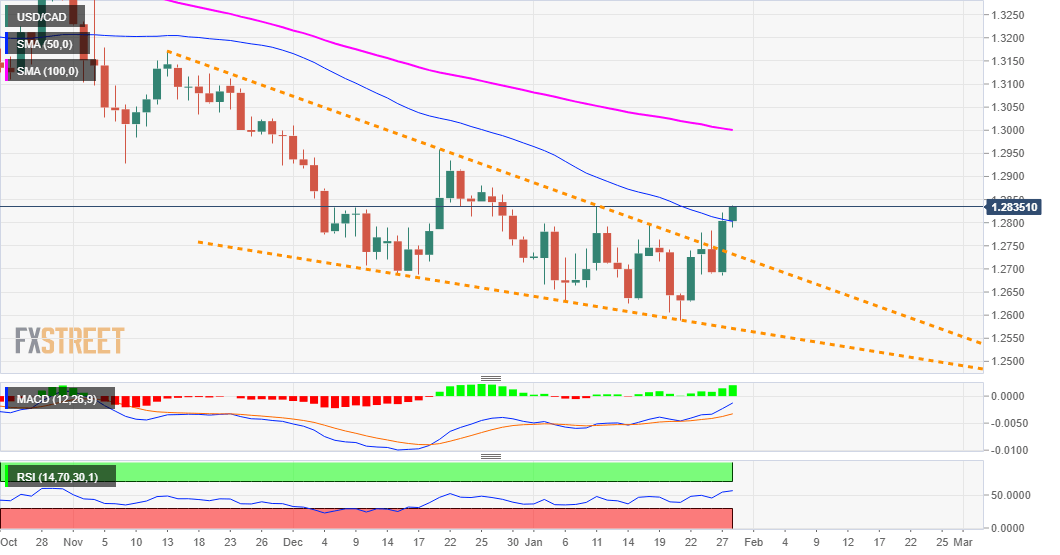

From a technical perspective, the momentum pushed the pair beyond an important resistance marked by over two-month-old descending trend-line. The mentioned trend-line constituted the formation of a bullish falling wedge and a sustained breakthrough has already set the stage for additional gains. Hence, some follow-through strength beyond an intermediate resistance, near mid-1.2800s, looks a distinct possibility. The next relevant target on the upside is pegged near the 1.2900 mark ahead of late December swing highs, around the 1.2955 region.

On the flip side, the 1.2800 round-figure mark now seems to protect the immediate downside. Any subsequent fall might now be seen as a buying opportunity and remain limited near the wedge resistance breakpoint, around mid-1.2700s. That said, some follow-through weakness and failure to defend the 1.2700 mark will negate the constructive outlook. The pair might then turn vulnerable to resume its prior/well-established bearish trend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.